Crypto Carnage: 3.7 Million Coins Vanish Since 2021 as Post-Pump.fun Purge Wipes Out Half the Market

The great crypto reckoning isn’t just coming—it’s here. New data reveals a staggering 3.7 million digital assets have gone to the blockchain graveyard since 2021, with 50% vanishing after the Pump.fun frenzy collapsed under its own speculative weight.

Survival of the fittest—or just the best-marketed? The Darwinian shakeout exposes how meme coin mania and get-rich-quick schemes ultimately cannibalized the very ecosystem they fed on. Traders who once chased 1000x gains now stare at wallets full of zombie tokens—worth less than the gas fees to dump them.

Meanwhile, Wall Street quietly scoops up Bitcoin ETFs while retail investors nurse their wounds. Some things never change.

The number of dead tokens | Source: CoinGecko

The number of dead tokens | Source: CoinGecko

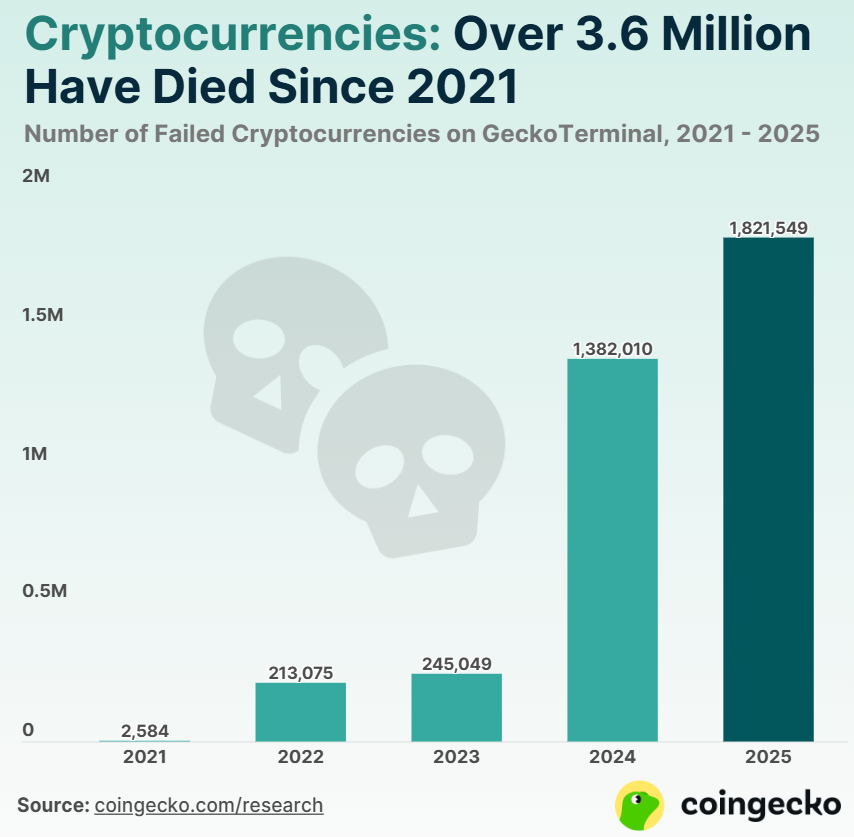

According to the research, a total of 1.8 million tokens failed in Q1 this year alone, making up 49.7% of all token failures recorded between 2021 and 2025. In 2024, nearly 1.4 million projects also went under, accounting for 37.7% of failures. Together, the two years saw most of the crypto market’s token shutdowns.

“This sharp decline in token survivability may be linked to broader market turbulence, particularly following Donald Trump’s inauguration in January 2025, which coincided with a downturn in the crypto market.”

GeckoTerminal

The number of new crypto projects has also surged. For instance, just over 428,000 tokens were listed on crypto price aggregator platforms in 2021. By 2025, that number had jumped to nearly seven million. The researchers say much of this growth “can be attributed to the launch of Pump.fun, which simplified the process of creating tokens, leading to a flood of meme coins and low-effort projects entering the market.”

Before Pump.fun launched in 2024, the number of project failures was significantly lower. From 2021 to 2023, failures remained in the low six digits. Combined, those three years accounted for just 12.6% of total token deaths, the data shows.

GeckoTerminal explained that it defines “dead tokens” as those which are no longer actively traded, noting that only tokens that had “one trade or more” before going defunct were considered.