Bitcoin at a Critical Juncture: Assessing the Potential for a Market Downturn or Imminent Recovery

As Bitcoin’s price action remains volatile, investors and analysts are divided on whether the cryptocurrency is poised for another prolonged bear market—often referred to as ’crypto winter’—or if a bullish reversal is on the horizon. Key technical indicators, macroeconomic factors, and institutional sentiment suggest the market is at a pivotal moment. With regulatory developments and macroeconomic uncertainty influencing trader behavior, the coming weeks could determine Bitcoin’s trajectory for the remainder of 2025. Market participants are closely monitoring support and resistance levels, as well as on-chain metrics such as exchange flows and miner activity, to gauge the likelihood of a sustained rebound or further downside.

Not All Declines Are Equal

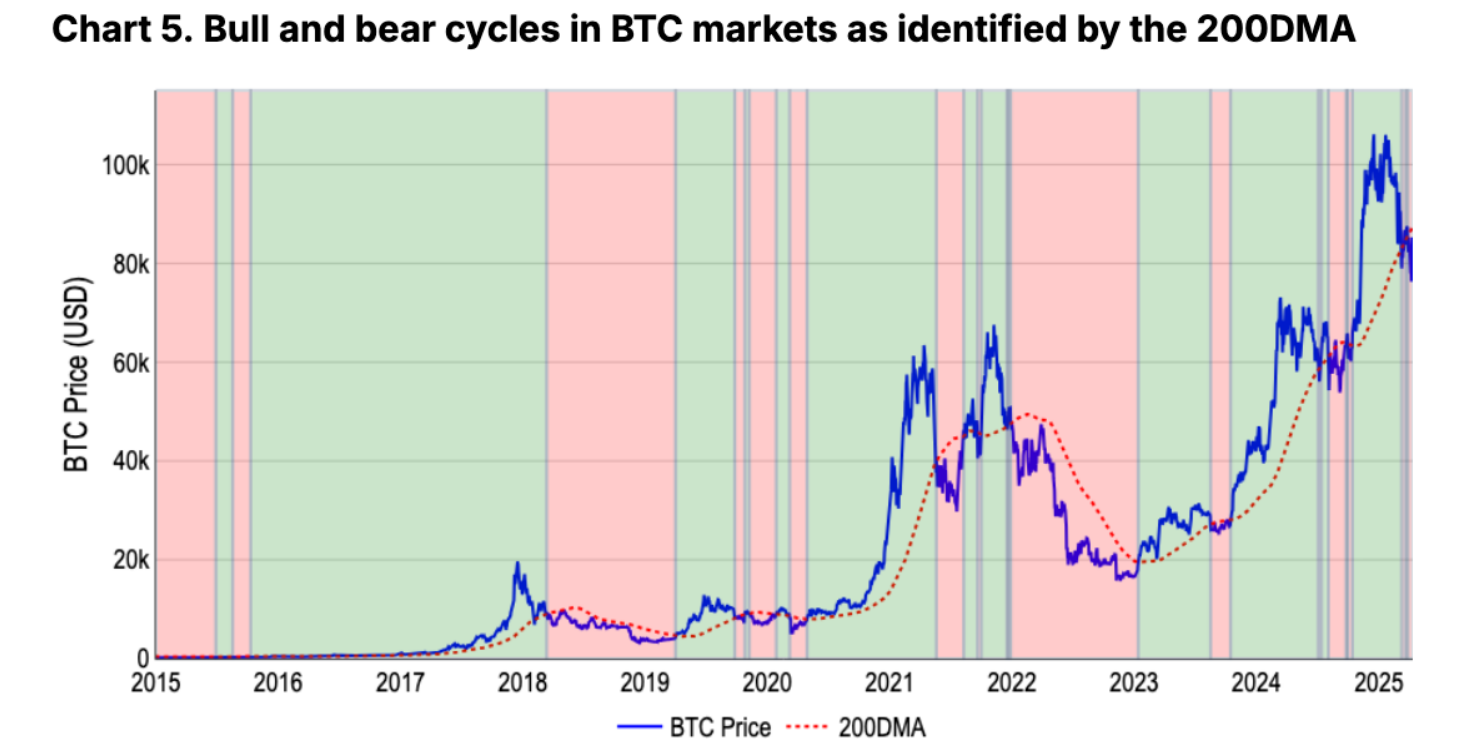

Traditionally, markets define a bear phase with a 20% drop from recent highs. But crypto doesn’t play by traditional rules. Bitcoin’s 76% decline between November 2021 and November 2022 was a stark contrast to the 22% drawdown in U.S. equities during the same period. Such volatility amplifies both fear and opportunity, and with the asset now dipping below its 200-day moving average, historical models suggest a bearish trend may be forming.

