Bitfarms Revenue Jumps 33%—But Halving Hammers Mining Margins

Bitcoin’s post-halving reality bites: Bitfarms’ Q2 revenue surges while costs eat profits. The miner’s 33% top-line growth can’t mask the squeeze—proof that even crypto’s ’sure things’ bow to brutal economics.

Wall Street analysts nod sagely, muttering ’told you so’ into their lattes. Meanwhile, hodlers shrug and stack sats.

Source: investor.bitfarms

Source: investor.bitfarms

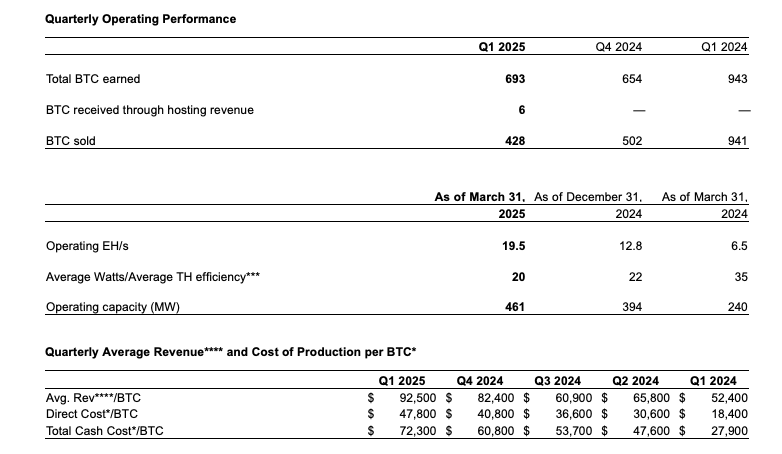

Declining margins are becoming the norm for Bitcoin miners following the April 2024 Bitcoin halving. Hut 8 Corp. also reported a steep revenue drop of over 50% in the first quarter of this year and swung to a significant loss, which CEO Asher Genoot attributed to the full impact of the halving now taking effect.

To offset reduced mining profitability, mining firms are moving into high-performance computing, and Bitfarms is following suit. During the quarter, the company secured a $300 million private debt facility from a division of Macquarie Group to fund the buildout of its HPC project at the Panther Creek site in Pennsylvania.

Other strategic developments in the quarter included the sale of the Yguazu facility in Paraguay and the acquisition of Stronghold Digital Mining, adding two power campuses in Pennsylvania.