Dow Slumps 180 Points as Traders Brace for U.S.-China Trade Showdown

Wall Street’s favorite volatility catalyst—geopolitical tension—strikes again. The Dow nosedives as markets price in another round of diplomatic theater between Washington and Beijing.

Subheader: ’Risk-Off’ Mode Engages Ahead of High-Stakes Talks

Traders dump equities faster than a crypto influencer abandons a sinking shitcoin. Safe-haven assets creep up while tech stocks lead the retreat—because nothing says ’uncertainty’ like watching two economic superpowers play chicken with tariffs.

Closing jab: At least the algo-traders will feast on the spread. Human investors? Grab some popcorn and Xanax.

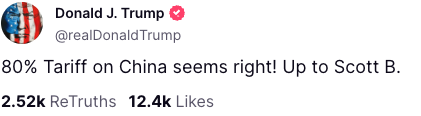

Trump’s post on Truth Social, dated May 9 | Source: Truth Social

Trump’s post on Truth Social, dated May 9 | Source: Truth Social

While this rate remains prohibitively high for many exporters, it is lower than the previous 145% imposed earlier. More importantly, Trump’s rhetoric suggests a tone of de-escalation ahead of the crucial trade negotiations with China. The talks could help reduce reciprocal tariffs between the two countries, as China had retaliated with its own 125% tariff on U.S. goods.

Strategy, Palantir, among the biggest losers, gold gains

Among tech stocks, Palantir was among the worst performers, down 2.23% today. The stock is set to close the week down 5% as investors reassess its high valuation. Notably, on Tuesday, its shares dropped 12%, losing 35 million in market cap due to a drop in quarterly earnings.

Interestingly, shares of Strategy, a Leveraged Bitcoin investment firm, were also down 1.78% since market open. This is despite Bitcoin (BTC) posting a 1.23% increase over the last 24 hours and a 5% increase over seven days.

On the other hand, bearish sentiment in the stock market prompted many traders to increase their Gold exposure. The precious metal was up 1.16%, reaching $3,344 per ounce.