Bitcoin Plunge: American BTC Stock Crashes 6%, Wiping Out Treasury Purchase Gains

Another day, another crypto rollercoaster—Wall Street's favorite Bitcoin play just got hammered.

The Great Unwind

American Bitcoin stock nosedived 6% in today's session, completely erasing the artificial pump from recent treasury acquisitions. That brief moment of institutional enthusiasm? Gone faster than a trader's patience during a flash crash.

Market Reality Check

The sell-off demonstrates how fragile these treasury-driven rallies can be when underlying market sentiment remains shaky. While the corporate balance sheet maneuvers made for nice headlines, they couldn't overcome the broader pressure dragging crypto equities lower.

Because nothing says 'stable investment' like digital assets that can wipe out weeks of gains in a single trading session—just ask your friendly neighborhood hedge fund manager currently explaining this to furious investors.

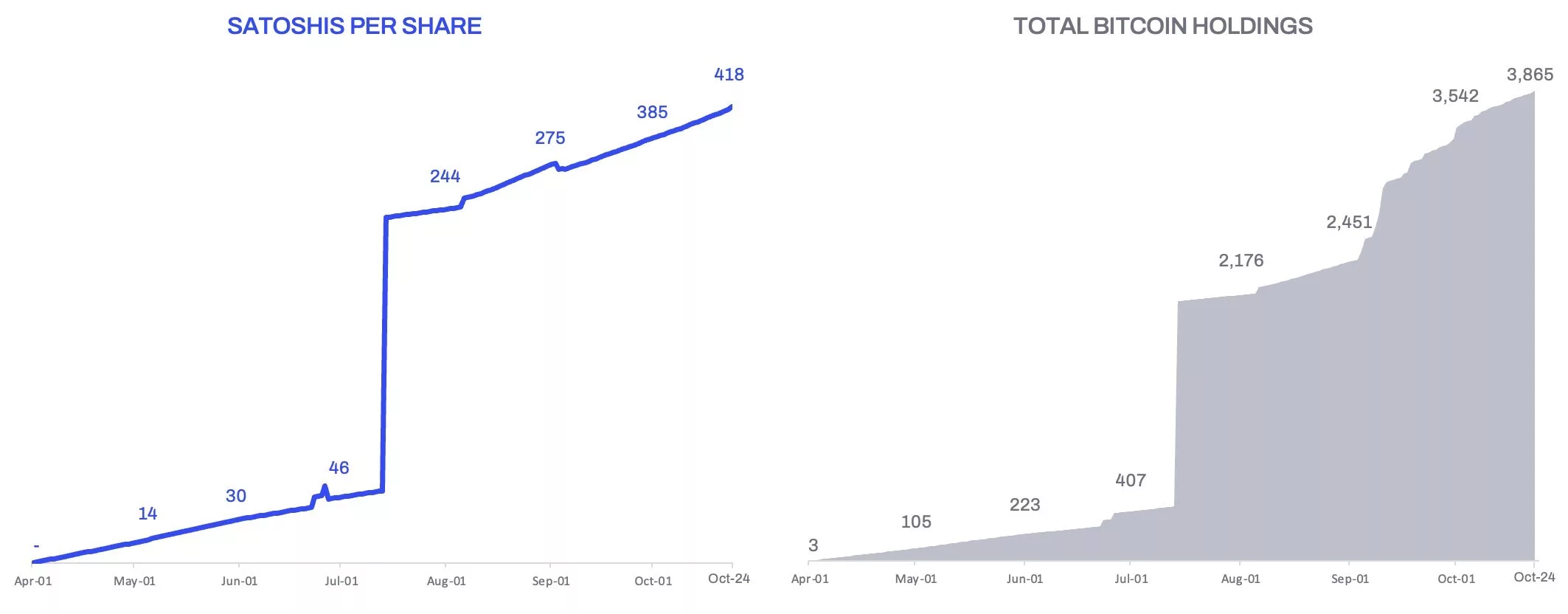

Satoshis per share that American Bitcoin owns | Source: PR Newswire

Satoshis per share that American Bitcoin owns | Source: PR Newswire

“We believe one of the most important measures of success for a Bitcoin accumulation platform is how much Bitcoin backs each share,” said Eric Trump, Co-founder and Chief Strategy Officer of American Bitcoin.

American Bitcoin faces market headwinds

Despite positive sentiment around the latest acquisition, some traders are concerned with ABTC’s valuation. While its current Bitcoin reserves are worth about $444 million, the company’s market cap is $5.10 billion. This lofty valuation gives the firm ample opportunity to acquire Bitcoin for equity, but it’s also dependent on its future performance.

American Bitcoin came out of a partnership between publicly traded BTC mining form Hut 8 and the TRUMP family. Notably, the firm’s co-founders are Donald Trump Jr. and Eric Trump, who is also the company’s Chief Strategy Officer.