Bitcoin Price Prediction: Will Profit-Taking Drag BTC to $105K?

Bitcoin faces its ultimate test as traders eye the exit doors. Could massive profit-taking derail the bull run?

The Psychology of Peak Profits

Every surge creates two types of investors: believers and opportunists. The latter now hold the keys to Bitcoin's next move. They're staring at life-changing gains—and wondering when to cash out.

Market Mechanics at Breaking Point

Liquidity evaporates when everyone heads for the exits simultaneously. The $105K question isn't about fundamentals—it's about human nature meeting market structure. Traditional finance types are already placing bets on the 'inevitable' correction, because apparently predicting doom is easier than understanding blockchain.

The Institutional Wildcard

Wall Street's recent Bitcoin embrace creates a fascinating dynamic. Their buying power could absorb retail sell pressure—or amplify the downturn if they join the profit-taking party. Nothing makes hedge funds happier than buying low after scaring weak hands out of positions.

Will BTC defy gravity or succumb to profit-taking pressure? The market's about to show whether diamonds hands still rule—or if paper hands will drag us back to reality.

Current BTC Price Scenario

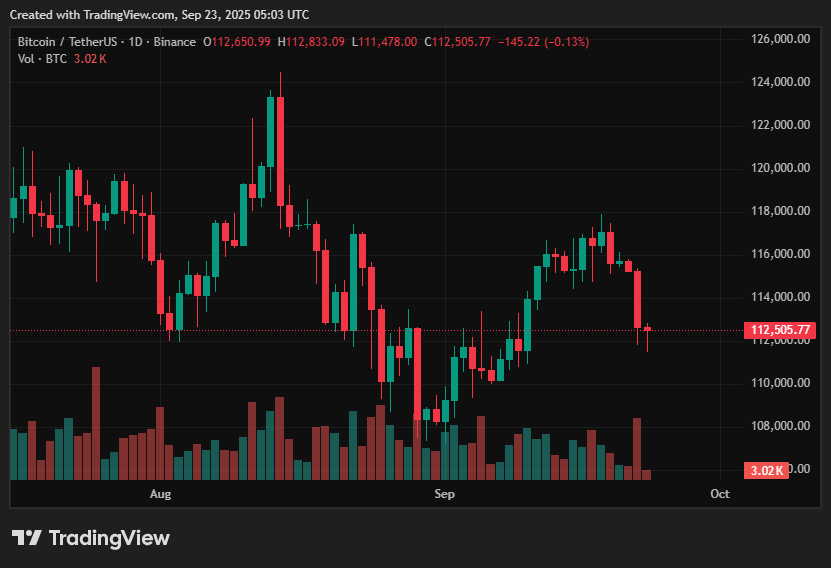

Bitcoin has been trading in a low-to-mid six-figure range, with technical support at around $112k and resistance at $115k. Price tested and briefly broke $113k amid recent volatility before settling back NEAR $112.7k, indicating that the current consolidation is short but fragile. Market participants are intently monitoring order flow and ETF activity to determine who will absorb selling at current prices.

On-chain and market-structure signals portray a mixed picture: exchange net outflows and earlier weeks of ETF accumulation indicate that some supply is being held back, but on-chain indications also show pockets of profit-taking and increased altcoin rotation on days when BTC is down. These elements work together to FORM a limited trading corridor in which momentum indicators can swiftly flip.

Upside Outlook

A strong break over $115k would likely flip short-term sentiment bullish and trigger momentum buying toward $118k-$122k, with higher objectives anticipated by experts if ETF flows resume. Historically, when ETFs have pumped sustained weekly inflows, bitcoin (BTC) has tended to push through local barriers as dealers and institutions pursue accumulation.

Such an upward trend would most likely necessitate both (a) increased visible ETF demand and (b) a reduction in liquidation risk across derivatives. Macro factors, like as lower-than-expected inflation figures or clearer rate-cut guidance, might intensify that trend by increasing risk-on flows into cryptocurrency. Under those conditions, BTC could sustain higher levels, with the BTC price forecast extending beyond near-term resistance levels.

Downside Risks

Failure to defend $112K WOULD expose BTC to a quick retest of $108K, where prior whale accumulation was observed. If this level gives way under strong selling pressure, cascading liquidations could drag BTC toward the $105K projection, especially if leveraged longs are flushed out en masse. Analysts have cautioned that technical momentum is already softening as RSI cools and funding rates normalize.

September also has a reputation for seasonal weakness in cryptocurrency. When combined with long-term holders’ profit-taking tendencies, this further dampens upside expectations and raises the possibility that any breakdown may accelerate. A cautious approach is still recommended until buyers reassert themselves with higher ETF inflows and unambiguous spot demand.

BTC Price Prediction Based on Current Levels

The current tactical range to monitor is $112k-$115k. If BTC clears and maintains above $115k on greater volume and renewed ETF absorption, the path to $118k-$122k becomes the most likely scenario in the coming weeks, with tail-risk upside if institutional buys surge once more. This is the constructive scenario supported by coverage, which signals continuing inflows and lower currency balances.

In contrast, a decisive collapse below $112k would support the bearish scenario and lay the way for a rapid test of $108k, with $105k a potential extension target if deleveraging intensifies. Traders should monitor ETF daily flows, derivatives open interest, and on-chain transfer activity for real-time indicators of breakout or collapse.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.