Top Altcoins Set to Skyrocket in Q4 2025 - Your Ultimate Profit Playbook

Breaking: Crypto markets surge as institutional money floods altcoin space - here's where smart money's positioning for Q4 gains.

Ethereum Killers Heating Up

Solana's network activity hits unprecedented levels while transaction fees remain microscopic. Meanwhile, Cardano's Vasil upgrade finally delivers scalability promises - developers are migrating in droves.

DeFi Blue Chips Primed for Breakout

Uniswap v4 launches with revolutionary hook system while Aave's GHO stablecoin adoption accelerates. These aren't speculative plays anymore - they're revenue-generating machines.

AI Tokens: Not Just Hype Anymore

Fetch.ai's autonomous agents now process real-world commercial transactions. Render Network's GPU power becomes scarce as Hollywood studios quietly onboard. The convergence of AI and blockchain? It's already happening.

Gaming Tokens Level Up

Axie Infinity's player-owned economy model gets copied by traditional gaming giants. Sandbox land prices hit new ATH as brands desperate for Web3 relevance overpay for virtual real estate.

Dark Horse Contenders

Chainlink's CCIP protocol quietly becomes backbone of trillion-dollar institutional transfers. Polkadot's parachain auctions see record bidding - developers bet big on interoperability.

Remember: The same Wall Street suits who called crypto a scam now allocate 5% of your pension fund to it. The revolution will be monetized - might as well get positioned early.

Pump.fun (PUMP)

Pump.fun is on a roll right now, with its price climbing 48% in the past week and 154% over the last month. However, the fact that it has already surged is certainly not a reason to avoid the PUMP token – Pump.fun has complete control of the meme coin launchpad market. As investor confidence grows in Q4, we’re likely to see more launchpad activity, which could boost the PUMP price.

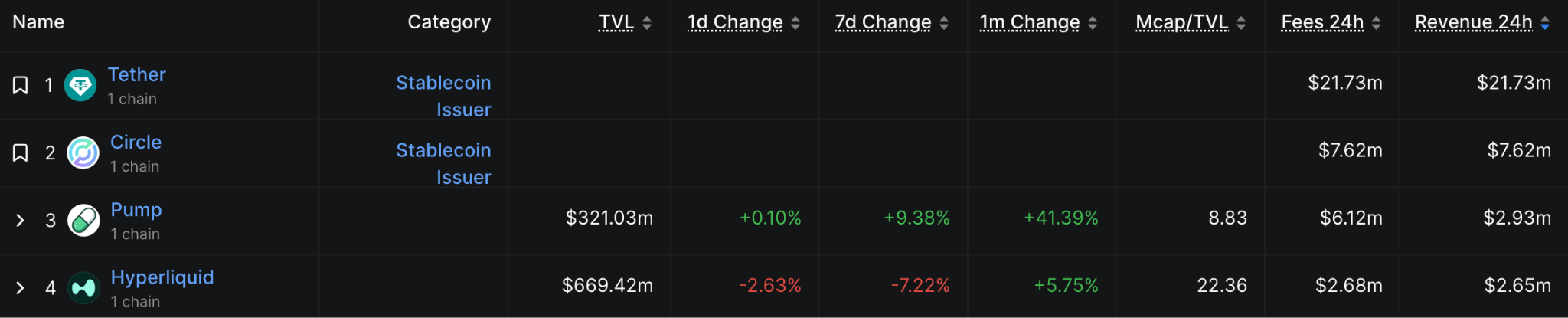

But the main reason PUMP might be the best altcoin to buy is even simpler: revenue and buybacks. The project has generated $2.93 million in 24-hour revenue, and the team is using most of that to buy back PUMP from the open market, creating demand pressure that helps push the price higher. If adoption rises even more in Q4, this buyback demand could help the PUMP price climb much higher.

But there’s more – Pump.fun has surpassed Hyperliquid in 24-hour revenue, as shown above. Despite this, HYPE is valued at $14.9 billion today, while PUMP is worth just $2.8 billion, clearly indicating that PUMP has a lot of untapped potential despite its recent gains.

But there’s more – Pump.fun has surpassed Hyperliquid in 24-hour revenue, as shown above. Despite this, HYPE is valued at $14.9 billion today, while PUMP is worth just $2.8 billion, clearly indicating that PUMP has a lot of untapped potential despite its recent gains.

PEPENODE (PEPENODE)

Pump.fun’s market-leading revenue reflects the high interest in the meme coin space right now. But what’s notable about the meme coin market is the new ways people are creating meme assets – it’s not just about launching simple tokens anymore. Pump.fun is gaining attention through creator live streams, while new projects like PEPENODE are introducing innovative utilities.

PEPENODE is developing the first Mine-to-Earn meme coin, allowing users to earn rewards from a gamified mining experience (with a presale staking option generating APYs of up to 1,101%). They buy and upgrade Miner Nodes using PEPENODE tokens to boost their mining power, and that earns them meme coin rewards.

And like Pump.fun, PEPENODE features innovative tokenomics, burning 70% of tokens spent in its store to create deflationary pressure and support long-term price growth.

Currently, PEPENODE is in a presale, having raised $1.1 million so far. This indicates strong community interest but also suggests significant growth potential compared to multi-billion-dollar meme coins like PUMP. Visit PEPENODE.

STBL (STBL)

STBL is another project that’s gaining traction, currently ranked at the top of CoinGecko’s trending list after a remarkable 474% increase in the past 24 hours. It’s a BNB chain project focused on stablecoin innovation.

STBL is the governance token for the project’s ecosystem, with USST as its main product. Unlike top stablecoins like USDT and USDC, USST offers holders passive income, giving them an added incentive that could attract a big user base.

Another key feature of STBL is that it is over-collateralized, backed by on-chain real-world assets.

The stablecoin narrative continues to grow stronger as banks recognize the potential for instant cross-border payments in dollar-pegged tokenized assets. Considering STBL’s innovative approach and its recent momentum, it could certainly prove to be a smart way to capitalize on this momentum.

The stablecoin narrative continues to grow stronger as banks recognize the potential for instant cross-border payments in dollar-pegged tokenized assets. Considering STBL’s innovative approach and its recent momentum, it could certainly prove to be a smart way to capitalize on this momentum.

It’s also worth noting that the token was only listed on exchanges on Tuesday, meaning investors still have a chance to get in early and maximize their potential returns.