Solana’s Decentralized Applications Outperform Competitors with Record Revenue Dominance

As of April 2025, Solana’s decentralized application (dApp) ecosystem has achieved a significant milestone by generating more cumulative revenue than all other blockchain networks combined. This remarkable performance underscores Solana’s growing dominance in the Web3 space, driven by its high throughput and low transaction costs. The network’s dApps across DeFi, NFT marketplaces, and gaming sectors have collectively surpassed the revenue totals of competitors including Ethereum, BNB Chain, and layer-2 solutions. Industry analysts attribute this achievement to Solana’s scalable architecture and increasing institutional adoption, marking a potential shift in the blockchain revenue landscape.

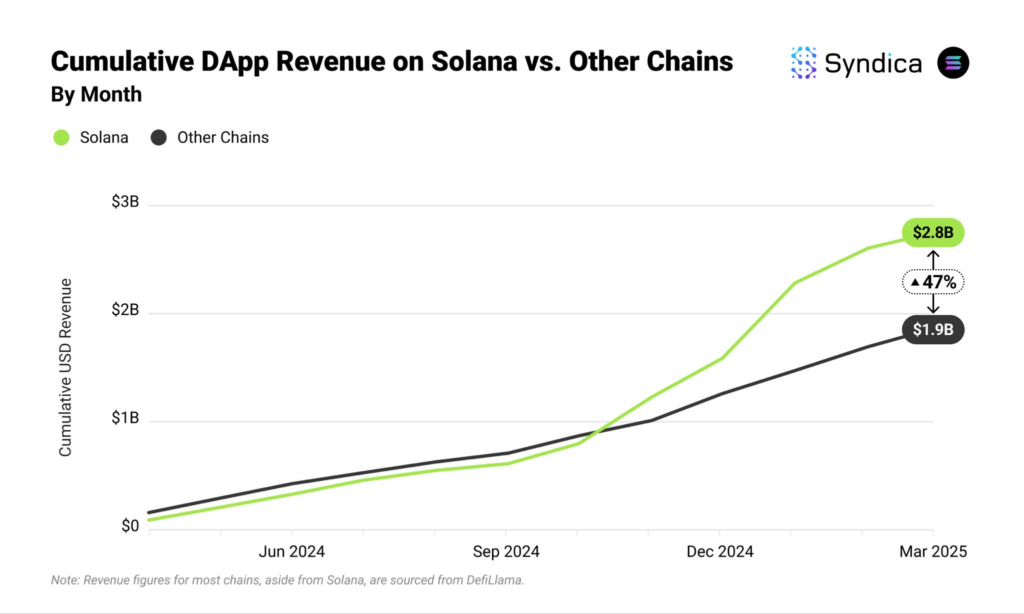

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Cumulative dApp revenue for Solana and all other chains | Source: Syndica

Solana’s dApp earnings began outpacing all other chains in October of last year. Since then, the gap has only continued to widen. These figures show that Solana’s ecosystem remains highly attractive to both users and developers. Its low fees and focus on user experience appeal to end users, while developers benefit from the network’s accessible and developer-friendly infrastructure.

