Cryptocurrency Scams Escalate Dramatically in Q1 2025 with Rug Pull Losses Surging Over 6,500%

The cryptocurrency sector has witnessed an alarming escalation in fraudulent activities during the first quarter of 2025, with rug pull schemes causing unprecedented financial damage. According to recent blockchain security reports, investor losses from these exit scams have skyrocketed by 6,500% compared to the same period last year. This staggering increase highlights growing vulnerabilities in the decentralized finance (DeFi) ecosystem as malicious actors develop more sophisticated methods to exploit liquidity pools and manipulate token valuations. Security analysts note that the majority of these scams have targeted newly launched tokens on EVM-compatible chains, particularly those with unaudited smart contracts and exaggerated yield promises. The dramatic surge in losses has prompted renewed calls for enhanced regulatory oversight and improved investor education in the Web3 space.

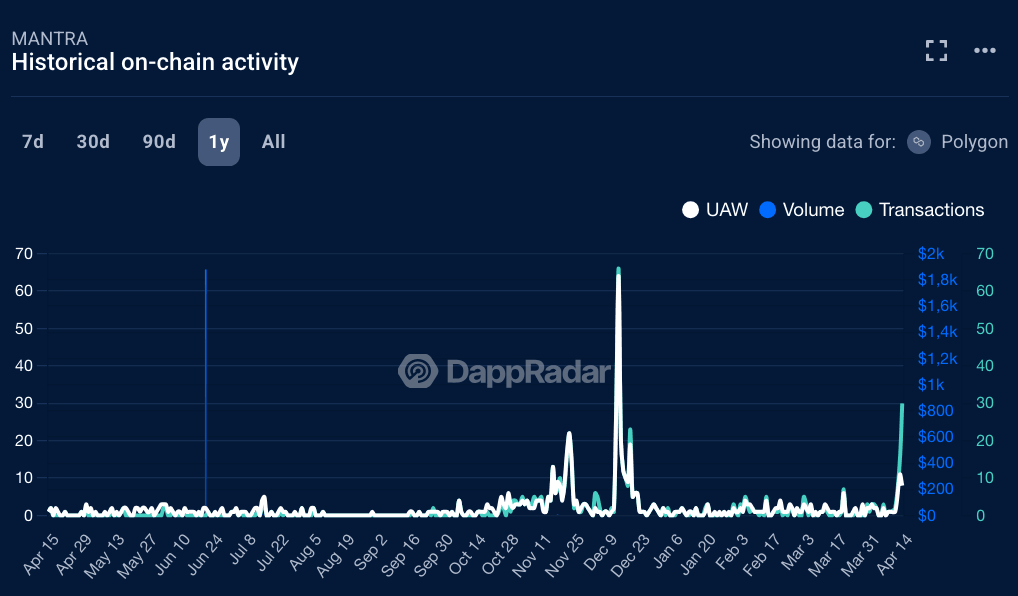

Mantra’s on-chain activity | Source: DappRadar

Mantra’s on-chain activity | Source: DappRadar

Despite the financial toll, rugpulls have become less common. DappRadar found that “only 7 [incidents] have been reported so far” in 2025, compared to 21 in early 2024, marking a 66% drop in frequency, even as losses have exploded.

The Mantra Network case shows how misleading signals can hide in plain sight, Gherghelas say, adding that the platform’s all-time high in Unique Active Wallets “was just 64, recorded in December 2024.”

“Outside of that brief spike, daily wallet interactions consistently ranged between 1 and 11, with multiple days showing zero activity altogether. This lack of consistent user engagement points to low traction, a potential red flag for any project claiming growth or adoption.”

Sara Gherghelas

Gherghelas says transaction data also raised concerns as some days “registered as many as 66 transactions,” adding that “activity just as often dropped back to zero.” The irregular patterns may point to “inorganic engagement — common signs in dapps that may be manipulated to appear more active than they are,” Gherghelas says.