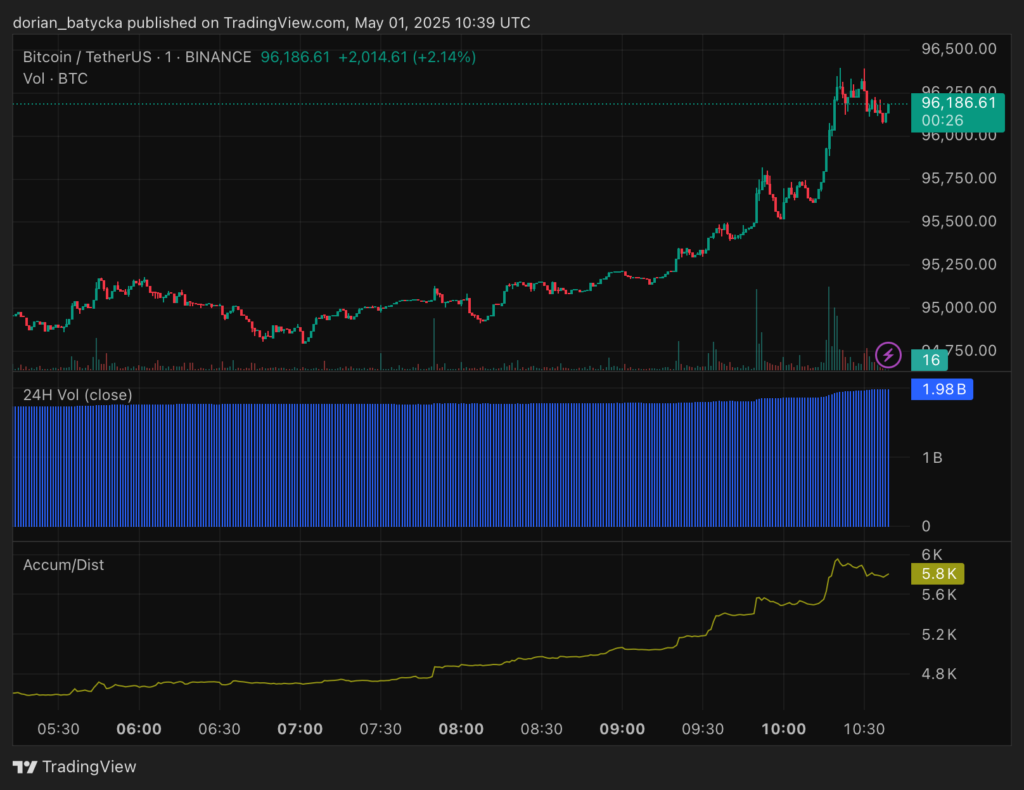

Bitcoin Smashes $96K Barrier as Wall Street’s Crypto FOMO Goes Mainstream

Institutional money floods BTC markets—just as the suits finally realize digital gold isn’t going away. Cue the ’we always believed in blockchain’ memos from banking CEOs who mocked it at $20K.

Price surge defies ’overbought’ warnings as ETF inflows hit record highs. Analysts whisper six figures by June—unless the SEC finds a way to ’protect investors’ by crashing the party.

Funny how pension funds suddenly love volatility when there’s a 150% YTD gain on the table. Where was this risk appetite during the 2022 bear market?

Source: crypto.news

Source: crypto.news

However, analysts warn of resistance at $94,000-$95,000, citing heavy selling pressure in spot markets. With BTC still 16% below its January peak of $109,000, volatility remains a concern, especially as stock market correlations persist. Investors are eyeing whether BTC can sustain momentum amid global economic uncertainties.

On the heels of renewed institutional interest, particularly from large players like Strategy who have continued to acquire the original cryptocurrency over the last several months, BTC’s latest rally comes as new players have also emerged in the space. In particular, from Twenty One Capital, which this week announced it too would be acquiring billions of dollars worth of BTC in an attempt to shore away business from Strategy.