XRP Price Plummets 12% on ETF Launch Day—Defying Record Market Debut

XRP tanks double-digits despite landmark ETF rollout—traders left scratching heads as crypto’s latest 'sure thing' stumbles out the gate.

Red Day for the 'Banker’s Crypto'

While Wall Street popped champagne over the long-awaited XRP ETF, the token itself nosedived—dropping a harsh 12% in a classic 'buy the rumor, sell the news' maneuver. No fancy charts or fresh data needed; the numbers tell a sobering story.

ETF Hype Meets Cold Reality

New fund? Check. Record launch volume? Check. Price rally? Absolutely not. Instead, sell-pressure flooded the market the second institutions got their easy button—proof that even crypto’s most polished narratives can’t outrun trader impulse.

Another 'Uncorrelated' Asset Doing Exactly What Traders Expect

Cynics might call it predictable—finance loves a good product launch almost as much as it loves a quick profit-taking exit. XRP’s dip isn’t a glitch; it’s a feature of crypto markets where even bullish milestones get priced in before the opening bell.

TLDR

- XRP analysts predict 226% surge to $9.90 with potential to reach $20, based on technical indicators

- First U.S. spot XRP ETF launched with record $37.7 million opening day volume

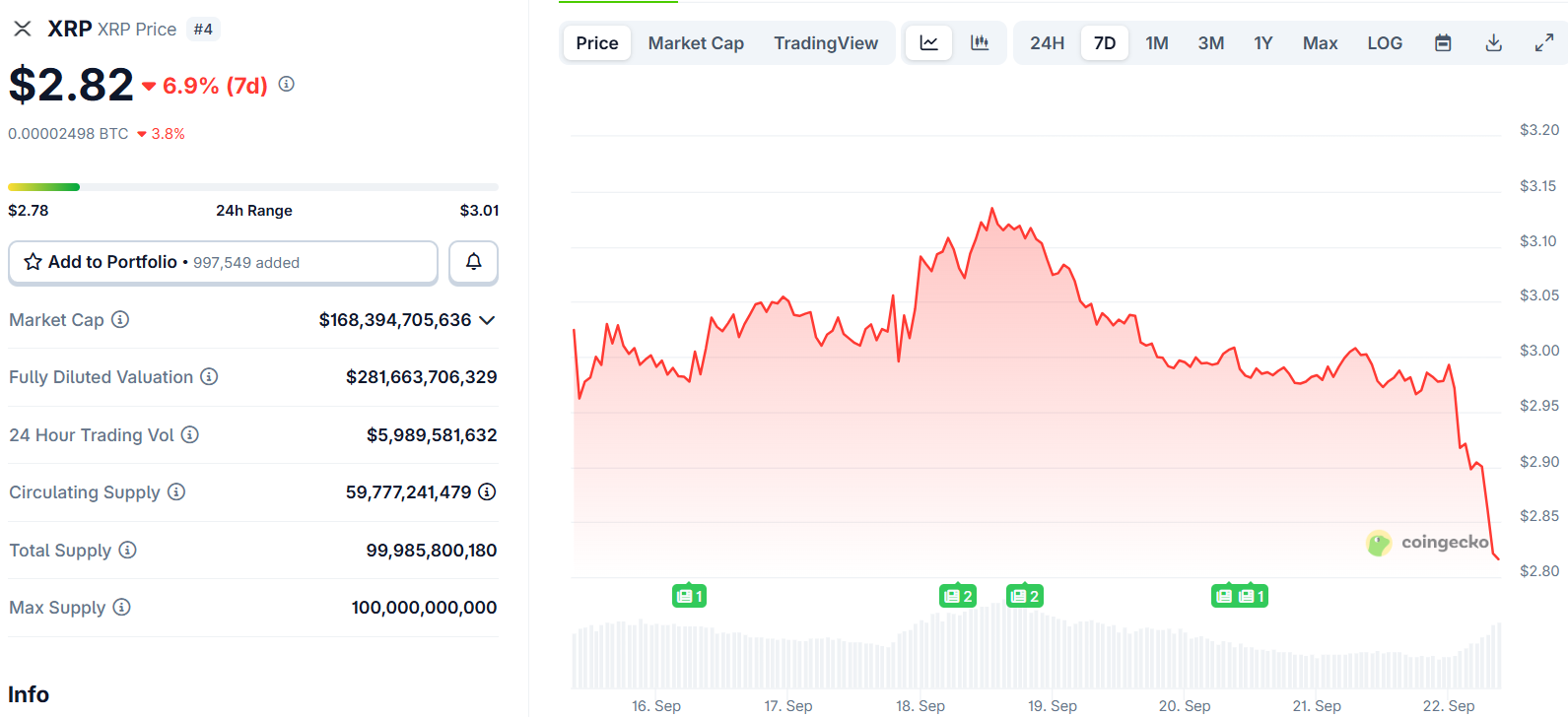

- XRP dropped 12% despite ETF launch, falling from $3.01 to $2.70 in volatile trading

- Technical analysis shows buy signals on TD Sequential indicator and strong accumulation patterns

- Institutional interest grows with tokenized funds planned for XRP Ledger platform

XRP faced a volatile trading session despite the launch of the first U.S. spot XRP ETF. The token dropped 9% over 24 hours, moving between $3.014 and $2.70.

The selloff happened even as the new ETF set records. The fund generated $37.7 million in opening day volume. This marked the largest ETF debut of 2025.

XRP started the day NEAR $3.00 but crashed at midnight. The token fell 2% in a single move. Trading volume spiked to 261.22 million during the crash.

This volume was four times the daily average. Liquidations totaled $7.93 million during the selloff. About 90% of these liquidations hit long positions.

Despite the recent drop, two analysts remain bullish on XRP. Trader Javon Marks sees potential for a 226% surge. His target sits at $9.90 for the token.

$XRP looks to be preparing here for ANOTHER +226% SURGE TO $9.90+ and a break above could send it towards $20 and higher! pic.twitter.com/ia5jJOcdkp

— JAVON⚡️MARKS (@JavonTM1) September 19, 2025

