SEC Faces Pile of 72 Pending Crypto ETF Applications Spanning Altcoins and Memecoins

The U.S. Securities and Exchange Commission is currently reviewing 72 cryptocurrency exchange-traded fund filings covering a wide spectrum of digital assets, from established altcoins to volatile memecoins, as institutional demand for crypto investment vehicles continues growing.

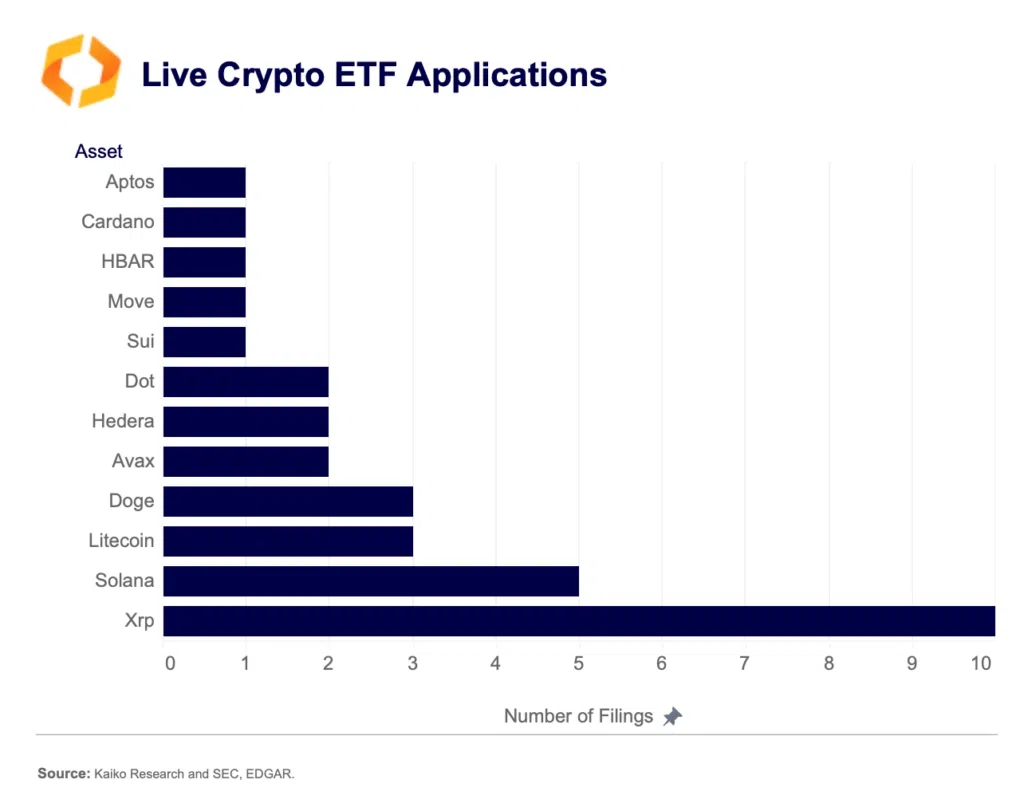

XRP leads with ETF filings

While the list of ETF filings is diverse to say the least, there are clear leaders in the space. Notably, altcoins like XRP (XRP), Solana (SOL), and Litecoin (LTC) are in the lead when it comes to the number of individual filings. Specifically, by April 15, there were 10 individual filings for XRP and five for Solana. As some of the biggest altcoins on the market, they have attracted institutional attention.

At the same time, Litecoin and Dogecoin (DOGE) were tied in third place, with three prospective issuers. Both of these tokens benefit from their decentralization, while Doge also gained mainstream attention thanks to its association with Elon Musk.

ETFs are becoming a key narrative for crypto adoption as they offer an easier way for both retail and institutional investors to gain exposure to digital assets. Instead of holding the assets directly, the fund holds underlying assets, while also having to adhere to stringent regulatory requirements over its custody.