Crypto Markets Tumble—Here’s Why Traders Are Panicking Today

Bitcoin sheds 5% overnight as Fed rate fears rattle speculative assets.

Whales dump $300M in ETH derivatives—leverage unwinds spark cascading liquidations.

Solana NFTs flatline after celebrity hype cycle peaks (again).

Regulators circle like vultures—because nothing screams ’consumer protection’ like shutting down exchanges during volatility.

Silver lining? Blood in the streets means fire-sale prices for diamond hands.

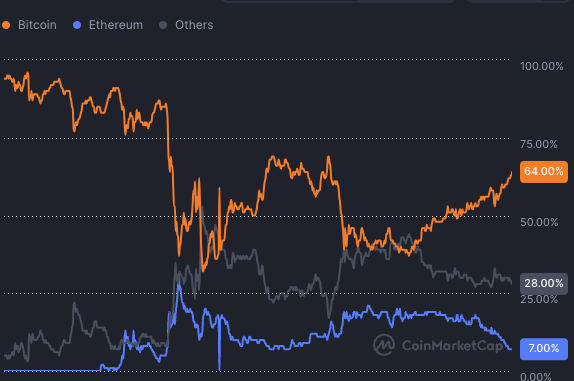

Bitcoin’s dominance vs Ethereum and all other tokens | Source: CoinMarketCap

Bitcoin’s dominance vs Ethereum and all other tokens | Source: CoinMarketCap

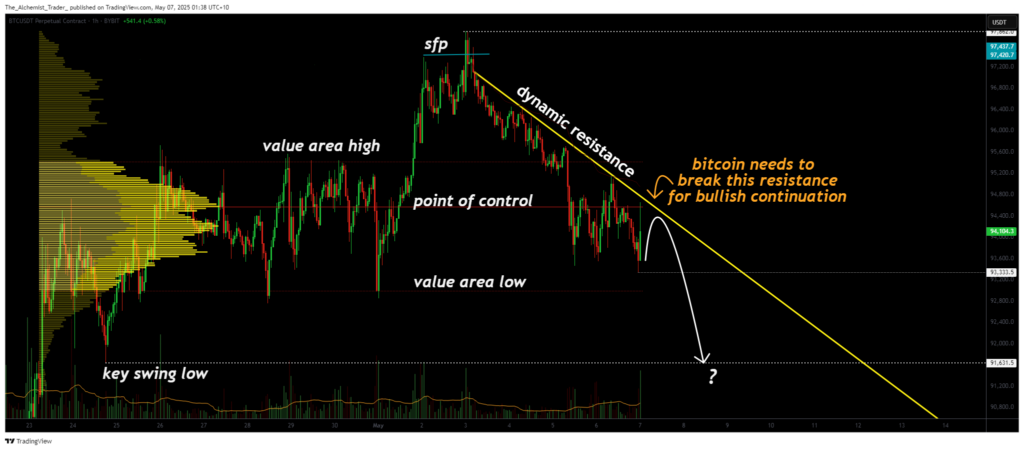

Bitcoin faces technical pressures

One of the reasons for Bitcoin’s underwhelming performance comes down to technical factors, which is unlikely to change very soon. Specifically, Bitcoin is facing a long-term dynamic resistance that started forming after its all-time high in January.

Since then, Bitcoin has consistently stayed below the resistance point, with a last breakout attempt on April 23. This means that further declines are likely, especially as its price has passed the point of control. That is, unless a major catalyst enables it to break this long-term resistance.