Bitcoin Miners Double Down—Structural Signals Flash Green Despite Market Jitters

Miners keep hodling like it’s 2021—Bitfinex data shows zero signs of surrender even as Wall Street ’experts’ clutch their pearls. Hash rate holds steady, reserves stay stacked, and the only capitulation happening is from traders who sold too soon.

Behind the scenes: On-chain metrics paint a bullish picture. Miner revenue rebounds, transaction fees stabilize, and those ’imminent’ death spirals? Still MIA. Meanwhile, legacy finance keeps trying to short innovation—some things never change.

The kicker: When even post-halving pressure can’t shake loose their coins, you know these operators are playing the long game. Either that, or they’re waiting for the next sucker—sorry, ’institutional investor’—to bid up prices again.

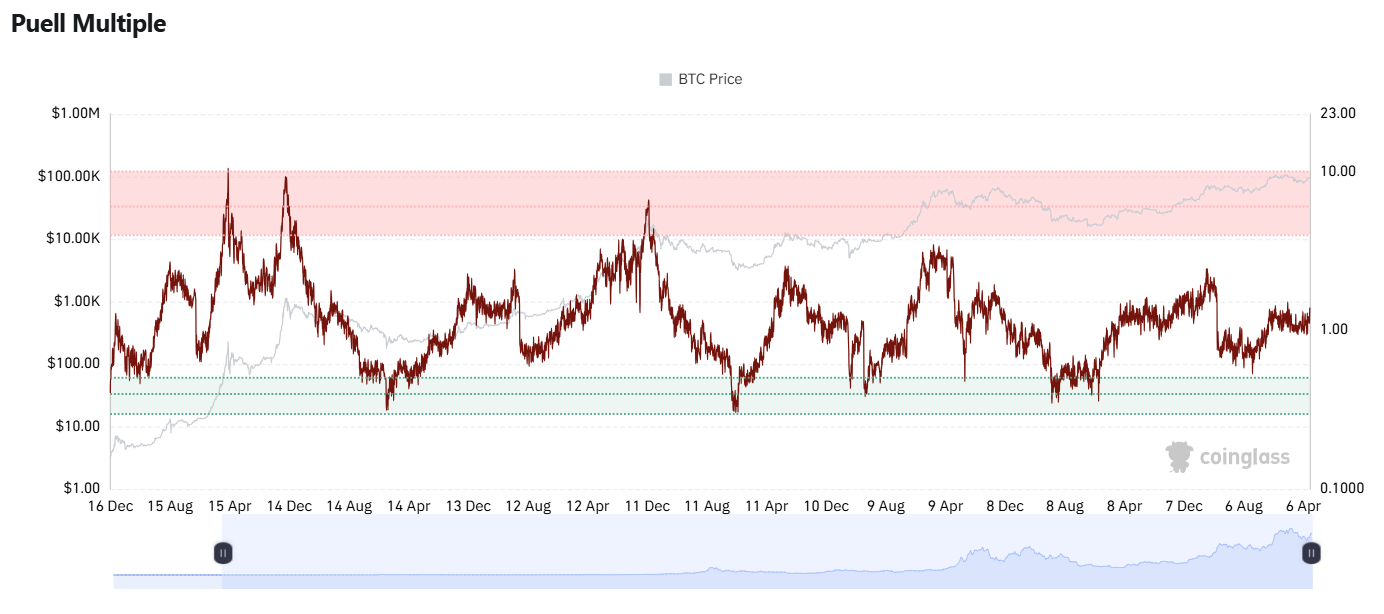

Puell Multiple | Source: Coinglass

Puell Multiple | Source: Coinglass

The Puell Multiple, a key indicator of miner profitability, also remains well below historically elevated thresholds, further confirming miners’ lack of incentive to sell. Typically, values above 2 signal an increase in selling activity, but the current level of the Puell Multiple suggests that large-scale miner selling is unlikely.

These stable reserves and low selling pressure reinforce the idea that Bitcoin miners remain confident in the asset’s potential for future gains. While the market remains susceptible to short-term fluctuations, the structural signals suggest that the current cycle may still have room to grow, with miners holding onto their positions in anticipation of further upside, the analysts explain.