XRP Primed for 60% Rally as Whales Accumulate and SEC Leadership Shifts Under Paul Atkins

Whales are loading up on XRP as regulatory winds shift—Paul Atkins’ SEC takeover sparks speculation of a softer stance on crypto. Meanwhile, technicals hint at a breakout toward $1.40. Just don’t expect Wall Street to notice until after they’ve front-run the retail crowd.

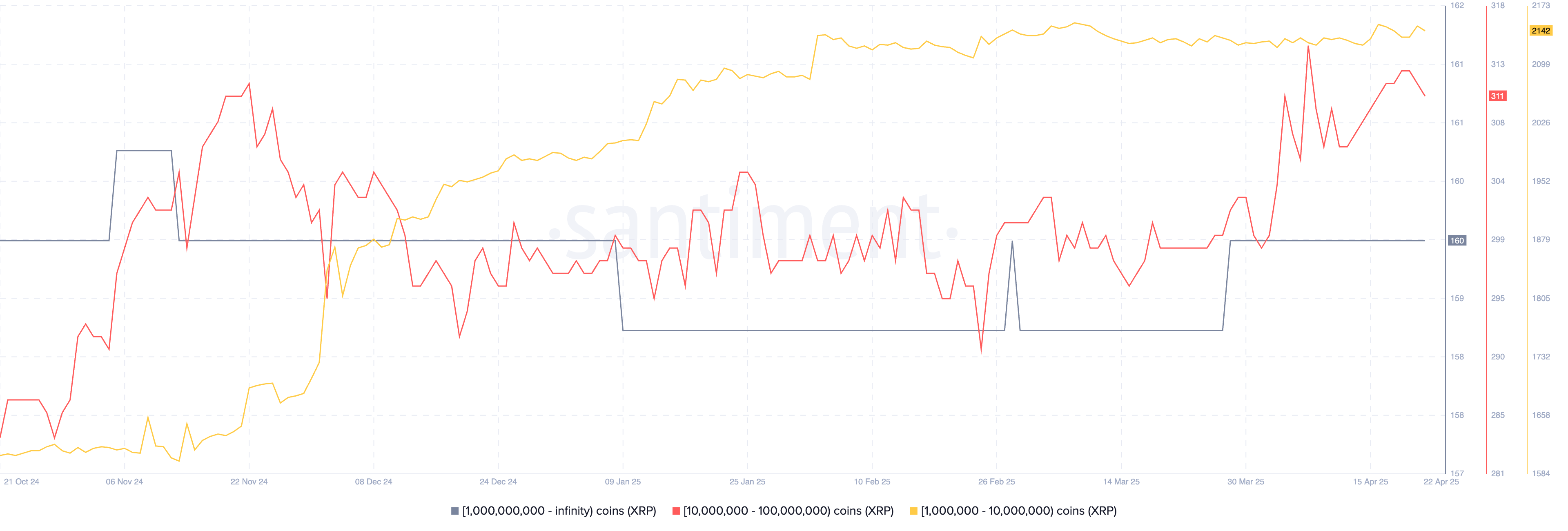

XRP on-chain data | Source: Santiment

XRP on-chain data | Source: Santiment

Additional data shows that the volume of XRP tokens on exchanges continues to fall, indicating that investors are not selling their holdings. These balances have dropped from over $3.28 billion in November last year to $2.7 billion today.

XRP investors have cheered numerous catalysts recently. Paul Atkins was sworn in as the head of the Securities and Exchange Commission on Monday. Polymarket investors expect him to approve XRP ETFs from eleven companies, including VanEck, ProShares, and Franklin Templeton.

🚨 The XRP takeover has begun 🚨

11 asset managers. Over $240B AUM. And now they all want a piece of the XRP pie.

They ignored it.

They laughed.

They fought.

Now they’re lining up with ETF filings like it’s gold rush 2.0.

Get ready for the institutional $XRP era. pic.twitter.com/TBC1GIw5GB

Ripple Labs recently acquired Hidden Road, a prime broker in a $1.25 billion. The company aims to integrate its $10 billion in daily transactions into the XRP Ledger.

Ripple continues to position itself as a major player in financial services, aiming to compete with SWIFT. Following the conclusion of the SEC vs. Ripple casethe company hopes to secure additional partnerships with banks and money transfer providers.

XRP price technical analysis: towards a 60% jump?

The daily chart shows that XRP has rebounded after reaching a low of $1.6112 on April 7. It has since bounced 35% from its lowest point this year.

It has now moved above the 25-day moving average, a sign that bullish momentum is building. The price has also broken above the descending trendline that connects the highest swing points since January 16. This line also marks the upper boundary of a falling wedge pattern.

The Relative Strength Index has crossed above the neutral level at 50. As a result, the token may continue to rise, with bulls targeting the year-to-date high of $3.40, approximately 60% above the current level. This bullish view will be confirmed if the price moves above resistance at $2.7045, the 23.6% Fibonacci retracement level.