Why Is Crypto Market Crashing Today? The Real Factors Behind September 2025’s Bloodbath

Crypto markets tumble as regulatory uncertainty meets technical breakdowns. September 26, 2025, marks another brutal day for digital assets.

Regulatory Whiplash Hits Hard

Global watchdogs flex muscles simultaneously—from SEC enforcement actions to EU MiCA implementation delays. Traders face whiplash as compliance costs spike overnight.

Technical Dominoes Fall

Major exchange outages during peak volatility exacerbate selling pressure. Liquidity vanishes faster than a Bitcoin maximalist's patience during a bear market.

Leverage Liquidation Cascade

Over-leveraged positions get obliterated as margin calls trigger automatic sell-offs. The crypto casino collects its dues—again.

Institutional Cold Feet

Wall Street's hot money retreats at first sign of turbulence. Apparently, their 'long-term blockchain conviction' lasts about as long as a meme coin's hype cycle.

This isn't a collapse—it's a recalibration. History shows crypto winters birth the next generation of innovators. The weak hands fold while builders keep coding.

Bitcoin options expiry

Traders are also concerned as roughly $22.3 billion in crypto options are set to expire today, including $17.06 billion tied to Bitcoin.

🚨 Options Expiry Alert 🚨

At 08:00 UTC tomorrow, over $22.3B in crypto options expire on Deribit; one of the biggest quarter-end expiries. 🔥$BTC: Notional: $17.06B | Put/Call: 0.76 | Max Pain: $110K$ETH: Notional: $5.20B | Put/Call: 0.80 | Max Pain: $3,800

Q3’s largest… pic.twitter.com/FDT1tWomYH

As expiry approaches, BTC’s price often gravitates toward the “max pain point,” the strike level where option buyers incur the largest losses and sellers benefit most.

For this month’s expiry, bearish positions are concentrated in the $95,000 to $110,000 range. If Bitcoin fails to reclaim the $110,000 level by 8:00 a.m. UTC, put options could gain an advantage of about $1 billion, potentially adding further downside pressure to the already bleeding market.

Crypto Fear and Greed Index hits Fear territory

At the same time, the current environment has weighed on market sentiment. Notably, the Crypto Fear and Greed Index has slipped into Fear territory at 29 after dropping from this month’s high of 73.

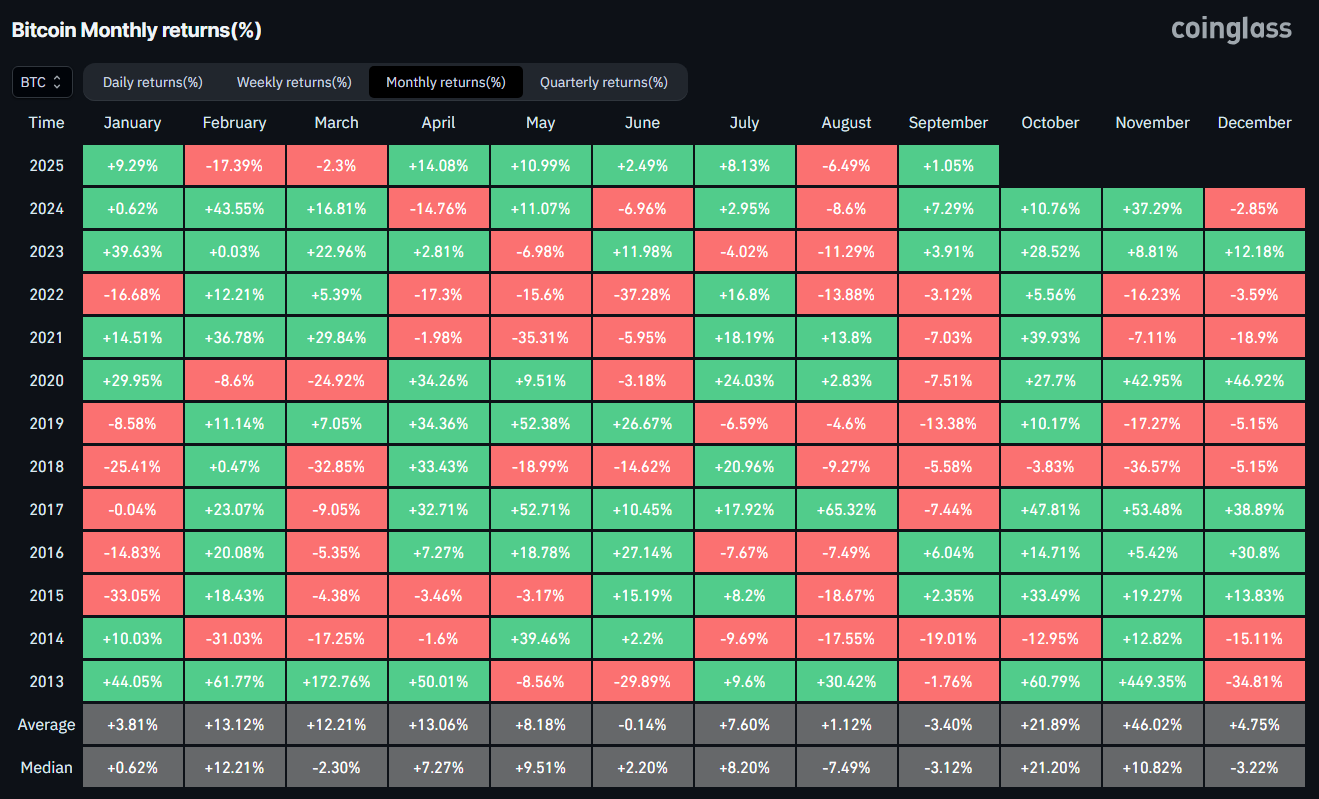

Traders are also weighing the fact that September is historically a bearish month for Bitcoin, which likely impacts the broader market sentiment. According to Coinglass data, Bitcoin’s average and median returns are roughly -3% as the flagship crypto has closed eight of the past twelve Septembers in losses.

Liquidations

Another reason for the crypto market slump today is the over $1.2 billion in liquidations hitting the market over the past day. Out of this, nearly $1.1 billion in liquidation came from long positions, data from CoinGlass show.

Such heavy, long liquidations are bearish for traders because they force Leveraged buyers to exit their positions, which therefore drives increased selling pressure on prices, and encourages traders to stay on the sidelines until the situation cools off.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.