Saylor Drops Bitcoin Bombshell on Q1 Earnings Call—Wall Street Braces for Impact

MicroStrategy’s CEO just schooled traditional finance—again. The Bitcoin maximalist revealed aggressive treasury strategy shifts during yesterday’s earnings call, doubling down on crypto while legacy banks fiddle with their ’digital asset frameworks.’

Key takeaways: Corporate balance sheets stacking sats, enterprise adoption tipping point hit, and yes—another thinly veiled jab at fiat debasement. Because when your treasury’s outperforming the S&P 500, why bother with ’responsible hedging’?

Analysts scramble to update models as Saylor’s playbook becomes corporate America’s worst-kept secret. Meanwhile, gold bugs quietly update their LinkedIn profiles.

Source: Strategy Q1 2025 earnings report

Source: Strategy Q1 2025 earnings report

Highlighting Strategy’s capital market maneuvers, which say the treasury raise $7.7 billion in Q1 through common stock, convertible notes, and preferred stock IPOs to acquire 61,497 BTC, the Q1 earnings report stated that it had achieved a 13.7% “BTC Yield” and $5.8 billion “BTC $ Gain” year-to-date.

In addition, Saylor celebrated BTC’s adoption by over 70 public companies, framing Strategy as a leader in a “digital gold rush.” He dismissed BTC’s volatility concerns, emphasizing long-term appreciation, and justified debt-fueled purchases as accretive, despite a $4.2 billion net loss from unrealized fair value losses.

Saylor’s bullish vision casts BTC as digital capital poised to dominate finance, but he glossed over risks like price swings, leverage, and potential shareholder dilution from perpetual preferred stock dividends.

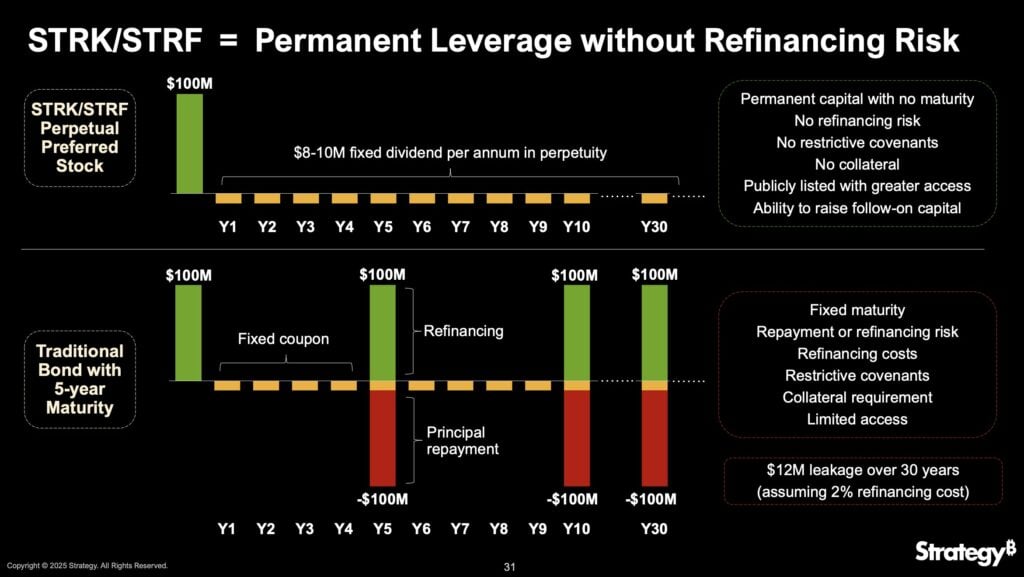

However, critics have pointed out numerous issues with Strategy’s highly Leveraged model. While the company touts a 50% share price increase and a $12.7 billion retained earnings boost from fair value accounting, its reliance on bonds to fund BTC purchases introduces significant risks. Issuing $2 billion in 0% Convertible Senior Notes due 2030 and perpetual preferred stock with high dividend obligations (8% for STRK, 10% for STRF) commits Strategy to substantial liabilities. These instruments, while providing capital, encumber the balance sheet with senior claims that could erode shareholder value if BTC’s volatility turns south.

Nevertheless, Saylor remains bullish, posting an aptly generated AI image to X shortly after the call.

Tulip season ends. Bitcoin is forever. pic.twitter.com/dBLTO2yIEu

— Michael Saylor (@saylor) May 2, 2025