Solana Plummets to Critical $200 Support as RSI Signals Oversold Territory

Solana faces a brutal market correction as technical indicators flash red across the board.

Technical Breakdown

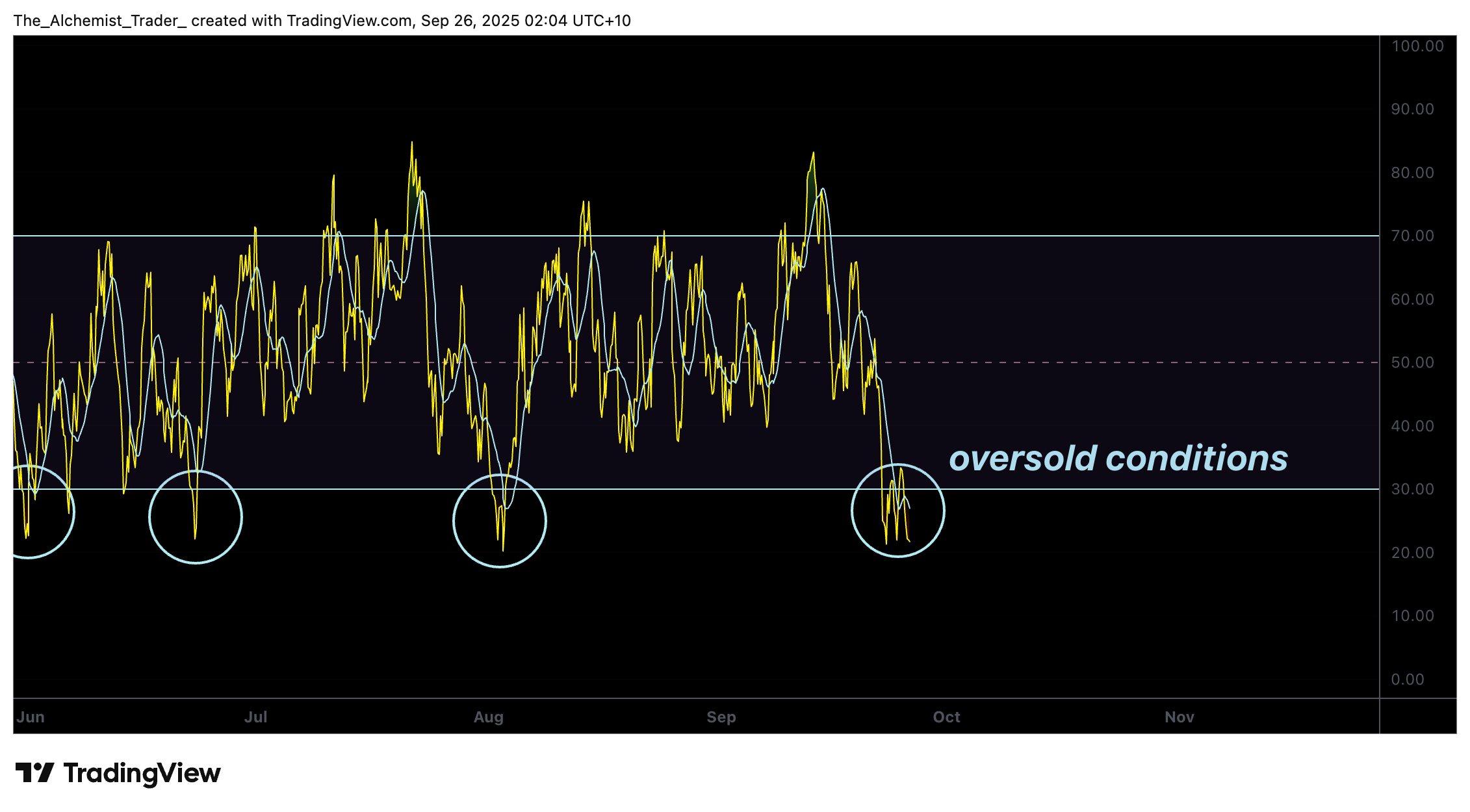

The cryptocurrency's RSI reading has plunged into oversold conditions below 30, suggesting potential exhaustion in the selling pressure. This technical signal often precedes short-term bounces, though Solana must defend the crucial $200 support level to prevent further downside.

Market Reaction

Traders are watching the $200 zone with intense focus—a breakdown here could trigger another wave of liquidations. Meanwhile, the oversold RSI creates a classic trader's dilemma: catch the falling knife or wait for confirmation.

Because nothing says 'sound investment strategy' like watching technical indicators while the market burns your portfolio to ashes.

Solana price key technical points

- Support Test: Price crashes to the $200 region, aligning with 0.618 Fibonacci confluence.

- RSI Oversold: The indicator now signals below 30, highlighting exhaustion of selling pressure.

- Potential Rotation: Historical patterns suggest Solana often bounces from 0.618 levels toward prior highs.

The recent bearish expansion was sharp and aggressive, mirroring prior moves where Solana respected the 0.618 Fibonacci retracement as a key turning point. This high-time-frame support provides a technically significant level that could attract buyers looking for value after the sell-off.

From a structural perspective, the $200 support carries more weight than just Fibonacci alignment. It also reflects a psychological round-number level where liquidity pools tend to form. A bounce here could reestablish Solana’s bullish trajectory by rotating price action back toward neutral volume levels such as the VAH and eventually retesting the $260 resistance mark.

Momentum indicators further support this narrative. The RSI, currently below the 30 threshold, shows oversold conditions that are rarely sustained for long. In past cycles, breaches of this level have consistently led to relief rallies, driven by short covering and opportunistic entries from bulls.

Volume analysis will be critical in confirming this scenario. If demand inflows return at these lows, it could mark the exhaustion of the current bearish leg and set the stage for another bullish impulse. However, failure to defend $200 may expose deeper liquidity levels, with the next supports lying below.

Adding to the broader ecosystem, PancakeSwap now supports Solana in its cross-chain swaps, enabling users to trade tokens across blockchains in a single transaction.

What to expect in the coming price action

In the short term, Solana’s oversold RSI and strong support at $200 favor a rebound scenario. A successful defense of this zone could trigger a rotation toward $230–$260.