However, sentiment doesn’t just depend on numbers. As the Coinbase report puts it: “Bear markets represent regime shifts more than mere percentages.” Metrics like z-scores and moving averages are becoming more relevant in interpreting Bitcoin’s erratic rhythm than arbitrary thresholds.

Bitcoin Whale Confidence and Technical Insights

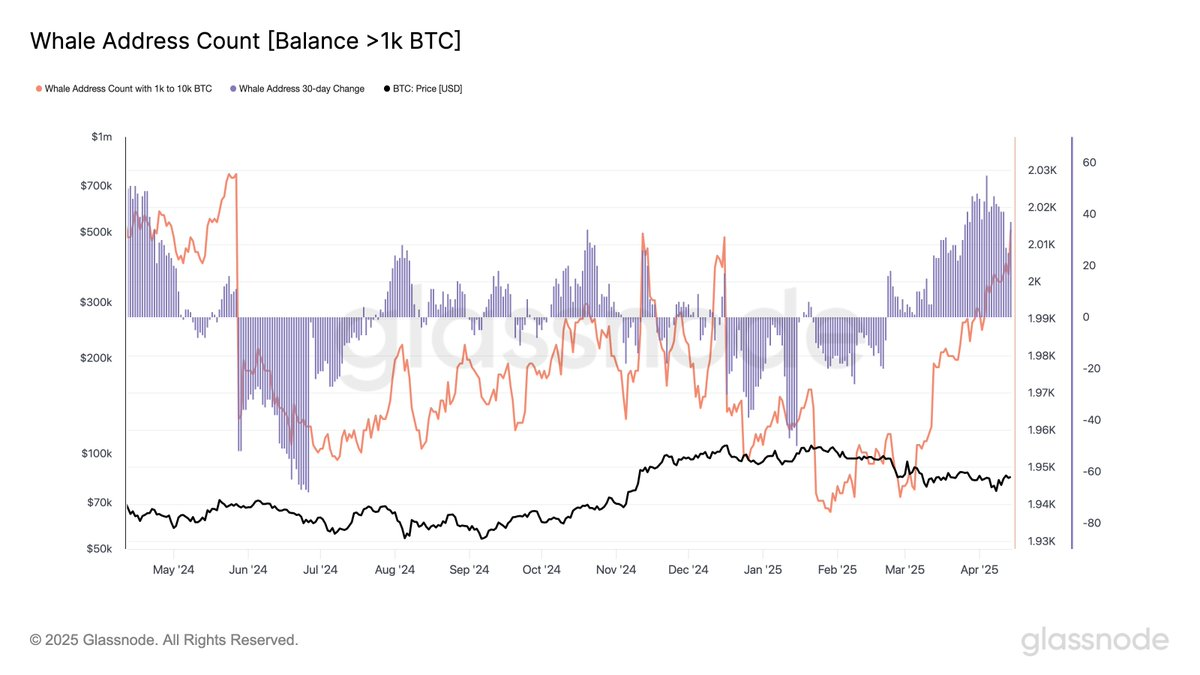

In contrast to the bearish signals, data from Glassnode reveals that the number of addresses holding 1,000–10,000 BTC has increased from 1,944 to 2,014 since March 5. This type of whale accumulation is a bullish undertone last seen in April 2024, hinting at growing confidence among institutions and high-net-worth individuals.

A crypto analyst, Titan of Crypto noted Bitcoin facing resistance at $81,000, suggesting a possible retest before further upside, while Michaël van de Poppe remains bullish as long as BTC holds above $80,000.

Minotaurus: A Bright Spot in Web3 Gaming

Amid Bitcoin price uncertainty, newer projects like Minotaurus (MTAUR) are gaining traction in the Web3 gaming sector. Minotaurus offers an interactive, strategy-based gaming experience, with the MTAUR token unlocking exclusive in-game features and power-ups.

The project has attracted growing interest from the crypto and gaming communities, with influencers highlighting its potential. Its focus on long-term engagement through structured vesting programs makes it a noteworthy altcoin to watch during this market downturn.

Final Thoughts: Looking Ahead: Caution with a Glimmer of Hope

The Coinbase report advises a defensive stance for the next 4-6 weeks, citing macro challenges, but sees a potential floor for crypto prices by mid-to-late Q2 2025. While Bitcoin navigates a possible crypto winter, its resilience and whale accumulation offer hope for a rebound. Altcoins like Minotaurus could also shine as the market evolves, making this a pivotal moment for the crypto space.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.