Hedera Hashgraph Price Forms Double Bottom at Support as Open Interest Resets - Bullish Reversal Brewing

Hedera flashes classic reversal pattern while derivatives markets hit reset button.

Technical Breakthrough

HBAR carves out double bottom formation at key support level - the kind of chart pattern that makes technical analysts reach for their bullish pencils. Price action suggests sellers are exhausting themselves just as open interest undergoes a healthy flush.

Market Mechanics Reset

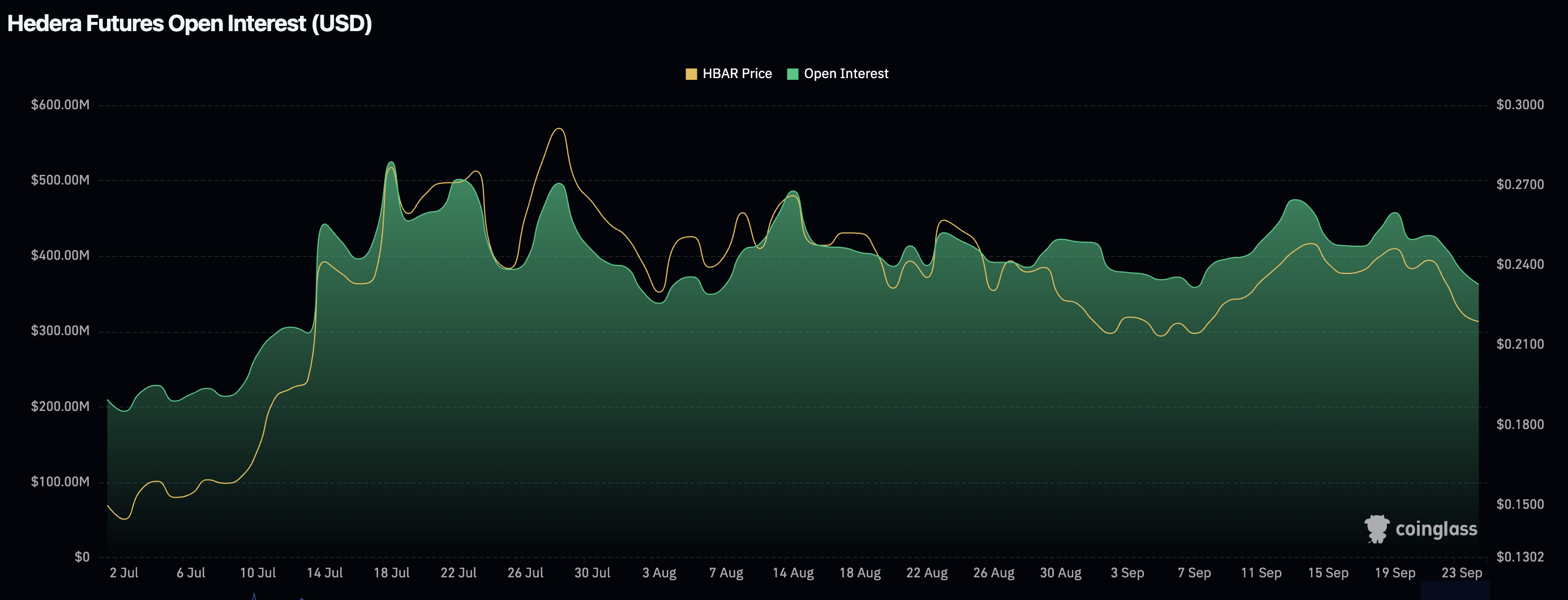

Open interest reset acts like a pressure release valve for overheated positions. It's the market's way of wiping the slate clean before the next major move. While traditional finance still debates blockchain use cases, Hedera's enterprise-grade network quietly builds momentum.

Upside Potential

Double bottoms historically precede significant rallies when confirmed. The pattern signals that two separate attempts to break support have failed miserably. Now watch for volume confirmation to validate the reversal.

Just remember: in crypto, even the most beautiful chart patterns can get wrecked by a single Elon Musk tweet. Such is the 'efficiency' of modern markets.

HBAR price key technical points:

- Critical $0.21 Support Zone: Aligned with high timeframe structure, 0.618 Fibonacci retracement, and VWAP.

- Double Bottom Formation: Pattern signals demand and the willingness of buyers to defend support.

- Open Interest Reset: Neutral levels create space for new bullish positioning.

Hedera has been trading at $0.21, a level that holds strong significance both structurally and technically. This area aligns with the 0.618 Fibonacci retracement and the VWAP, making it a high-confluence zone where buyers often look to re-enter the market. The development of a double bottom pattern at this level further strengthens the bullish case, as it reflects demand absorption and renewed buying pressure.

The importance of the double bottom cannot be understated. Forming at the 0.618 Fibonacci level, it highlights that market participants are defending the retracement zone. Historically, such setups often act as springboards for a reversal rally, creating the conditions for rotation toward higher resistance levels. In HBAR’s case, the immediate upside target WOULD be the high timeframe resistance at $0.30.

Derivatives data reinforces this outlook. Open interest, which had previously expanded in tandem with bullish price action, has now returned to neutral levels. This reset is constructive for the market because it clears out excessive leverage and leaves room for new long positions to accumulate. A rise in both open interest and price from this point would be a strong confirmation of bullish continuation.

The combination of structural support, technical confluence, and healthy derivatives positioning makes the current region critical for HBAR. Failure to hold $0.21 would threaten the bullish outlook, but a sustained defense could lead to significant upside momentum in the sessions ahead.

What to expect in the coming price action

If $0.21 continues to hold, HBAR could initiate a bullish reversal, targeting $0.30, which would represent a potential 46% gain from current levels. Buyers must confirm this setup with volume inflows and sustained growth in open interest to validate its continuation.