Crypto Smashes $3 Trillion Barrier as Bond Traders Outmuscle Tariff Panic

Digital assets just bulldozed past a historic milestone—flipping the ’3’ in $3 trillion from fantasy to fact. Bond vigilantes, those self-appointed enforcers of fiscal sanity, are playing whack-a-mole with tariff fears, leaving crypto to moon unchecked.

No ’safe haven’ gold-bug nonsense here—just pure, unadulterated speculative momentum. Wall Street’s still trying to price in geopolitical risk while DeFi degens are already levering long on the next meme coin. Priorities.

Funny how ’uncorrelated assets’ suddenly move in lockstep when liquidity floods the system. But hey—when the Fed’s punchbowl gets refilled, even the most cynical traders grab a glass. Cheers to the ATH... until the next ’black swan’ Twitter thread drops.

Crypto rallies

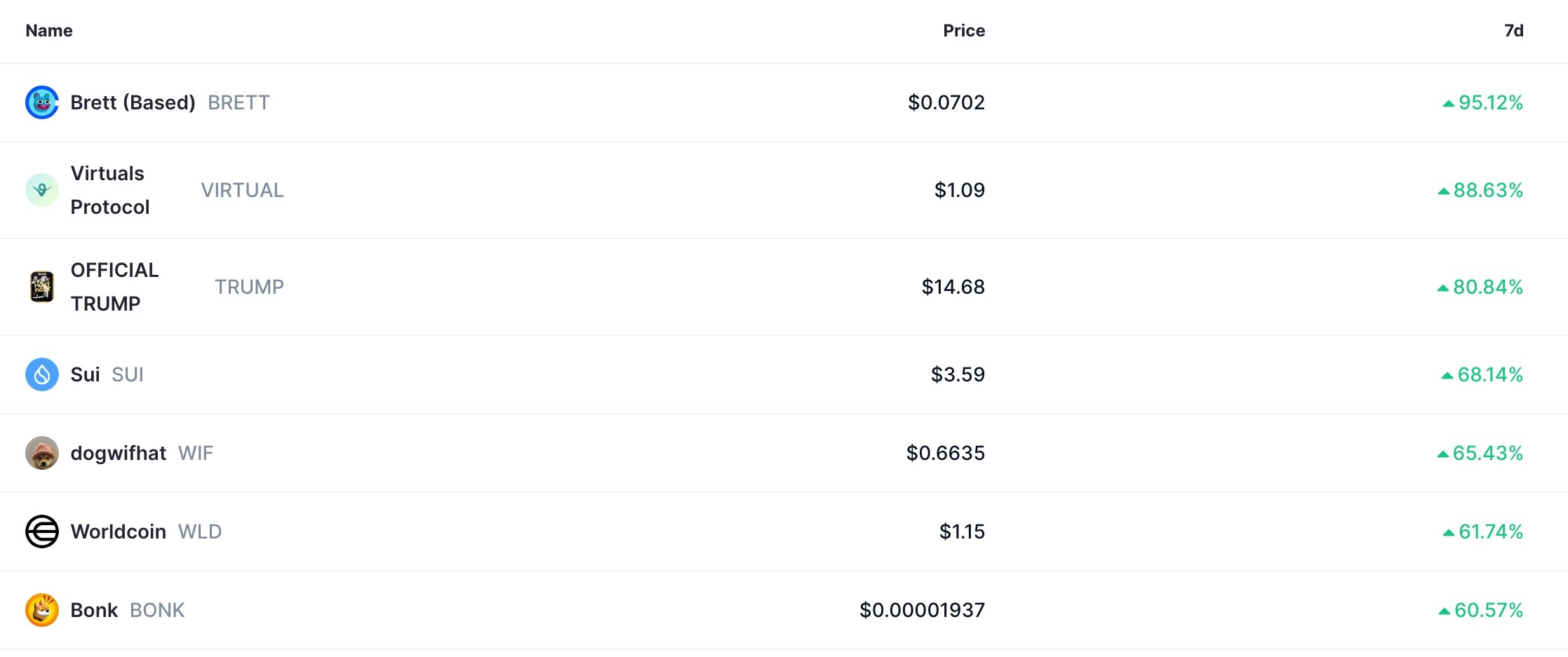

Bitcoin (BTC) price rose and retested the important resistance at $95,000 for the first time in over a month. BRETT (BRETT), the biggest meme coin on the Base blockchain, jumped by 95% in the last seven days.

Other top coins, such as Virtual Protocol (VIRTUAL), Official Trump (TRUMP), Sui (SUI), and dogwifhat (WIF), have all jumped by over 50% in the last seven days. As a result, the market cap of all coins jumped to $3 trillion.

Bond vigilantes also contributed to Trump’s decision to abandon firing Jerome Powell from the Federal Reserve.

The U.S. president cannot legally remove the Fed chair without cause.

If the Supreme Court allowed such a move to stand, it would have led to a lack of confidence in U.S. bonds and the greenback. It would have also likely pushed bond vigilantes to dump Treasuries again.

Trump also hinted that he was ready to strike a deal with China, even though China denied talks were taking place.

Therefore, crypto prices may continue to rise in the coming weeks as tariff risks ease, and the odds of Federal Reserve cuts increase.