Deloitte: Tokenized Real Estate Poised to Disrupt $4 Trillion Market by 2035

Wall Street’s next gold rush? Brick-and-mortar assets meet blockchain in a seismic shift—just don’t ask the suits how they’ll handle decentralized title deeds.

Why it matters: Tokenization slashes liquidity barriers, letting investors trade fractions of skyscrapers like meme coins. The catch? Regulators still can’t agree if a digital deed belongs in a crypto wallet or a filing cabinet.

The bottom line: When legacy finance finally stops gatekeeping property deals, the revolution won’t be televised—it’ll be minted on-chain. (And yes, bankers will still take their 2% cut.)

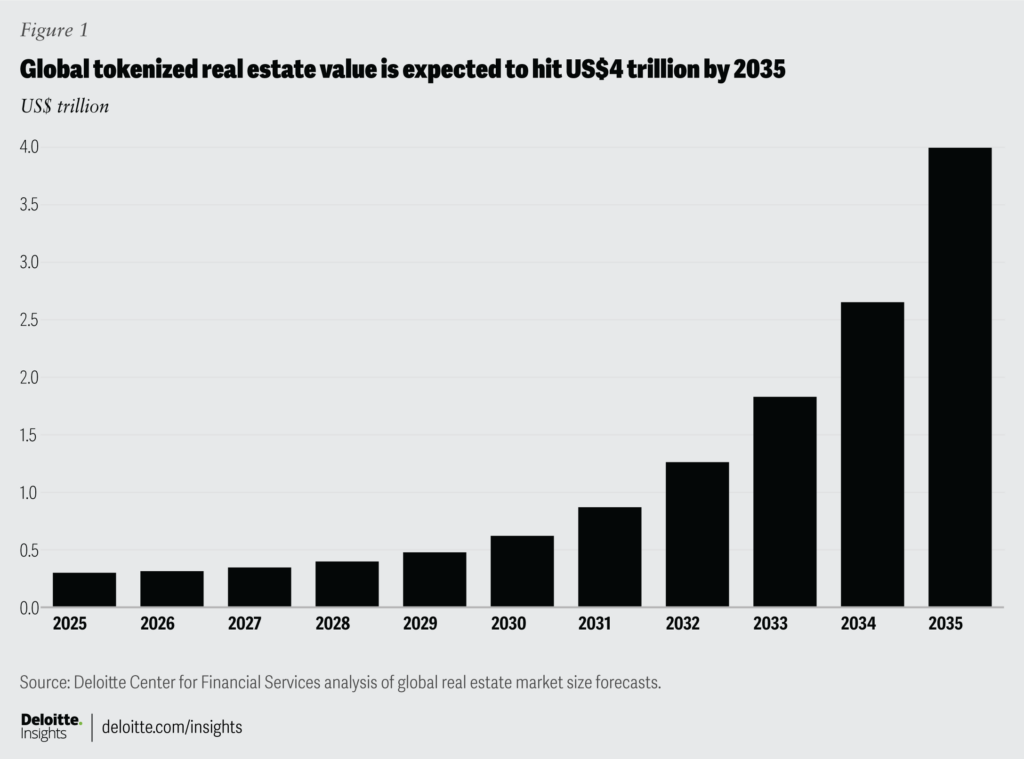

Projected growth of tokenized real estate value by 2035 | Source: Deloitte

Projected growth of tokenized real estate value by 2035 | Source: Deloitte

Out of the projected $4 trillion figure, $1 trillion will likely be in tokenized private real estate funds. So far, these funds have only been accessible to accredited investors. However, asset tokenization could make them accessible to all types of investors.

Tokenized real estate shows major potential: Deloitte

Instead of traditional shares, investors would receive tokens representing ownership in the fund. Tokens could even represent a specific portion of a fund’s real estate portfolio and could be easily tradable. This would make entry and exit from investments easier.

Another $2.39 trillion is expected to be tied to tokenized loans in securitization by 2035, capturing around 0.55% of the market. This is equivalent to mortgage-backed securities, a major segment of the financial markets. Deloitte suggests that tokenization could enable real-time payment data, reduce costs, and improve traceability.

Tokenization in this market offers major advantages over the traditional model, Deloitte explains. For one, blockchain technology can significantly reduce administrative costs, which are a major burden for the industry. At the same time, it expands investor access, making funds accessible to global and retail investors.

Still, Deloitte also highlights certain risks and questions the industry needs to address. For one, there are concerns around custody, accounting practices, and what happens in the event of a default. Additionally, cybersecurity may pose a major threat to the emerging tokenized real estate industry.