Visa Doubles Down on Stablecoins—Backs BVNK’s Infrastructure Play

Visa just placed a strategic bet on the future of payments—and it’s not in legacy rails. The payments giant is backing BVNK, a stablecoin infrastructure provider, signaling a quiet but seismic shift toward crypto-native settlements.

Why it matters: When traditional finance starts funding the plumbing for stablecoin transactions, the ’experimental phase’ is over. Visa’s move validates what crypto builders knew years ago: dollar-pegged digital assets are eating cross-border payments.

The cynical take: After years of dismissing crypto as a niche, Visa now wants a cut of the action—just as regulators start circling. Typical bank playbook: fight innovation until it’s profitable, then absorb it.

Chasing stability

The Visa investment comes at a time when the stablecoin sector is showing signs of broader institutional interest. In late April, Visa partnered with Stripe-acquired Bridge startup to enable fintechs to issue Visa cards that draw directly from stablecoin balances.

The new product, initially launching in six Latin American countries, allows users to fund cards with stablecoins, which are then converted to local fiat at the point of sale. Merchants receive payments in their local currencies, with no exposure to crypto volatility.

Bridge CEO Zach Abrams described the collaboration as a “massive unlock for developers,” adding that everyone “will be able to use stablecoins with just a tap.” Visa’s chief product and strategy officer, Jack Forestell, emphasized that the company aims to “integrate stablecoins securely into its global network,” giving consumers and developers more financial options.

BVNK appears to be part of this broader strategic direction. In its announcement, the company noted that its stablecoin rails could help redefine how businesses operate in the digital economy, particularly in regions with limited access to efficient cross-border banking.

The firm has also been expanding into the U.S. market, opening offices in San Francisco and New York earlier this year. Its U.S. operations are being led by former BlockFi executive Amit Cheela and former Cross River executive Keith Vander Leest.

‘Trillion-dollar opportunity’

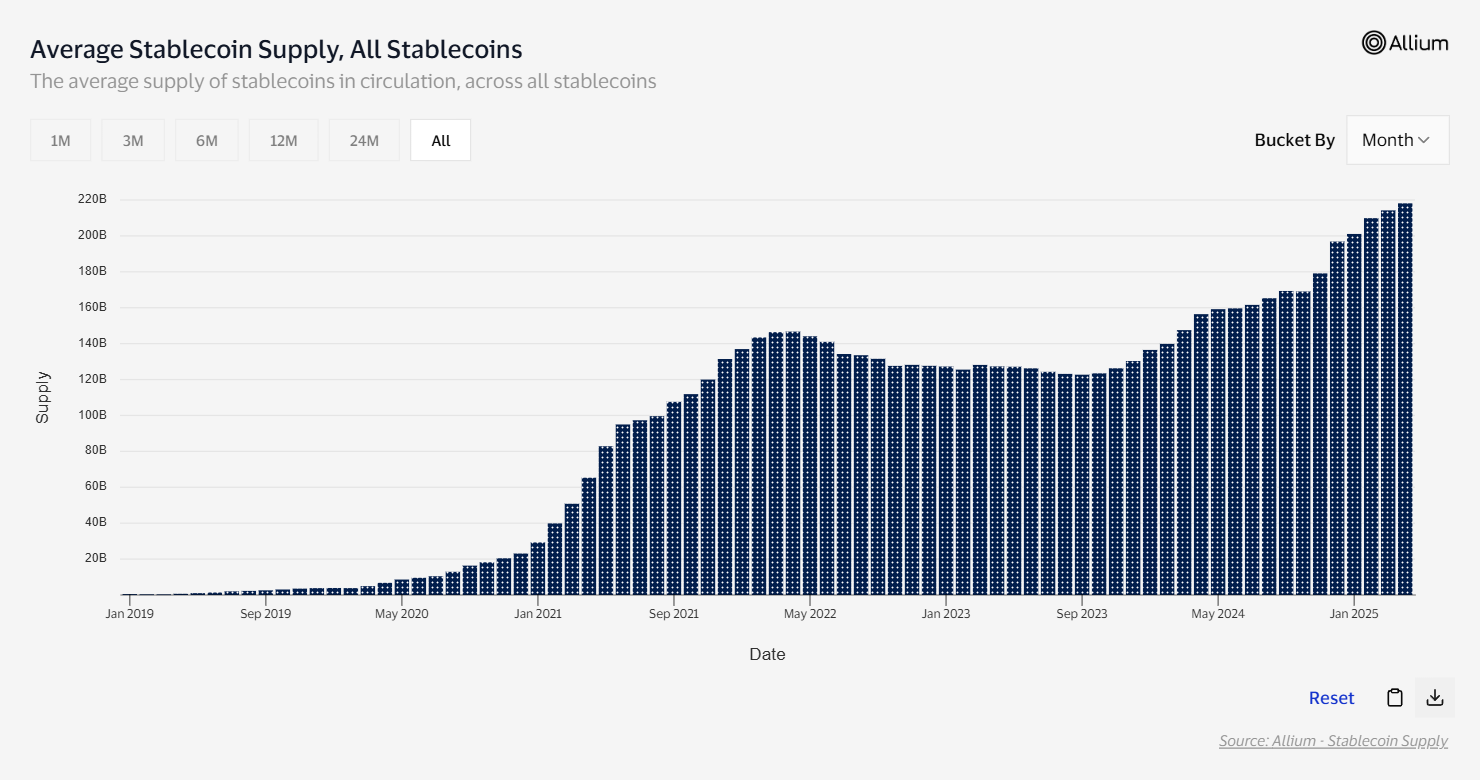

Stablecoin payment volumes have surged in recent quarters. Visa’s Onchain Analytics platform reports $33.4 trillion in global stablecoin volume across 5.5 billion transactions, indicating growing traction beyond trading use cases.

Citi Wealth also noted that stablecoins “could end up reinforcing the U.S. dollar’s dominance,” particularly as stablecoin infrastructure scales globally.

https://twitter.com/hosseeb/status/1874288532686295058Dragonfly Capital’s managing partner Haseeb Qureshi has earlier also projected that 2025 could mark a turning point for stablecoins, saying they could become key tools for small and medium-sized businesses, moving beyond speculative crypto trading into real-world payments and settlement.

“Stablecoin usage will explode, particularly among SMBs. Not just trading and speculation — real businesses will start using on-chain dollars for instant settlement.”

Qureshi

He also added that efficiency and accessibility would allow stablecoins to outpace traditional systems, especially as regulatory clarity improves.

Pantera Capital, another prominent crypto venture firm, has called stablecoins a “trillion-dollar opportunity,” noting that they now account for over 50% of blockchain transaction activity, compared to just 3% in 2020.

For BVNK, the Visa deal is also a reputational milestone. Hemson-Struthers framed it as a return to first principles in payments innovation.

“I’m particularly excited about what it means to partner with Visa—the original payments innovator,” he said, adding that Visa’s expertise in building global payment networks, combined with BVNK’s stablecoin infrastructure, would create “powerful possibilities.”