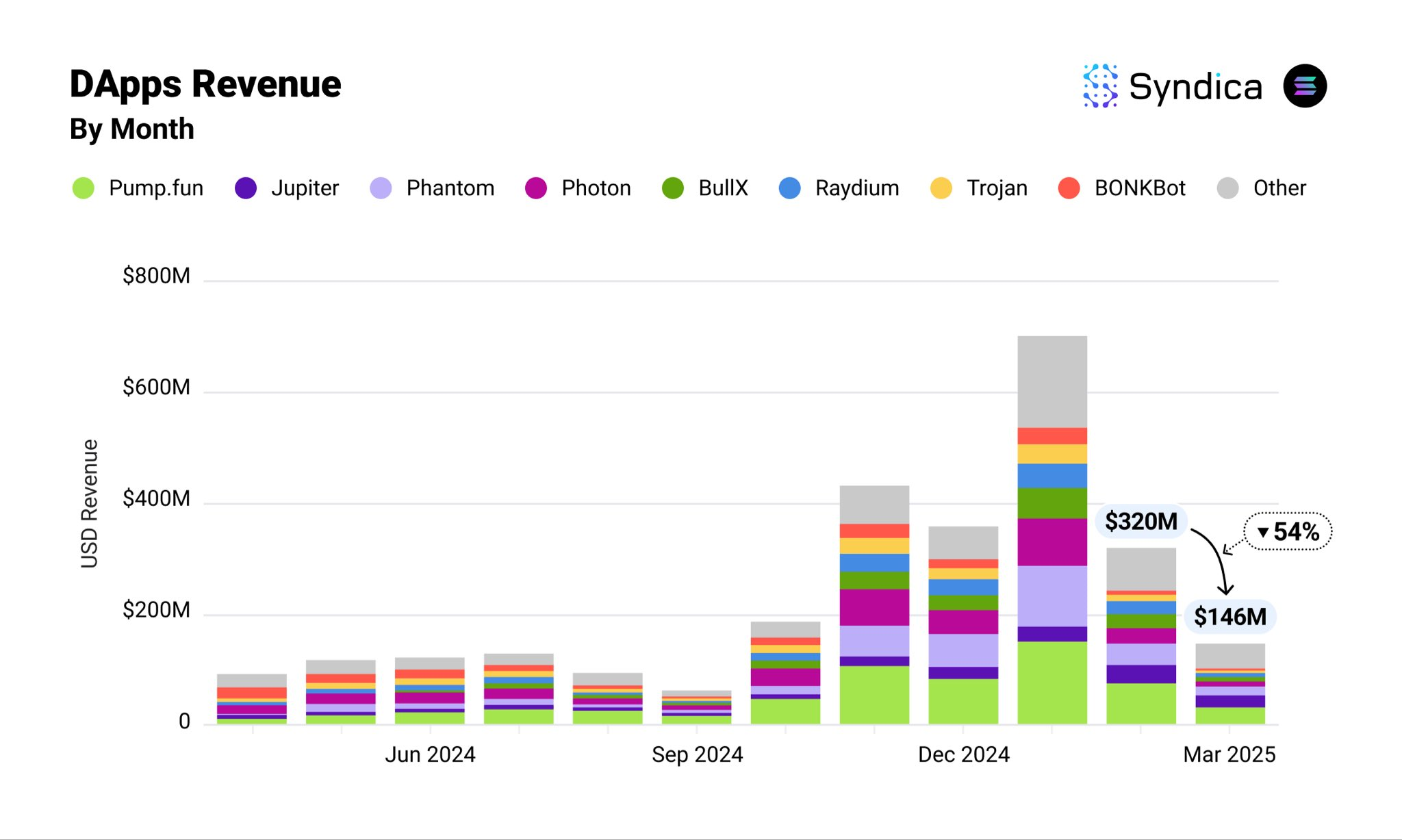

Still, Solana’s dApp revenue is largely driven by crypto trading applications, which makes earnings highly volatile. For example, revenue peaked in January at $701 million, coinciding with Solana’s all-time high of $294.33.

Since that peak, dApp revenue has declined significantly, dropping to $146 million in March. This highlights how closely dApp earnings correlate with high trading volumes and elevated asset prices.

