Tether’s Q1 2025 Revenue Approaches $1.5B While Ethereum Struggles to Surpass $200M Mark

In a striking divergence of performance among major crypto assets, Tether (USDT) has reported staggering quarterly revenues nearing $1.5 billion as of Q1 2025, cementing its position as the dominant stablecoin. Meanwhile, Ethereum’s revenue metrics continue to underperform, remaining below the $200 million threshold. This growing disparity highlights the shifting dynamics in cryptocurrency adoption, where stablecoins are increasingly capturing market share from smart contract platforms. Analysts attribute Tether’s success to its deep liquidity across global exchanges and growing use in emerging markets for remittances and dollar hedging. The Ethereum ecosystem, while maintaining technological leadership in dApp development, appears to be facing revenue pressure from layer-2 solutions diverting transaction fees away from the mainnet.

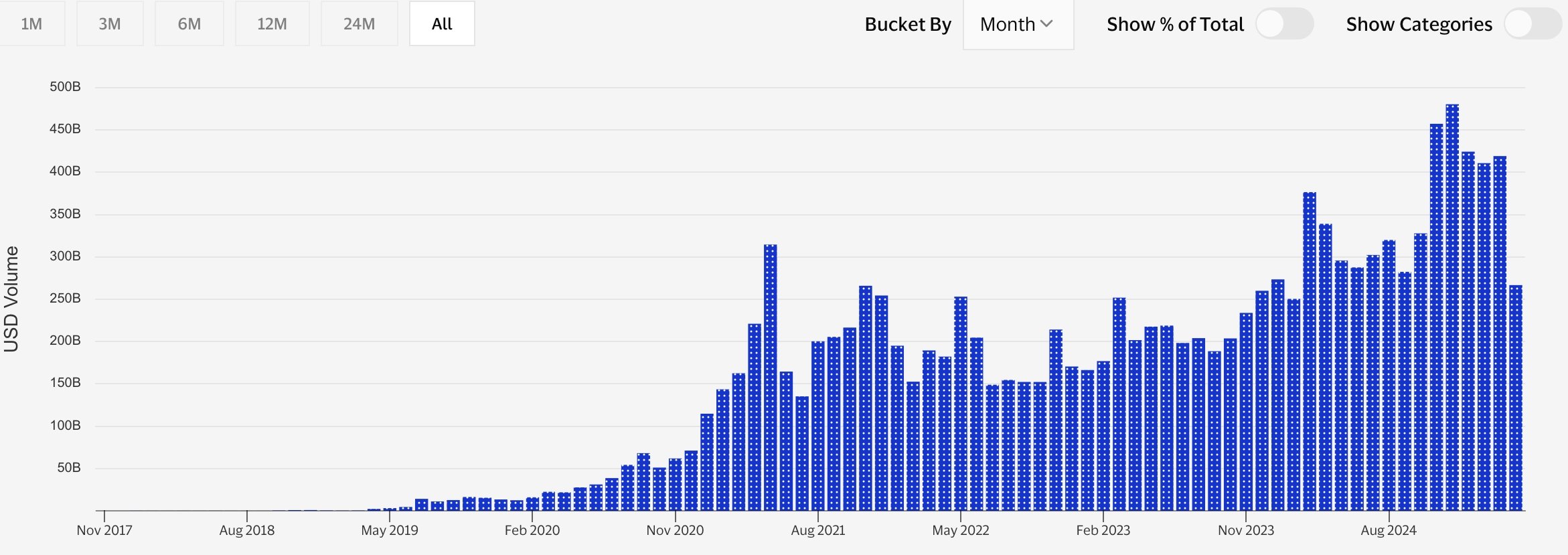

USDT monthly volume | Source: Visa

USDT monthly volume | Source: Visa

Tether’s revenue has increased as the market cap of the stablecoin has continued to rise. There are now over $144 billion worth of USDT tokens in circulation, up from $109 billion a year earlier.

Tether generates its profits by investing its funds primarily in Treasuries, which are often regarded as SAFE assets. US government bonds have generated higher yields in the past few years as interest rates have remained above average. It has just a handful of employees and operational costs, making it one of the most profitable companies in the world.

Tether’s growth has also helped to mint several billionaires. Forbes estimates that Paolo Ardoino, who has a net worth of about $9.5 billion. Giancarlo Devasini, the biggest shareholder in Tether is worth about $22.4 billion, while Jean-Louis van der Velde is valued at $9.5 billion.

Tether has used its windfall to invest in several companies this year. It invested in firms like Fizen, Be Water, AdecoagroJuventus Football Club, Rumble, Northern Data, Bitdeer Technologies Group, and Blacirock Neurotech.