Crypto Bloodbath: What’s Driving Avalanche, Aster, and Dogecoin’s Brutal Downturn?

Digital assets hemorrhage value as altcoin season turns to liquidation event.

Market Mechanics Exposed

When Bitcoin stumbles, altcoins don't just fall—they get thrown off the cliff. The correlation matrix that worked in their favor during bull runs now accelerates the plunge. Leveraged positions get liquidated, creating cascading sell pressure that even fundamentally strong projects can't escape.

Institutional Exodus

Smart money rotates to safety during volatility storms. Hedge funds that piled into altcoins for outsized returns now retreat to Bitcoin or flat-out cash positions. Their algorithmic trading systems detect momentum shifts faster than retail investors can blink.

Regulatory Ghosts Resurface

Every crypto downturn resurrects regulatory anxieties. The SEC's ambiguous stance on altcoin classification creates perpetual uncertainty—traders would rather sell first and ask questions later when sentiment sours.

Network Activity Divergence

Some projects show robust on-chain metrics despite price action. But in panic selloffs, fundamentals become afterthoughts. The market punishes all altcoins equally—whether they're building revolutionary tech or just riding hype cycles.

Remember: Wall Street still prices crypto like tech stocks—except with 3x volatility and zero P/E ratios to anchor valuations. The dip either makes you or breaks you.

Crypto crash triggered by hawkish Fed officials’ statement

One major reason for the crypto crash is the fear that the Federal Reserve may not cut interest rates as many times as it hinted in its meeting last week.

In a statement this week, Jerome Powell suggested that the Fed was still concerned about inflation. Other Fed officials, including Beth Hammack and Austan Goolsbee, urged the bank to exercise caution when cutting rates.

Their message was that U.S. inflation remains high and that the labor market is still tight, with the unemployment rate hovering at 4.3%.

Cryptocurrencies do well when the Fed is cutting interest rates, as that leads to a risk-on sentiment.

Falling Crypto Fear and Greed Index

Bitcoin and altcoins like Avalanche, Aster, and dogecoin also plunged as sentiment in the industry worsened. This situation is demonstrated by the Crypto Fear and Greed Index, which has dived from this month’s high of 73 to 41. It is at risk of plunging to the fear area.

In most cases, cryptocurrencies drop when the index moves to the fear zone. In contrast, most coins rally when there is greed, as this stimulates fear of missing out among investors.

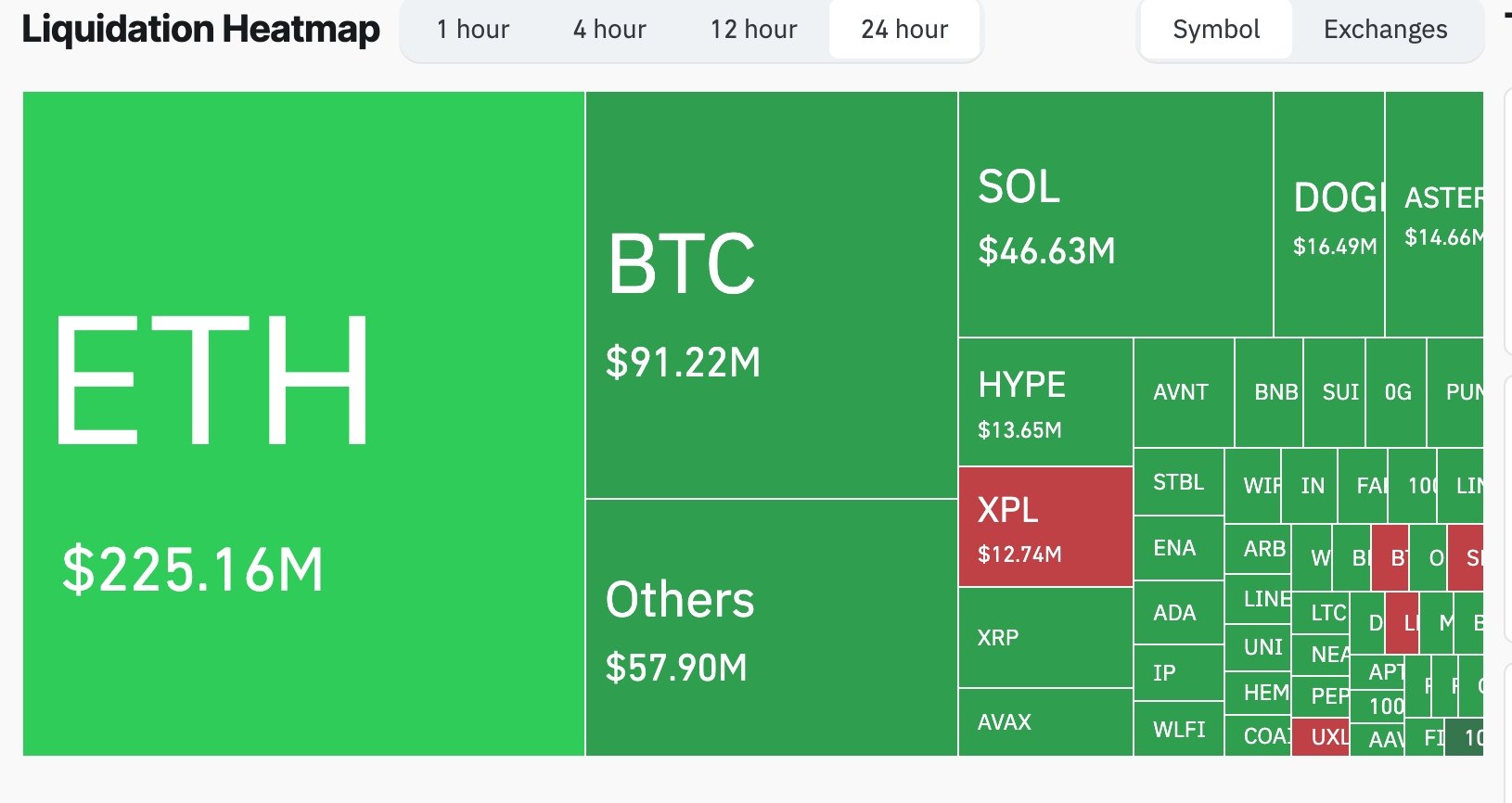

Crypto market falling amid strong liquidations

The other reason why the crypto market is going down is that liquidations have jumped this week. Crypto liquidations jumped by 100% on Thursday to $585 million.

Liquidations also jumped by over 800% on Monday to more than $1.65 billion. Avalanche had liquidations worth over $9.4 million on Monday and $5.5 million on Thursday.

Similarly, Dogecoin liquidations jumped to $58.6 million and $11.8 million on the two days, respectively.

Soaring liquidations are bearish for the crypto market, as they mean that long positions are being closed. Also, traders often stay on the sidelines when this happens. Data shows that the futures open interest of all coins fell by 2% on Thursday to $203 billion.