Dow Jones Plummets 1,000 Points as Trade Tensions and Fed Policy Concerns Rattle Markets

The Dow Jones Industrial Average plunged sharply on April 22, 2025, shedding 1,000 points amid growing investor anxiety over escalating tariff disputes and uncertainty surrounding the Federal Reserve’s monetary policy direction. Market analysts attribute the sell-off to heightened risk aversion as traders weigh the potential economic impact of renewed trade restrictions and divergent views on interest rate trajectories.

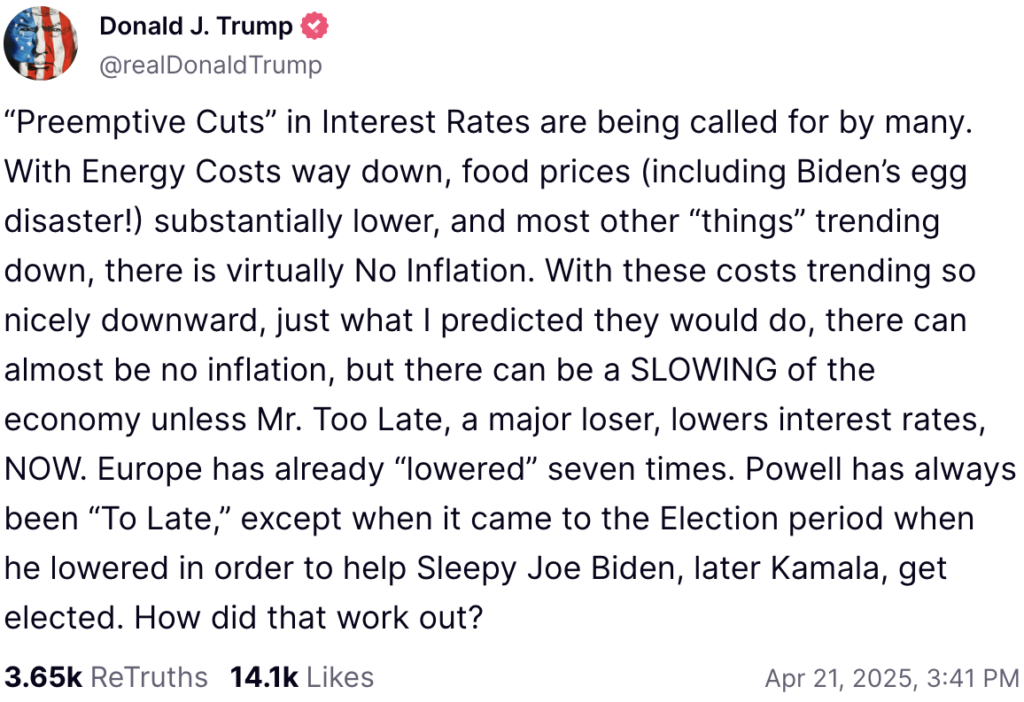

Trump pressures Fed Chair to cut rates

In a Monday, April 21, post on Truth Social, Trump called Powell a “major loser” and “Mr. Too Late,” pressuring him to cut interestest rates to help the struggling stock market. Trump claimed that lower energy prices, which are partially due to recession fears, would help buffer any inflation that might result from a rate cut.

Unlike Trump, Powell has repeatedly shown skepticism over the potential effects of easing monetary policy. In a speech in March, the Fed Chair explained that the U.S. economy is doing well, despite wild fluctuations in the stock market. Notably, Powell cited strong employment figures that suggest that the Fed has time to react.

Since its inception, the Federal Reserve has set monetary policy independently of Washington’s directives, just like central banks in all developed countries. This independence is seen as vital to ensure the strength of the domestic currency, as it helps against political pressures in favor of devaluation.