IMX Token Surges—Can ImmutableX Keep the Momentum Alive?

Gaming’s favorite Ethereum layer-2 token is back in the spotlight as IMX rallies 40% this month. Traders pile in ahead of Q2 protocol upgrades—but is this just another ’buy the rumor’ play?

Key drivers: ImmutableX’s zero-gas NFT minting keeps attracting big studios, while their zk-rollup tech finally delivers on scaling promises (take notes, Solana). On-chain data shows whales accumulating at $2.80—a critical support level since March.

The catch? IMX still trades 60% below its 2021 ATH. Either we’re witnessing the smart money positioning early... or retail’s about to get rekt chasing ’the next big gaming token.’ As always in crypto: hope cuts deeper than reality.

ImmutableX price analysis

ImmutableX is bullish on several time frames. The daily and weekly price charts show the IMX token’s underlying bullish momentum. The IMX/USDT daily price chart shows the gaming token is 12% below its closest resistance level at $0.70.

Another key resistance level is $0.78, identified as R2. On the daily timeframe, support is at $0.50.

Momentum indicators RSI and MACD support a bullish thesis for IMX token. RSI reads 61, and is climbing higher, well under the “overbought” zone that starts at 70. MACD flashes green histogram bars above the neutral line, meaning there is an underlying bullish momentum in IMX price trend.

The IMX/USDT 12-hour price chart shows the possibility of a correction in the gaming token over the weekend. MACD flashes red histogram bars under the neutral line, and the closest support levels for the gaming token are $0.55 and $0.50.

The weekly price chart mimics the daily chart, RSI is sloping upward, MACD is flashing a green histogram bar after consecutive red histogram bars. IMX has an underlying positive momentum on the weekly timeframe.

IMX price prediction

If the gaming token’s bullish momentum is sustained, the IMX price could test resistance labeled R2 on the daily timeframe at $0.785. IMX currently trades at $0.627, close to the $0.70 resistance.

Nearly 12% rally could push IMX to test R1 at $0.70. The lower boundary of the Fair Value Gap at $0.508 is a key support for the gaming token. The $0.508 level comes into play if there is a flash crash or a correction in IMX.

RSI and MACD support a bullish thesis for ImmutableX’s native token, traders could expect further gains in IMX in the coming week. Sidelined buyers need to watch for a correction under $0.60 to add to their positions or buy the dip in IMX.

IMX on-chain and sentiment analysis

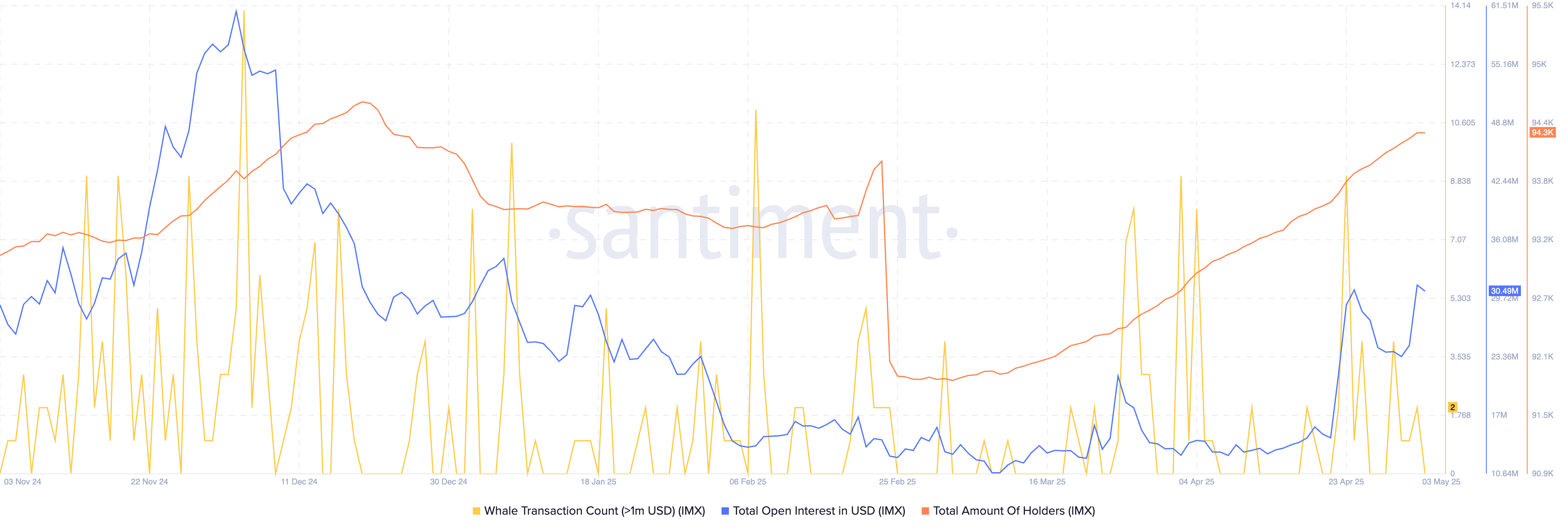

On-chain data intelligence platform Santiment shows that the total number of IMX holders has increased at a steady pace between February 25 and May 2. IMX token holder count has climbed to 94,300.

The total open interest recorded a large positive spike on May 2 before receding. Open Interest climbed to $30.49 million, a relatively high volume of open contracts for a gaming token.

Total count of whale transactions valued at $1 million and higher is down, after several consecutive spikes in transaction count.

The Crypto Fear & Greed Index on Alternative.me reads “Greed,” a turnaround from the “extreme fear” sentiment among market participants last month. The indicator’s value ranged between 65 and 67 last week and at the time of writing.

Market participants’ sentiment is slowly recovering and turning bullish, per the indicator.

Catalysts driving gains in IMX token

Web3 gaming engagement climbed in Q1 2025 after a slowdown in the last quarter of 2024. A boost in user activity, interest in games, and user engagement caused native tokens of gaming blockchain platforms to note a rally in their prices.

NFT may have lost relevance amidst the market turmoil, barring a few blue-chip projects like Pudgy Penguins, however data gathered by Messari shows that the pullback was modest.

IMX announced its plans of merging into the zero-knowledged Immutable zkEVM chain to form a single unit, labeled “Immutable Chain.” The key technical development at a time when Web3 gaming gathers attention in the ecosystem, has acted as a catalyst for IMX price rally.

Rising number of token holders drives consistent demand across exchange platforms and supports further gains in the web3 gaming token. Coupled with bullish on-chain and technical activity, IMX is in a position to extend gains.

GameFi market insights

Messari’s “State of ImmutableX Q1 2025” report notes that the average daily transactions on IMX climbed 5.7% QoQ. Web3 gaming growth supported the rise, IMX notes an underlying network activity resilience even as gaming engagement contracts on competitor platforms.

NFT sales volume were hit 1.6% QoQ, the pullback to $78.3 million is considered modest, while in Q4 when ImmutableX’s competitors noted a decline in NFT sales, the platform recorded a 55.3% increase.

The development lined up for late 2025, IMX’s merge into the Immutable Chain could act as a key catalyst and support a positive close to the last quarter of 2025. The IMT token’s releases slated for the year include games like Immortal Rising 2, and MARBLEX’s upcoming titles.

The U.S. Securities and Exchange Commission has softened its stance on crypto and web3 firms under the Trump administration. The SEC concluded its investigation into Immutable and took no enforcement action. The closing of the Wells Notice issued to the gaming platform serves as a positive development and a likely end to regulatory hurdles faced by the gaming token in 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.