Crypto Bloodbath: Why Digital Assets Are Taking a Beating Today

Bitcoin tanks 8% as macro fears rattle speculative assets—because nothing says ’safe haven’ like volatility that could give a hedge fund manager ulcers.

The Fed Effect: Hawkish whispers from central bankers send risk assets scrambling. Crypto, ever the drama queen, overreacts as usual.

Liquidity Crunch: Whale wallets move stacks to exchanges—either panic selling or preparing to buy the dip (narratives are flexible in this market).

Tech Wreck Spillover: Nasdaq’s 3% slide drags crypto down with it, proving Wall Street still treats digital assets like a leveraged tech ETF.

Silver lining? The ’crypto is dead’ crowd will be obnoxiously loud for 48 hours—until the next 20% green candle silences them. Classic.

Crypto markets remain strong

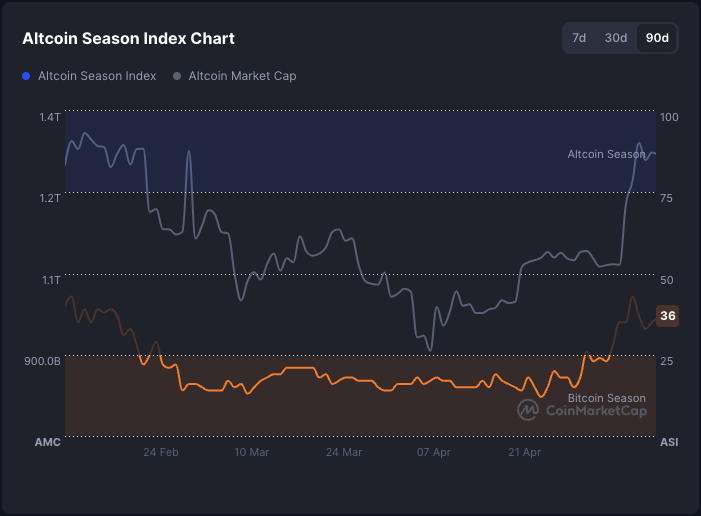

Over the past few weeks, altcoins have seen improved performance, with the altcoin index reaching the highest value since February. In the past 90 days, 36 out of the 100 altcoins have shown better performance than Bitcoin. What is more, over the past week, the altcoin market cap rose from $1.1 trillion to $1.35 trillion.

The strength of the altcoin market suggests bullish momentum for crypto and risk assets in general. Still, continued growth in the market will depend on what the Fed decides to do in the coming months. Notably, the Fed may decide to wait with rate cuts until September, to see what the effects of the new trade agreement between the U.S. and China will be.