Pump.fun leads in Solana revenue

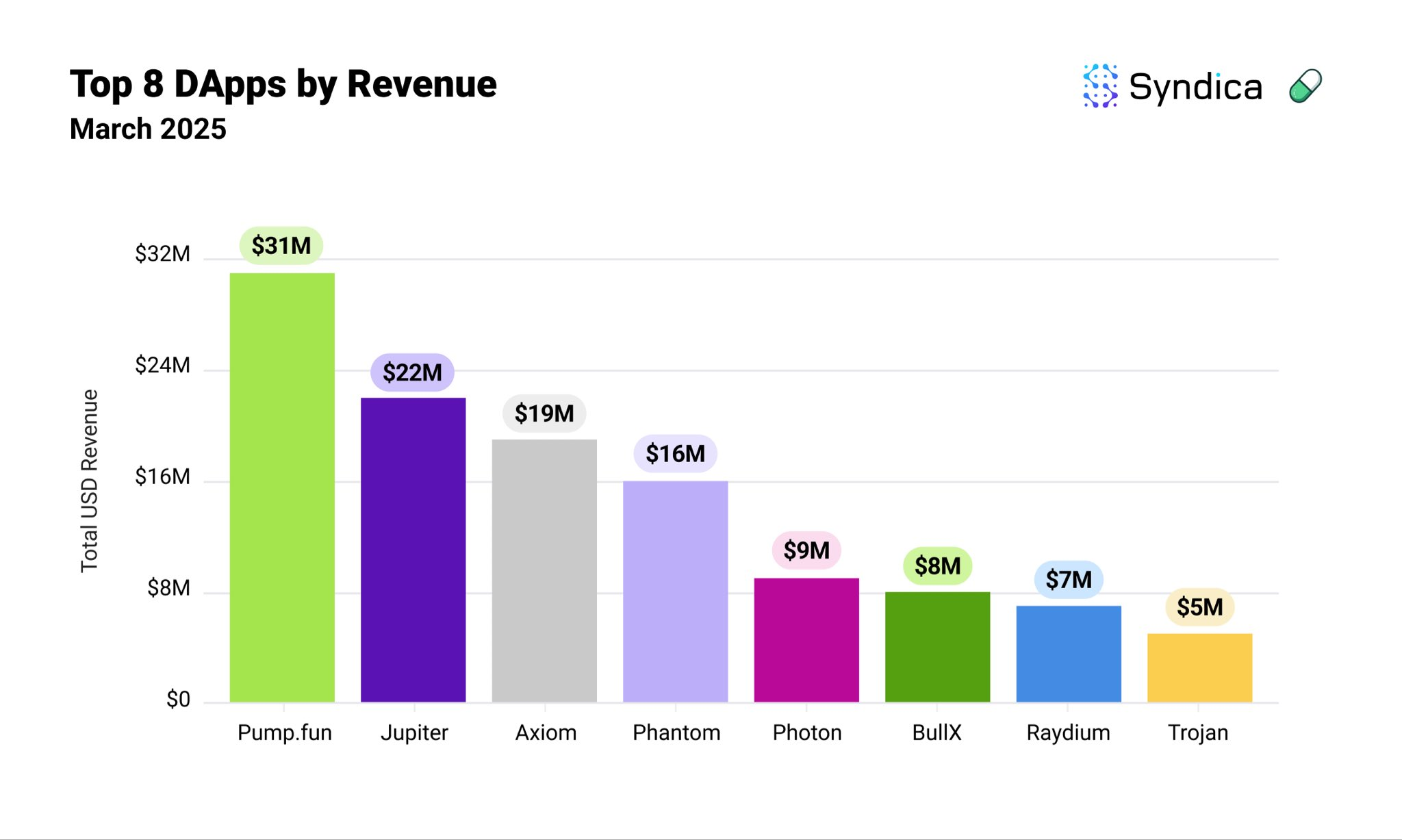

Exchanges, wallets, and other trading-focused platforms dominate Solana’s top-earning dApps. The biggest contributor in March was memecoin launchpad Pump.fun, which brought in $31 million, surpassing platforms like Jupiter and Phantom.

Pump.fun is now facing rising competition from Axiom, a memecoin launchpad backed by Y Combinator. Axiom has quickly gained traction, capturing 29% of the memecoin dApp market and generating $19 million in revenue.

Meanwhile, Jupiter remains the dominant force among Solana DEXs, earning 93% of total DEX revenue on the network. It maintained strong performance in March, bringing in $22 million despite the cooling market—alongside consistent results from Kamino Finance.