Smarter Web Company Skyrockets Bitcoin Holdings to 2,650 BTC - Strategic Crypto Bet Pays Off

Smarter Web Company just dropped a bombshell announcement that's sending shockwaves through the crypto space.

Massive Bitcoin Accumulation

The tech firm revealed it now holds 2,650 BTC in its treasury reserves - a move that positions them among the most aggressive corporate Bitcoin adopters. This isn't just dipping toes in the water; it's a full-scale plunge into digital gold.

Strategic Treasury Management

While traditional companies cling to cash reserves losing value daily to inflation, Smarter Web Company chose the asset that actually appreciates. Their CFO must be the only one on Wall Street who understands what 'store of value' actually means.

Corporate Adoption Trend Accelerates

This massive acquisition signals growing confidence among tech leaders that Bitcoin represents the future of corporate treasury management. Other companies still playing with bonds and cash equivalents? They're basically investing in rotary phones.

Market Impact

The announcement comes as institutional adoption reaches fever pitch. With each major corporate addition like this, Bitcoin's case as a legitimate reserve asset grows stronger - while traditional finance executives scratch their heads wondering why their MBA programs didn't cover this.

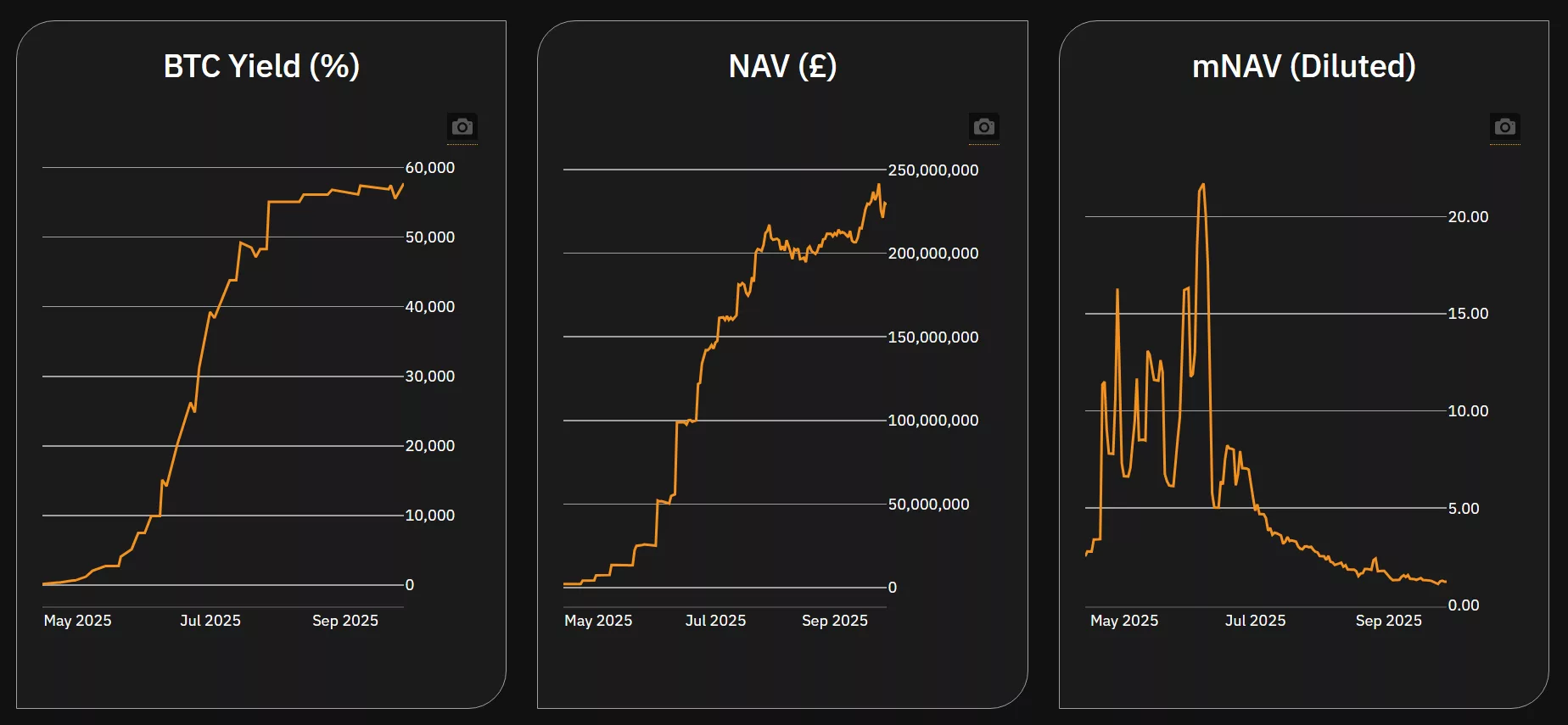

The Smarter Web Company has a BTC Yield of 57,718% on a year-to-date basis | Source: The Smarter Web Company

The Smarter Web Company has a BTC Yield of 57,718% on a year-to-date basis | Source: The Smarter Web Company

Shortly after the BTC purchase was made, the Smarter Web Company’s stock saw modest gains of about 0.63% on the market. Although the increase is comparatively smaller compared to past stock jumps after it conducted Bitcoin purchases, it was able to pull the company’s share back from its downward trend.

In the past few days, the Smarter Web Company’s stock has been on the decline. In the past month, the stock has fallen nearly 30% from its previous peak at £1.59. Even though the company has been regularly purchasing Bitcoin throughout September and October, with its previous BTC purchase taking place on October 7, when it bought 25 BTC.

As of October 13, the company holds a total of 2,650 BTC in its reserves; meanwhile, its share price is trading below £1. According to the company’s official website, Smarter Web Company has a market Net Asset Value of 1.21. This means that investors are paying £1.21 in stock value for every £1 of treasury value held in BTC and cash.

Are Bitcoin treasuries still all the rage?

Over the past few months, the HYPE surrounding BTC treasuries has started to die down. At the start of June 2025, there were at least 60 companies out of the 124 total that began doubling down on their BTC treasury strategies, owning a combined 673,897 BTC or 3.2% of the supply.

Since then, the number has multiplied to 346 entities that hold BTC worldwide. On Oct. 13, there are 3.91 million BTC held in corporate treasuries. This means that stockpiling Bitcoin is no longer a novel business strategy, considering hundreds of companies have started adopting BTC into their operations.

This change in investor appetite for Bitcoin accumulation is reflected in Smarter Web Company’s share price. At its peak in June 2025, the share price bounded as high as £5, but now each share is valued at less than £1. Even with the constant BTC purchases, the company still has not managed to bump up its stock price to levels previously seen mid-year.