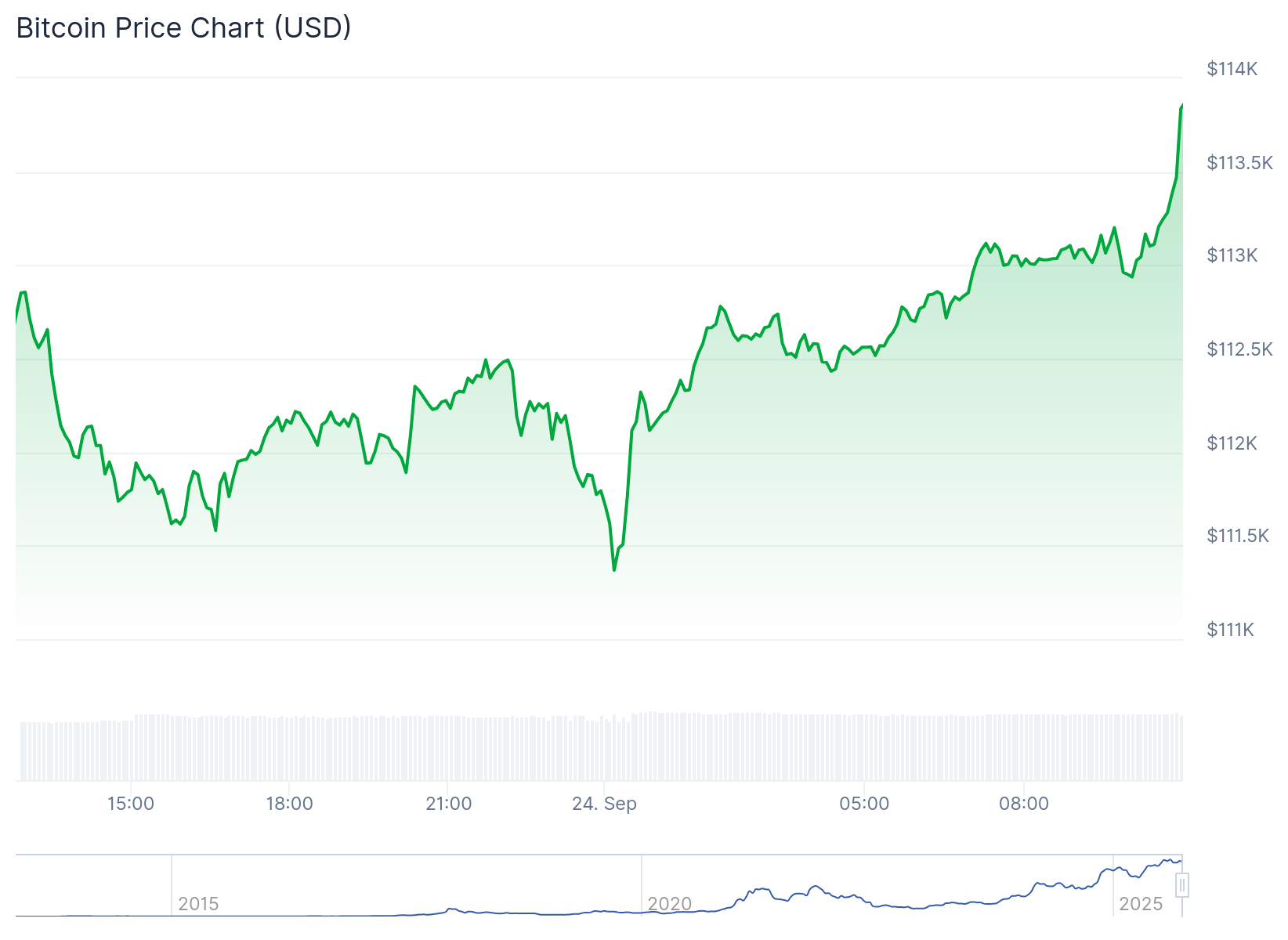

Bitcoin Soars Past $113,800 While S&P 500 and Nasdaq Tumble: Midday Market Shakeup

Digital gold crushes traditional markets in stunning midday reversal.

The Great Decoupling Accelerates

Bitcoin's relentless surge defies gravity—and Wall Street's expectations—as it smashes through the $113,800 barrier. Meanwhile, legacy indices bleed red, with the S&P 500 and Nasdaq both stumbling during midday trading.

Traders Flee Traditional Assets

Money flows tell the story: investors ditch sluggish stocks for crypto's explosive momentum. The correlation breakdown between digital and traditional assets reaches unprecedented levels, leaving portfolio managers scrambling.

Institutional FOMO Kicks In

Hedge funds and corporate treasuries can't ignore these numbers. The performance gap becomes too wide to rationalize—even for the most skeptical traditional finance veterans.

Wall Street's math just got a crypto-sized variable it can't ignore. Maybe those quarterly earnings reports need a blockchain upgrade.

Source: CoinGecko

Source: CoinGecko

- Nasdaq is down 0.53% in midday trading.

- The benchmark index S&P 500 is down 0.37%.

- The blue chip index Dow Jones Industrial Average is down 0.17%.

Stocks showed bulls were set for another big day as Wall Street cheered fresh artificial intelligence-related news from Alibaba (BABA), which rallied 7.34% at last check on Wednesday.

The Alibaba stock soared more than 9% in premarket trading and extended the gains as traders bet on AI spending budget. While it planned to spent $50 billion on AI initiatives, Alibaba says it will go beyond this in a push to keep pace with competitors.

And Micron Technology (MU), despite surpassing Wall Street’s expectations in its latest earnings report, dipped 3.9% at the time of reporting.

Meanwhile, Gold held at record highs while top cryptocurrencies stalled.

Wall Street also eyes inflation report

Federal Reserve chair Jerome Powell spoke this week, days after the U.S. central bank cut its interest rate by 25 basis points.

While investors have priced in more cuts in 2025, Powell’s speech indicated the Fed remains largely cautious. His remarks also alluded to the stock market’s rally as one that sees stocks “fairly highly valued.”

Although the major indices are near record highs, Wall Street’s immediate attention is on the upcoming release of the Personal Consumption Expenditures index. CPE is the Fed’s preferred inflation gauge and the latest inflation report on this is set for release on Friday, September 26, 2025.

Investors will be keen on CPE data that does not impact the anticipated interest rate cuts.