Bitcoin’s Market Grip Tightens to 4-Year Peak as Altcoins Fade: Binance Data Shows

Bitcoin just flexed its dominance—hitting levels not seen since 2021—while altcoins sputter. Here’s what’s unfolding:

The king isn’t dead: BTC’s market share surge signals a flight to ’safe’ crypto bets as traders ditch riskier altcoin plays. Binance’s latest metrics spell it out: this isn’t a rotation, it’s a retreat.

Altcoins left gasping: Even former high-flyers are bleeding against BTC pairs. The ’altseason’ playbook? Gathering dust alongside 2021 NFT whitepapers.

Why it matters: When liquidity gets scarce, crypto behaves like traditional markets—everyone crowds into the blue-chip. (Yes, we said ’blue-chip’ about Bitcoin. The 2010s called; they want their irony back.)

The takeaway? Speculative capital isn’t leaving crypto—it’s just parking where the volatility hurts less. For now.

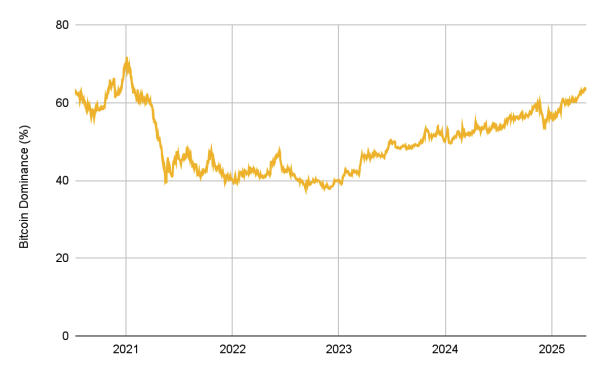

Bitcoin dominance since 2020 | Source: Binance Research

Bitcoin dominance since 2020 | Source: Binance Research

Periods when Bitcoin dominance fell often coincided with broader bull markets, most recently in late 2024. However, April’s increase suggests the narrative around BTC is evolving, as the asset moves further into the financial mainstream.

A rise in money printing boosts Bitcoin

One of the trends that coincided with Bitcoin’s rise was a steep increase in the money supply. Notably, the M2 measure of money supply for the G4 countries is projected to increase by a record $93 trillion. This expansion in the U.S. Japan, China, and Europe’s money supply is positively correlated with Bitcoin’s price.

For one, Bitcoin supporters see it as digital gold and a hedge against inflation. Moreover, the increase in money supply helps add more liquidity to the markets, including crypto markets.

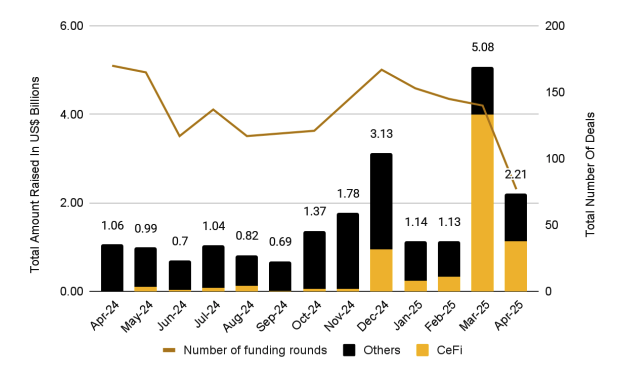

Aside from Bitcoin’s potential decoupling from crypto markets, Binance Reserch also pointed out a new trend in centralized finance. In past two months was the sharp increase in the money raised by centralized finance companies.

According to Binance, CeFi companies are more attractive to investors thanks to a shift in regulations around crypto in the U.S., which continues to be the world’s venture capital hub.