XRP Whales Go on Buying Spree—Is a Price Breakout Imminent?

Deep-pocketed investors are loading up on XRP, sparking speculation of a major price surge. On-chain data shows whale wallets accumulating millions of tokens—just as the SEC vs. Ripple case enters its final innings.

Bullish signal or another ’smart money’ trap? Retail traders scramble to front-run the whales, because nothing says ’healthy market’ like following the herd off a cliff.

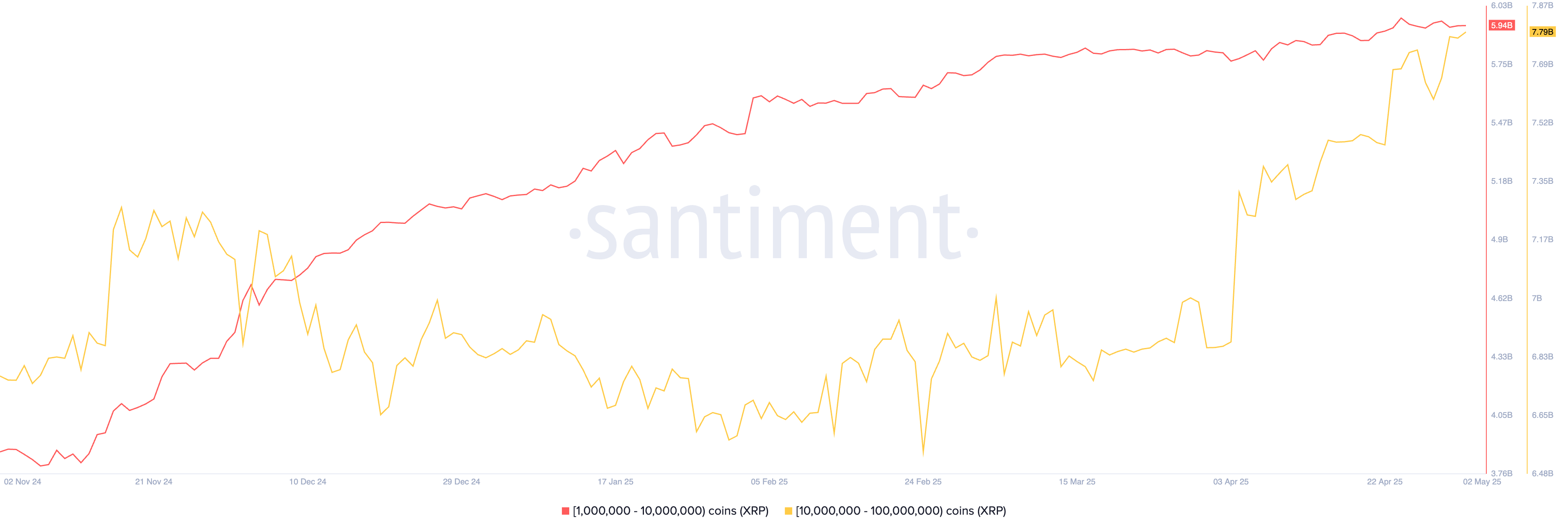

XRP whales are accumulating | Source: Santiment

XRP whales are accumulating | Source: Santiment

Ripple price has numerous catalysts

The ongoing XRP buying frenzy is largely driven by investor Optimism surrounding several key catalysts.

One major factor is the anticipated approval of an XRP ETF by the Securities and Exchange Commission, which analysts believe could bring in over $8 billion in inflows within the first year. While the official deadline is in October, expectations are that the SEC could approve it as early as June. As a result, investors see buying XRP now as a chance to front-run this development.

Further, analysts are highly bullish on the XRP, with Standard Chartered predicting that it may rise 6x from here. Such a move would push its market cap to over $600 billion, overtaking Ethereum (ETH) if its price continues to underperform.

XRP price may benefit from its growing market share in the stablecoin market. Its Ripple USD (RLUSD) has gained a market cap of over $330 million. Visa expects that the stablecoin market will be worth $1.6 trillion by 2030. If RLUSD gained a 5% market share, its assets would amount to over $80 billion.

Other catalysts are its goals to disrupt the Swift payment system, the recent acquisition of Hidden Road, and the potential Circle buyout.

XRP price technical analysis

The daily chart shows XRP has held steady in recent sessions. This period of consolidation comes after a breakout above a descending trendline connecting the highest swing points since January.

That trendline marked the upper boundary of a falling wedge pattern, which is often viewed as a bullish reversal signal. The price also remains above both the 50-day and 200-day Exponential Moving Averages and has formed an inverse head and shoulders pattern.

Given these indicators, XRP is likely to continue climbing, with an initial target around $3.40, the year-to-date high, which represents about 53% upside from current levels. However, a drop below the 200-day EMA at $2 would invalidate the bullish outlook.