Uniswap Price Primed for Rally as Unichain Outpaces Ethereum, Polygon, and Sei in Critical Metrics

Move over, legacy chains—Unichain just lapped the competition. Daily active users, transaction volume, even developer activity: Uniswap’s new layer-2 solution isn’t just competing, it’s dominating. Ethereum’s gas fees look downright medieval by comparison.

Polygon and Sei? More like spectators. Unichain’s throughput is eating their lunch while somehow keeping fees lower than a Wall Street intern’s coffee budget. The ’flippening’ might start here—not with Bitcoin, but with DeFi’s infrastructure.

Of course, crypto being crypto, today’s golden child could be tomorrow’s abandoned testnet. But for now? The market’s voting with its wallet. UNI holders, buckle up.

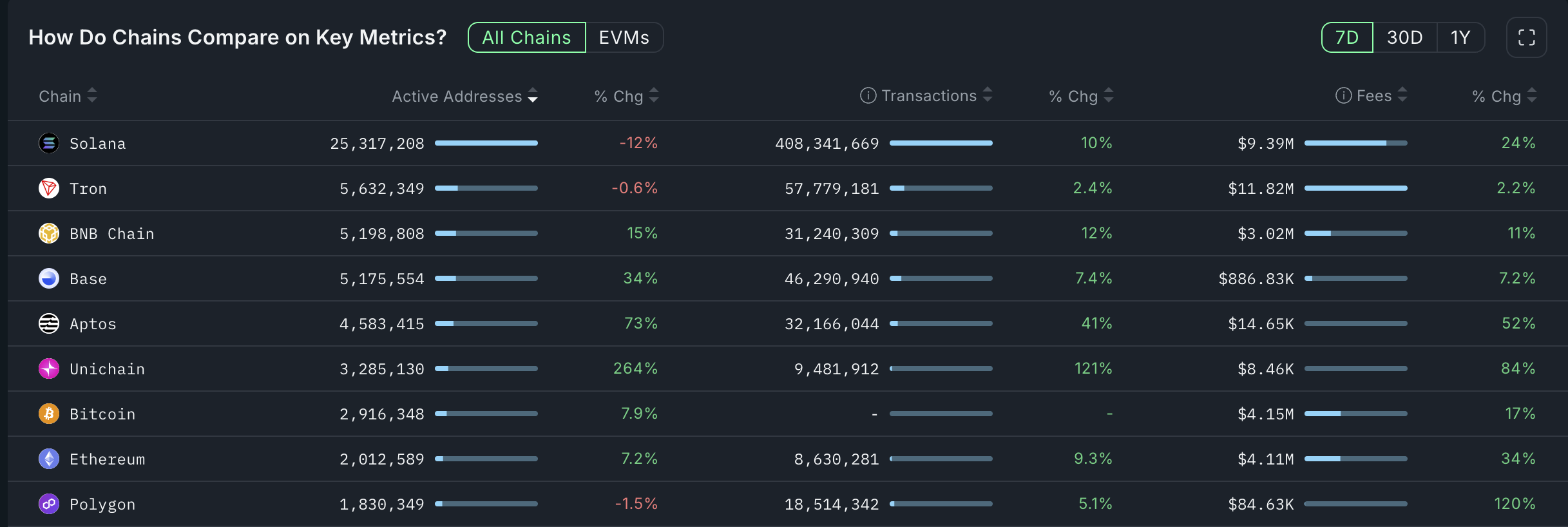

Unichain active addresses, fees, transactions | Source: Nansen

Unichain active addresses, fees, transactions | Source: Nansen

More data by DeFi Llama shows that Unichain has become one of the top players in the decentralized exchange industry. It processed tokens worth $1.7 billion in the last seven days, a 36% increase from the previous period. This increase brings the monthly transactions to over $3.2 billion. This growth is impressive since it was launched in February.

Meanwhile, Uniswap continues to hold a significant market share in the decentralized finance sector despite rising competition. Its network processed $61.4 billion in transactions over the last 30 days — more than PancakeSwap and Raydium combined.

This growth has pushed Uniswap to make substantial fees this year. TokenTerminal data indicates that it has generated over $328 million this year, surpassing Ethereum’s $242 million. These fees are usually routed to liquidity providers on the network.

Uniswap price has formed a unique pattern

The weekly chart shows that UNI price has dropped to a significant support level around $5, where it has repeatedly held throughout the year. This level aligns with a trendline connecting the lowest swing points since June 2022.

Notably, UNI has formed a broadening wedge pattern, commonly known as a megaphone — often interpreted as a bullish reversal signal.

Given this technical setup, Uniswap’s price may bounce back in the coming weeks. The initial target to watch is last year’s high of $19.30, which would represent a 255% increase from current levels. However, a drop below the lower edge of the wedge pattern would indicate further downside risk.