Crypto Funds Rake in $882M as Institutional Money Floods Back—Wall Street Still Pretending Not to Notice

Digital asset investment products just notched their fourth consecutive week of inflows—$882 million worth of institutional FOMO as Bitcoin claws back from its 2022 lows. CoinShares’ latest report confirms what traders already knew: the smart money’s quietly rebuilding positions while retail remains shell-shocked.

ETFs and hedge funds lead the charge, with Bitcoin capturing 90% of inflows. Ethereum finally wakes up with a modest $10 million injection—better late than never for the ’ultrasound money’ crowd.

Meanwhile, traditional finance pundits still can’t decide if crypto is ’dead’ or ’too volatile’—conveniently ignoring that their beloved S&P 500 swings 2% on Fed coffee-stain interpretations.

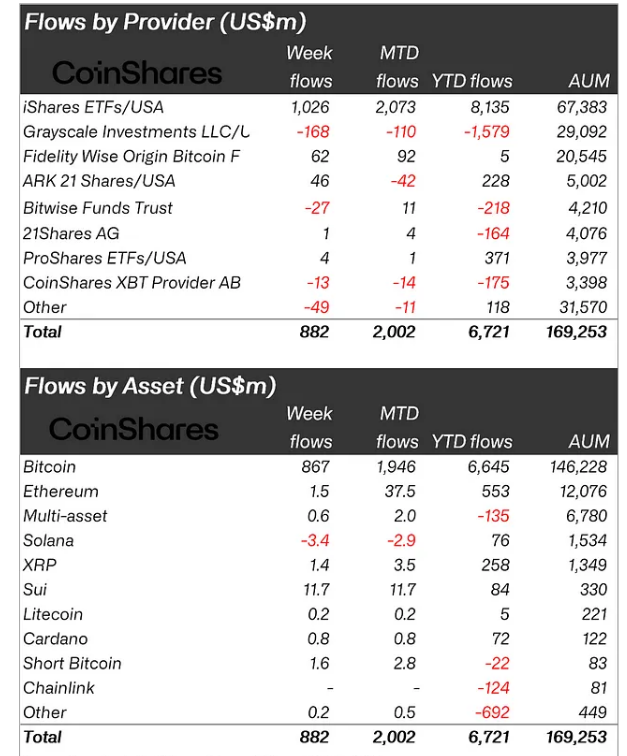

Crypto flows recorded last week by asset type and provider | Source: CoinShares

Crypto flows recorded last week by asset type and provider | Source: CoinShares

When measured by region, the United States have maintained its position as the largest contributor for inflows, accumulating as much as $840 million. This was followed by Germany with $44.5 million and Australia with $10.2 million inflows.

On the other hand, Sweden saw the largest outflows out of all the countries listed with $12 million. Meanwhile, Hong Kong and Canada experienced modest outflows of $8 million and $4.3 million respectively.

Bitcoin (BTC) continues to dominate inflows with $867 million last week. BTC also managed to reach a major milestone, as U.S. listed ETFs accumulated net inflows of $62.9 billion since they were launched in January 2024, as noted by CoinShares. Therefore, BTC inflows have surpassed its previous all-time high of $61.6 billion that was set in early February.

Compared to Bitcoin, ethereum (ETH)’s inflows still have a long way to go, contributing a meager $1.5 million from the grand total. In contrast, Sui (SUI) was able to surpass major tokens like Solana (SOL) and Ethereum with $11.7 million inflows. In fact, Sui has now attracted $84 million in year-to-date inflows, effectively overtaking Solana’s $76 million year-to-date inflows.