Marks believes XRP could reach $20 if it breaks above $9.90. He points to accumulation patterns similar to past bull runs. His chart shows XRP building strength for another surge.

Technical Indicators Point Higher

Ali Martinez also shared a bullish view on XRP. He noted a buy signal on the TD Sequential chart. This indicator helps identify trend reversals.

$XRP is a BUY, according to the TD Sequential! pic.twitter.com/fY7GTgXEB0

— Ali (@ali_charts) September 20, 2025

Martinez says the 4-hour chart shows improving price movement. The signal suggests a new upward trend may start soon. Technical indicators now favor buyers after recent consolidation.

The token traded in a tight range near $2.92 after the crash. XRP attempted to rebound to $2.94 but failed to hold. Resistance formed around $2.93 to $2.94.

Support emerged at $2.91 to $2.92 during the selloff. This zone was tested multiple times after the midnight crash. The price action created clear levels for traders.

Exchange reserves hit 12-month highs during the session. This indicates potential supply pressure despite growing institutional interest. The high reserves could limit upside moves.

Growing Institutional Interest

The ETF launch represents growing institutional confidence in XRP. The fund allows traditional investors to gain exposure to the token. Settlement happens faster than direct crypto purchases.

Plans for tokenized funds on the XRP Ledger add to institutional interest. These products will trade like tokens on the blockchain. They offer exposure to regulated investment products.

The funds provide faster settlement and greater liquidity than traditional products. This marks XRP’s evolution beyond just a payment token. It now supports regulated investment products too.

CME Group plans to launch XRP and solana futures options. This adds another institutional product to the ecosystem. The move shows growing acceptance of XRP in traditional markets.

Federal Reserve policy remains in focus for crypto markets. Markets price in near-certain rate cuts in September. Lower rates typically support digital asset prices.

The current price action shows mixed signals for XRP. Technical analysts see bullish patterns forming. Yet the recent selloff suggests caution among traders.

Resistance persists near the $3.00 level despite ETF momentum. The token needs to break above $3.00 to confirm the bullish outlook. Volume and institutional flows will be key factors.

XRP closed the volatile session at $2.92 after testing both support and resistance levels multiple times.