Aster Token Soars 14% as Protocol Dominates Daily Fees Among Perpetuals DEXs

Aster token rockets double-digits while its protocol outearns every perpetual decentralized exchange in the market.

Fee Generation Machine

The Aster protocol generated more daily fees than any other perps DEX—fueling that 14% price surge as traders flock to the platform. Numbers don't lie, even when traditional finance analysts pretend not to see them.

DeFi's Silent Majority

While Wall Street debates theoretical adoption, decentralized perpetual exchanges keep printing real revenue. Aster's fee dominance shows where the actual trading volume lives—off the traditional books and in the hands of actual users.

Another day, another DeFi protocol proving that financial innovation happens despite regulators, not because of them. The suits will catch up eventually—probably just in time to miss the next 14% move.

Aster token gains as platform overtakes rivals in fees

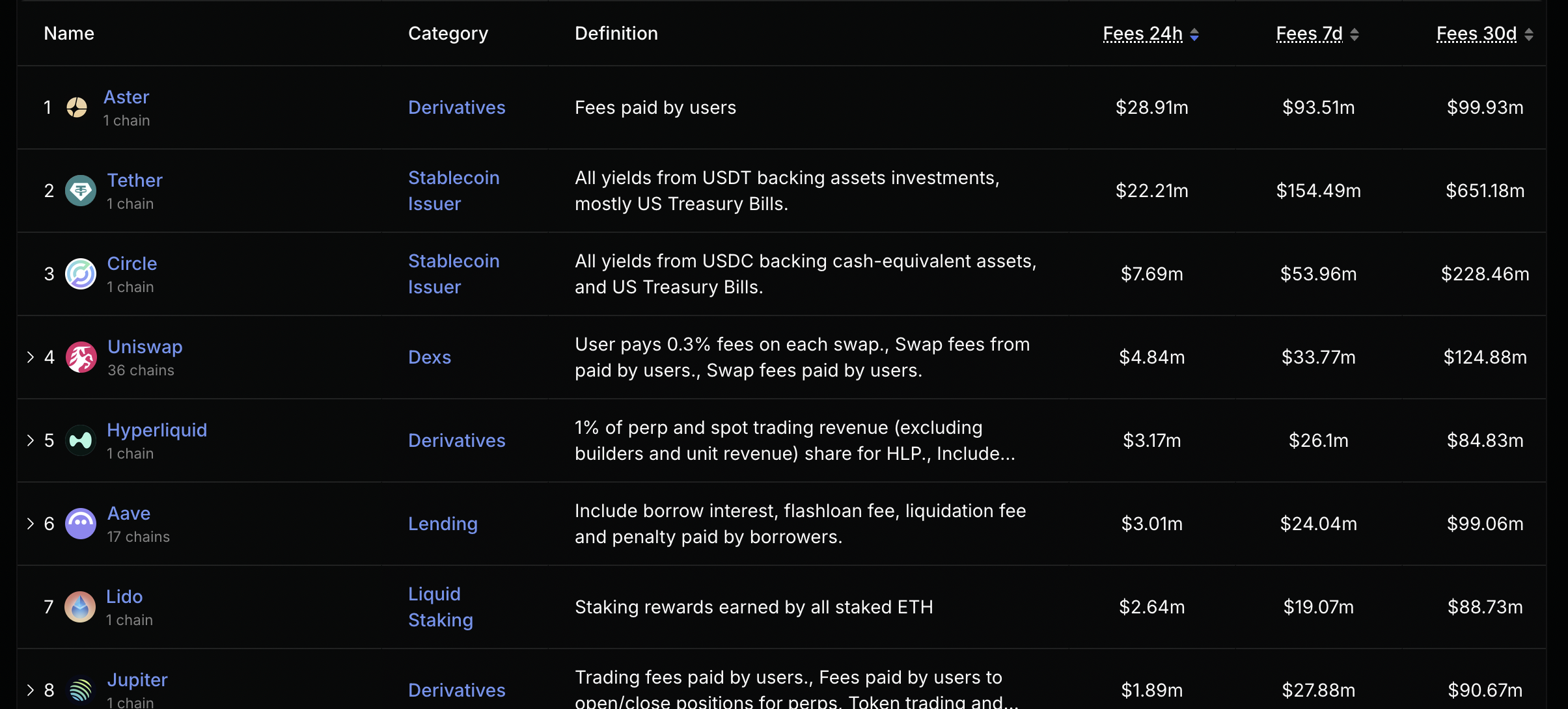

While the token’s price is attracting attention, Aster is also making waves in the DeFi sector. According to DefiLlama, Aster has emerged as the top fee-generating protocol across all chains, raking in $29.16 million in the past 24 hours.

This puts it well ahead of its rival Hyperliquid, which generated a more modest $3.17 million during the same period.

On the weekly chart, Aster has also maintained a clear lead, with $93.5 million in fees generated. This surpasses Tether and Circle, two of the largest stablecoin issuers, which recorded $154 million and $54 million, respectively. Their daily fees also lag behind the exchange by a wide margin, with Tether at $22.2 million and Circle at approximately $7.7 million.

This adds to Aster’s dominance in perpetual trading volume. It reflects DEEP user engagement, sustained trading volumes, and its growing relevance in the decentralized derivatives space. However, whether the protocol can sustain this dominance remains to be seen.

With the Aster token now approaching key resistance levels and the broader crypto market showing signs of recovery, the next few days will reveal whether it can continue its current upward movement.