Will ’Uptober’ Rally Persist? Crypto Markets Retreat Ahead of October

Crypto's seasonal surge hits a wall—just as October approaches. Markets pull back, leaving traders questioning whether the famed 'Uptober' momentum will hold.

Signs of Cooling

Bitcoin and major altcoins shed gains after a strong September run. The retreat comes amid mixed macroeconomic signals and regulatory murmurs—nothing new for crypto veterans.

Institutional Whispers

Big money stays cautious. Hedge funds and family offices hover at the edges, waiting for clearer signals. Typical finance move—wait for retail to take the risk first.

What’s Next?

All eyes on Fed policy and ETF flows. A strong October could set up a bullish end to the year. A stumble? Just another 'buy the dip' opportunity in a market that never sleeps.

TLDR

- Bitcoin has historically posted gains in October, earning the “Uptober” moniker in recent years.

- The crypto market faced a sharp decline on Monday, with Bitcoin falling to a twelve-day low.

- Analysts question whether the “Uptober” rally will continue this year due to broader economic factors.

- Kyle Chassé believes the likelihood of a Federal Reserve rate cut could fuel a potential crypto rally.

- Some analysts predict muted Bitcoin rallies due to low volatility and weakening market momentum.

As October approaches, cryptocurrency enthusiasts are questioning whether the expected “Uptober” rally will materialize. Historically, Bitcoin has seen significant gains in October. However, recent market movements have created doubts about the continuation of this trend.

The crypto market began to retreat on Monday, with total capitalization sinking by $80 billion. Bitcoin dropped to a twelve-day low of $114,270. Ether also faced a sharp decline, dipping below $4,300, marking its lowest point in two weeks.

Uptober Gains Questioned Amid Economic Concerns

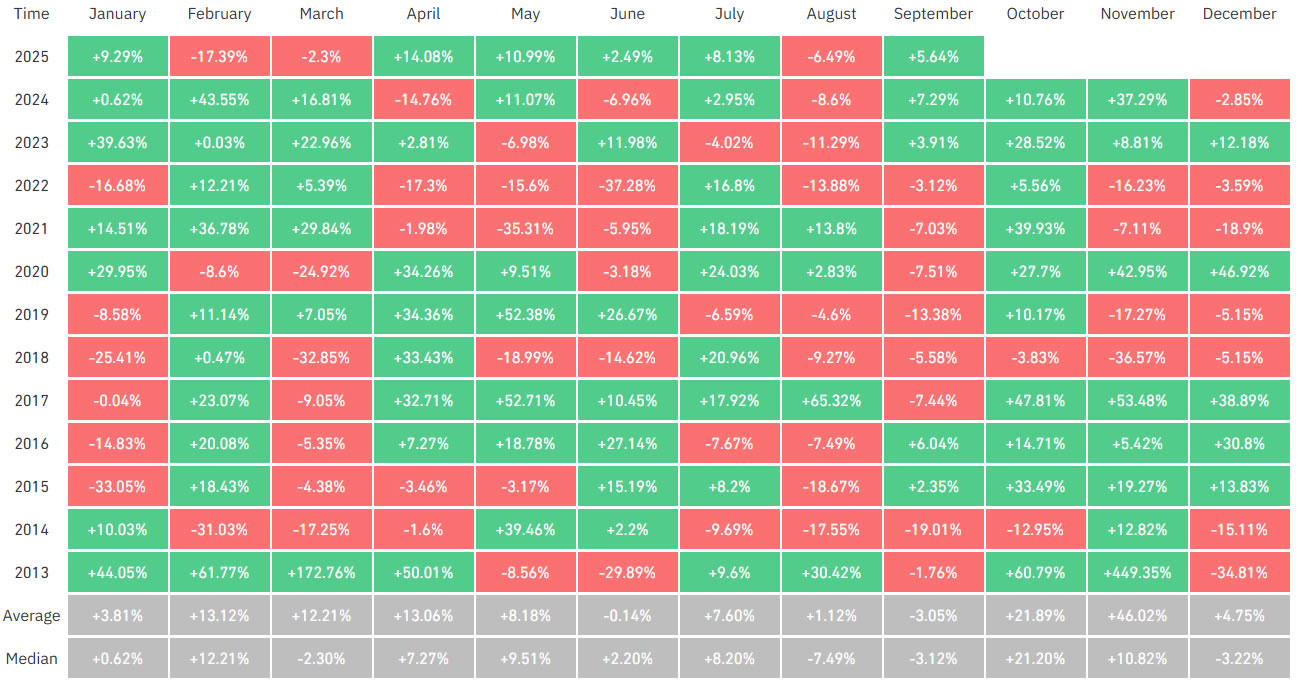

Bitcoin has historically performed well in October, earning the moniker “Uptober.” According to CoinGlass, it has posted gains in 10 of the last 12 years. In 2017 and 2021, Bitcoin saw impressive gains of 48% and 40%, respectively.

Despite the strong track record, there are uncertainties this year. Market watchers are concerned about the impact of broader economic factors. Analysts suggest that October’s rally may not be as strong due to current market conditions.

Kyle Chassé, a prominent Bitcoiner, believes that the odds of a Federal Reserve rate cut next month are high. CME futures predict a 92% chance of such a move. Chassé points out that this could provide liquidity, which bitcoin and crypto markets thrive on.

Rate cut odds keep climbing.

Markets now see a 91.1% probability the Fed cuts rates by 25bps in October.

Translation: the easing cycle is basically priced in.

Liquidity is on the way…

And that’s the fuel Bitcoin and crypto thrive on.

— Kyle Chassé / DD🐸 (@kyle_chasse) September 22, 2025

Crypto Market Faces Uncertainty Ahead of October

Despite the historical performance, some analysts remain skeptical about the upcoming “Uptober.” Jeff Mei, the COO of the BTSE exchange, believes this October’s rally is less likely. Mei attributes the uncertainty to macroeconomic factors and September’s market performance.

Analyst Augustine Fan suggests that any BTC rallies may be muted. He points to low implied volatility and weakened momentum in the markets. Fan further mentions that long-term investors may need more patience before seeing new all-time highs.

Arthur Hayes, the co-founder of BitMEX, offered a different perspective. He believes the crypto market could enter an “up only mode.” Hayes argues that once the U.S. Treasury meets its liquidity target, Bitcoin could see renewed growth.