XRP ETF Smashes $67M in Assets—Leaves Ripple’s Native Token in the Dust

Wall Street’s latest crypto flirtation—a shiny new XRP ETF—just bulldozed past $67 million in assets under management. Meanwhile, XRP’s price action is clowning Ripple’s own performance. Who needs the OG when the derivative’s eating its lunch?

Fun fact: This ETF’s success proves institutional investors still prefer packaged products over actual blockchain utility. Some things never change—finance loves its middlemen.

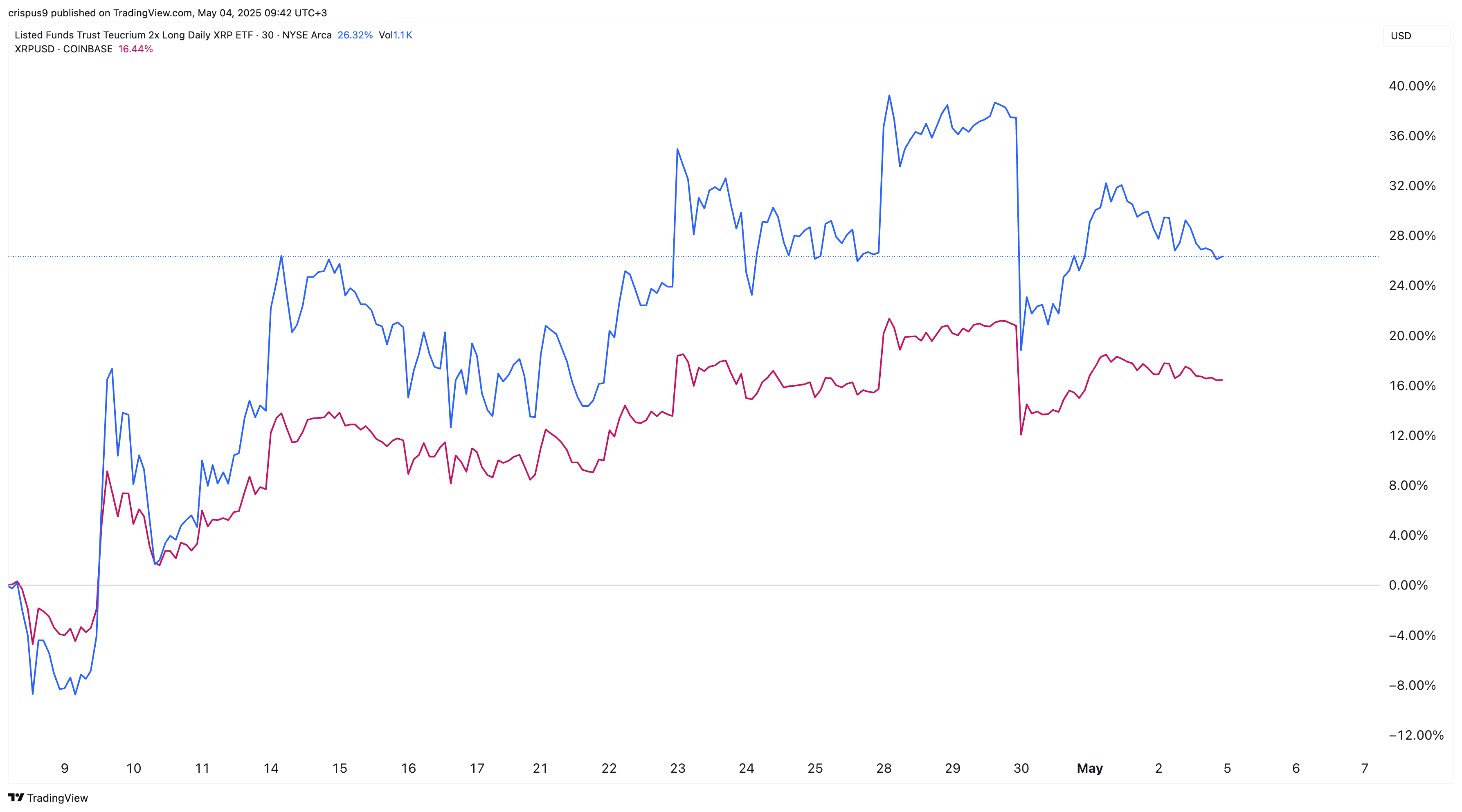

XRP vs XXRP ETF | Source: crypto.news

XRP vs XXRP ETF | Source: crypto.news

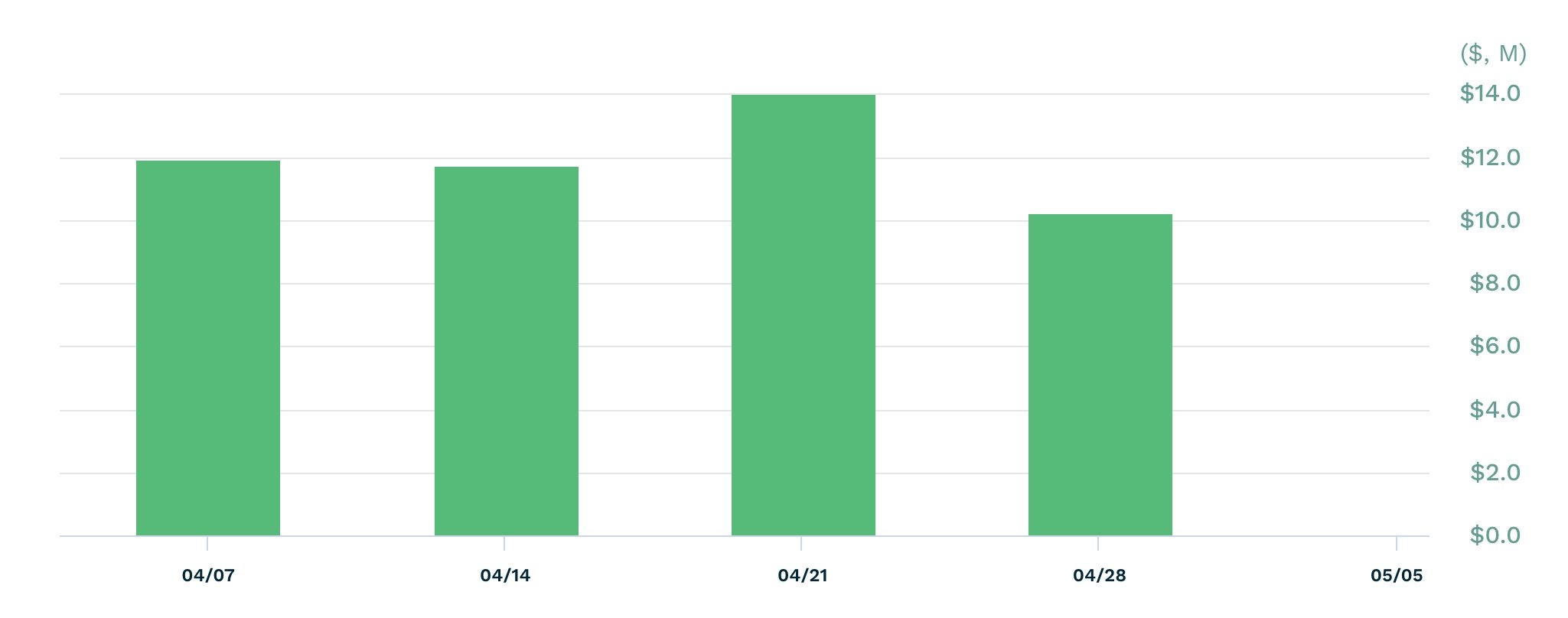

The XXRP ETF’s inflows are notable because of its cost structure. While one can easily buy the XRP token and pay no fee, its investors pay a premium for the fund, which has an expense ratio of 1.89%.

A 1.89% fee is high even when compared with other leveraged ETFs. The popular Direxion Daily Semiconductor Bull 3x Shares ETF, which has $9.9 billion in assets, charges a 0.75% management fee.

Similarly, the $22 billion ProShares UltraPro QQQ ETF has an expense ratio of 0.84%. XXRP’s fees mean that a $10,000 investment will cost at least $189 annually.

Strong institutional demand

Despite XRP’s high fees, sustained XXRP inflows signal strong institutional demand for XRP ETFs. It also means that the upcoming XRP ETFs will likely have more inflows.

The Securities and Exchange Commission is currently reviewing 9 XRP ETFs from companies like Bitwise, Canary, 21Shares, WisdomTree, Franklin Templeton, and Grayscale.

JPMorgan, the Wall Street bank, estimates these ETFs will have over $8 billion in inflows in the first year. If this happens, the inflow will be higher than that of Ethereum (ETH).

SoSoValue data shows that spot Ethereum ETFs have attracted less than $2.5 billion in the first seven months.

XXRP, like other leveraged ETFs, is a high-risk and high-reward fund. That’s because the fund seeks daily investment returns that correspond to 2x the daily performance of the XRP token.

A good example is the ProShares QQQ ETF and the ProShares UltraPro Short QQQ ETFs. TQQQ, which provides leveraged exposure to the Nasdaq 100 Index, has jumped by 261% in the last five years, while the Nasdaq 100 Index has risen by 127% in the same period.

SQQQ, which provides leveraged short exposure to the Nasdaq 100 Index, has crashed by 98% in the same period. Therefore, an XRP price crash will lead to more pain for XXRP ETF investors.