Bitcoin’s ’Digital Gold’ Thesis Stalls as Real Gold Soars - The Proof Gap Widens

Bitcoin's store-of-value narrative faces its toughest test yet as traditional gold rallies while crypto's flagship asset stagnates.

The Great Decoupling

Gold prices hit fresh records this week, leaving Bitcoin's correlation claims looking increasingly theoretical. The divergence exposes what analysts call 'the proof gap' - the chasm between cryptocurrency aspirations and real-world performance metrics.

Market Realities Bite

While gold ETFs see record inflows, Bitcoin's price action mirrors more speculative tech stocks than a true safe-haven asset. The digital gold narrative now requires either catching up to physical gold's momentum or redefining its value proposition entirely.

Wall Street's Selective Embrace

Institutional adoption continues - but primarily for Bitcoin's volatility plays rather than its store-of-value characteristics. Traditional finance loves the trading fees while quietly dismissing the fundamental thesis. Typical banker move: profit from the hype without believing the story.

The path forward demands either convergence with gold's trajectory or acceptance as a distinct asset class. For now, Bitcoin's golden ambitions remain just that - ambitions.

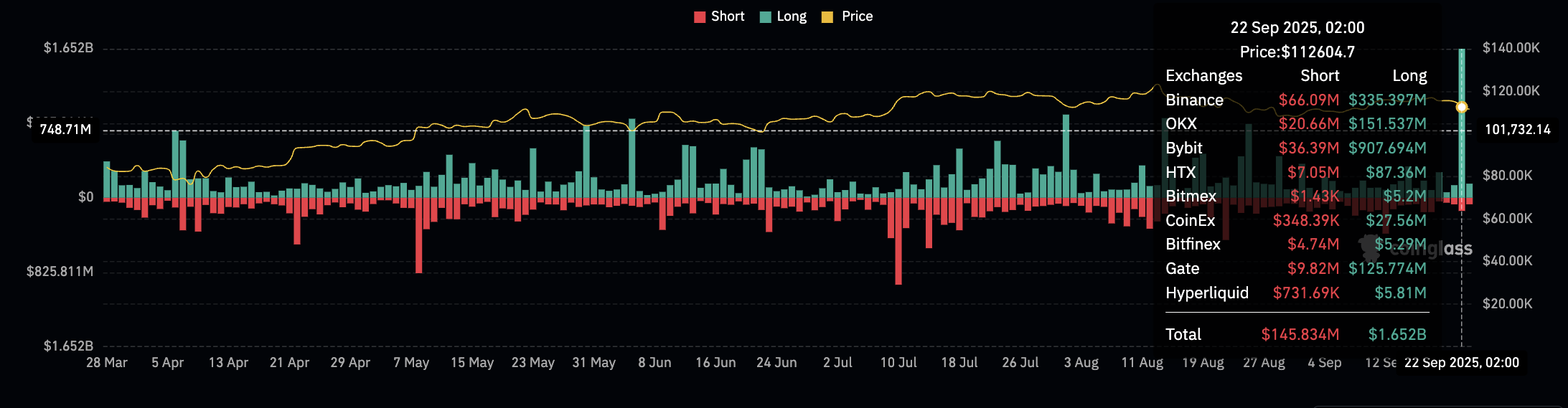

Daily Bitcoin long and short liquidations | Source: CoinGlass

Daily Bitcoin long and short liquidations | Source: CoinGlass

According to Shawn Young, Chief Analyst at MEXC Research, the recent selloff is a classic reminder of crypto’s structural fragility when leverage builds up. In a comment for crypto.news, he noted that 407,000 traders faced liquidations as Bitcoin (BTC) fell below $112,000.

“The U.S. dollar regained strength after the Fed’s rate cut, catching markets off guard. That strengthened dollar, combined with high Treasury yields and looming inflation data, has kept crypto markets defensive,” Shawn Young, MEXC Research.

Bitcoin drops, gold thrives on macro uncertainty

Still, Gold and Bitcoin diverged in their reactions to the dollar’s strength. Farzam Ehsani, CEO and co-founder of VALR, told crypto.news that this is likely due to gold’s more entrenched position as a hedge against geopolitical risk.

When the dollar is strong, Bitcoin often struggles to fulfill its ‘digital gold’ thesis, Ehsani noted. “The sharp divergence between gold and Bitcoin reflects shifting priorities. Gold has surged due to central bank accumulation and its entrenched status as a geopolitical hedge, while Bitcoin remains in early stages of institutional uptake.”

Geopolitical tensions favored gold more in 2025, and the asset was up 42.7% so far this year, according to StatMuse. During that same period, Bitcoin returned just 20.7%, despite major tailwinds in regulations and institutional adoption.