Ethereum’s Pectra Upgrade Locked for May 7 Launch—EOF Bundled with Fusaka

Mark your calendars—Ethereum’s next major upgrade, Pectra, is confirmed for May 7 despite whispers of dev delays. The Ethereum Foundation just dropped the bombshell: EOF (EVM Object Format) won’t arrive solo—it’s hitching a ride with the Fusaka hardfork.

Why it matters: Pectra’s the biggest ETH overhaul since Dencun, promising lower gas fees and smarter contracts. But let’s be real—Wall Street still won’t understand it.

Devs are sweating bullets to hit the deadline. Meanwhile, traders are already front-running the news—classic crypto casino behavior.

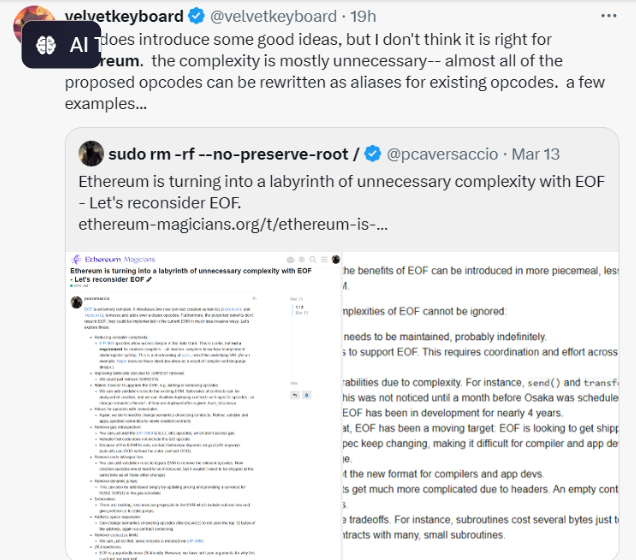

Source: @velvetkeyboard

Source: @velvetkeyboard

Despite this, Ethereum leadership decided to go ahead with implementing Full EOF — but only with the next network upgrade, Fusaka, which is now tentatively slated for Q3/Q4 this year. Tim Beiko, who runs Ethereum’s CORE protocol meetings, told participants during Thursday’s All Core Developers call, “We can’t choose not to do something just because it’s complex.”

Pectra, the upgrade set for May 7, is aimed at improving Ethereum’s validator UX, making it possible for users to pay transaction fees in USD Coin (USDC) instead of ETH, increasing validator staking limit from, and more.

Fusaka, the following upgrade, is more ambitious. Besides restructuring how smart contracts are written and executed through EOF, it aims to make Ethereum network more efficient and scalable. This is meant to improve the performance of Ethereum’s base layer, which has been steadily declining, leading several major players to sharply reduce their Ether holdings.

According to Lookonchain, Galaxy Digital recently deposited 65,600 ETH (worth $105.5 million) to Binance and then withdrew 752,240 Solana (SOL), suggesting it sold its ETH to buy SOL. Paradigm has also recently cut its ETH exposure by selling 5,500 ETH ($8.66M) to an institutional brokerage platform Anchorage, according to EmberCN.

“While institutional investors initially bought into the ‘ultra-sound money’ narrative, they’re now facing a reality where decreasing protocol revenue and weakening tokenomics create legitimate concerns,” Jayendra Jog, co-founder of SEI Labs, told Cointelegraph.