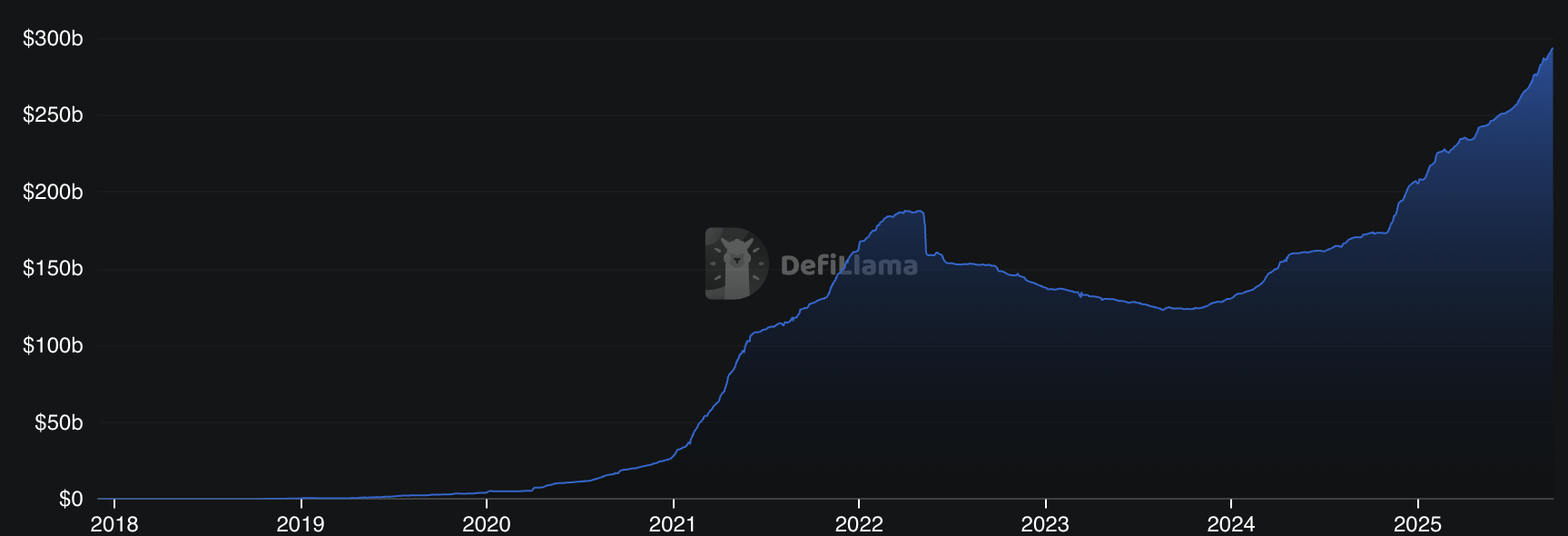

Stablecoin Market Cap Explodes to Record $294.6 Billion as Regulatory Tailwinds Fuel Unprecedented Growth

Digital dollars hit escape velocity as regulatory clarity unleashes institutional tidal wave.

The Regulatory Catalyst

Clear frameworks transform stablecoins from crypto curiosities to legitimate financial infrastructure. Governments finally recognize what traders knew years ago—digital dollars move faster than bureaucratic paperwork.

Market Momentum Builds

That $294.6 billion milestone represents more than just numbers—it's Wall Street voting with its wallet. Traditional finance finally admits blockchain moves money more efficiently than their legacy systems.

Institutional Adoption Accelerates

Hedge funds and payment processors now treat stablecoins as essential plumbing rather than speculative assets. The irony? Regulators spent years fearing crypto volatility while stablecoins became the boring, reliable workhorses.

Future Trajectory

This surge proves digital assets are maturing beyond speculation into practical utility. Banks might still charge $50 wire fees, but stablecoins already won the efficiency race—regulation just made it official.

Total stablecoin market cap over time | Source: DeFiLlama

Total stablecoin market cap over time | Source: DeFiLlama

Regulatory tailwinds boost stablecoin demand

Perhaps the most significant tailwind came from the WHITE House

World Liberty Financial (WLF), co-founded by President Donald Trump’s sons, launched the USD1 stablecoin in March, backed by U.S. Treasuries, cash, and audited reserves.

The TRUMP family holds a major stake, raising conflict-of-interest concerns as the administration pushes crypto-friendly policies. For example, in May, UAE-based MGX pledged to use USD1 for a $2 billion investment in Binance, drawing criticism as a possible influence-peddling scheme.

Since then, stablecoins have benefited from crypto-friendly legislation. In July, Congress passed the GENIUS Act in the U.S., a piece of legislation that regulates stablecoin issuance, boosting demand from traditional institutions.

The EU has also taken significant steps in regulating stablecoins, with the passage of the MiCA regulatory framework. Most recently, on Sept. 18, the Bank of Italy called for clarity on stablecoins issued across borders.

Moreover, several governments worldwide have taken steps to create stablecoins in their own national currencies. A key motivation for these moves was the concern that USD-denominated stablecoins could come to dominate the growing stablecoin ecosystem.