Dogecoin Primed for Major Breakout as Grayscale ETF Fuels Market Optimism

Grayscale's ETF move ignites Dogecoin rally potential—memecoin momentum meets institutional validation.

The Catalyst

Grayscale's ETF announcement sends shockwaves through crypto markets, positioning Dogecoin for its most significant price surge since the 2021 retail frenzy. Trading volumes spike 40% as whales accumulate positions ahead of potential institutional inflows.

Market Mechanics

Technical indicators flash bullish signals across multiple timeframes. The 50-day moving average converges toward critical resistance levels—a classic breakout pattern forming. Options traders pile into calls, betting on 30% upside within weeks.

The Institutional Play

Wall Street's sudden embrace of meme assets proves even bankers chase yield wherever it hides—though they'll never admit watching TikTok for investment theses. ETF wrappers legitimize what skeptics called 'internet jokes,' creating reflexive demand loops.

Risk Dynamics

Volatility compress suggests explosive movement imminent. Retail FOMO meets institutional allocation—a combination that historically produces both spectacular gains and devastating corrections. Leverage ratios approach dangerous territory as momentum chasers overcrowd the trade.

Regulatory Overhang

SEC scrutiny remains the wildcard. Past ETF rejections haunt the market, but Grayscale's legal victories establish new precedents. The agency's resistance to crypto innovation continues—because protecting investors apparently means denying them access to 300% annual returns.

Bottom Line: Dogecoin's infrastructure moment arrives as ETF mania meets meme magic. Whether this marks sustainable adoption or another speculative bubble depends entirely on whether 'number go up' theology survives first contact with Fed policy.

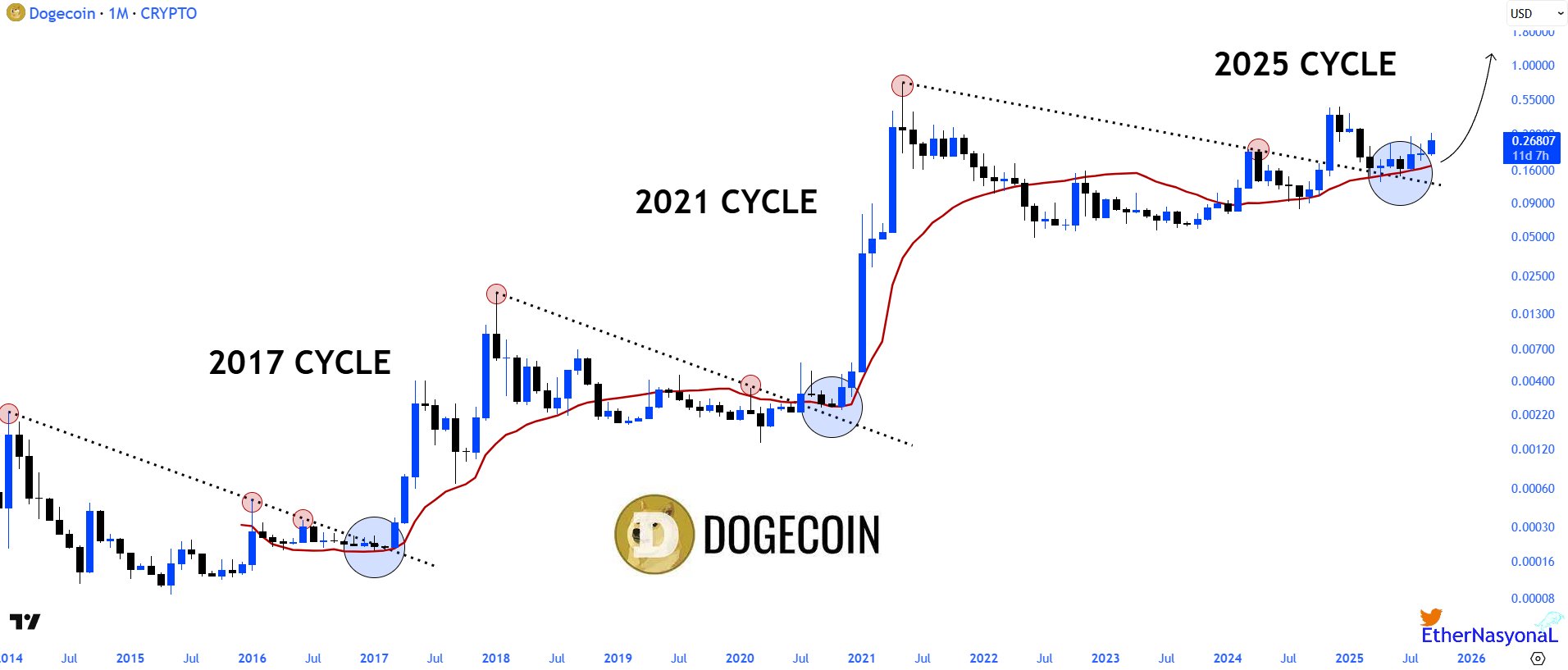

Dogecoin’s Cyclical Behavior and Market Structure

Dogecoin’s price movements have consistently followed cyclical patterns, marked by periods of consolidation followed by sharp rallies. In 2017, the price of Doge surged from under $0.0002 to nearly $0.017, and in 2021, the rally took the price from around $0.0022 to a peak of $0.70. In both cases, the rallies followed a prolonged period of consolidation, where the price held above the 50 EMA, signaling strong upward conditions.

Source: X

As of 2025, the market structure remains similar, with DOGE holding above the 50 EMA while retesting a descending trendline NEAR $0.26. This setup echoes the conditions seen in previous cycles and has led some analysts to suggest that a breakout could be imminent. If the pattern holds, the price could surge toward $1 or higher, similar to the explosive rallies of 2017 and 2021.

Grayscale ETF Filing and Institutional Interest

In a significant move, Grayscale has filed to convert its dogecoin Trust into an exchange-traded fund (ETF) under the ticker GDOG. This step is expected to bring Dogecoin closer to mainstream financial markets by providing a regulated investment vehicle for institutional investors. If approved, the ETF would be traded on NYSE Arca, with Coinbase serving as the custodian and prime broker.

This filing aligns with recent changes in the SEC’s approach to crypto funds, which have made it easier for such funds to gain approval. Grayscale’s ETF move comes after the launch of similar products for other cryptocurrencies, including Dogecoin’s rival, XRP. The filing suggests that institutional interest in Dogecoin is growing, which could provide a new wave of investors looking to gain exposure to the meme coin.

Market Sentiment and Speculative Optimism

Data from CoinGlass shows that 77% of accounts are currently holding long positions on Dogecoin, signaling strong speculative optimism. This trend mirrors the enthusiasm seen during previous rallies, when high levels of long positions were observed ahead of price surges. The current bullish sentiment is also supported by the growing interest in the proposed ETF, which could attract additional retail and institutional investors.

The high percentage of long positions indicates that many traders expect the price of Dogecoin to rise. As a result, market participants are increasingly optimistic about the possibility of a breakout, especially with historical cycles showing similar setups before major price increases.

The Outlook for Dogecoin’s Price

As the price of Dogecoin hovers around $0.26, the potential for another breakout remains high. The technical indicators suggest that the cryptocurrency could follow the same trajectory as in 2017 and 2021, where extended consolidation periods were followed by substantial price increases. Combined with Grayscale’s ETF filing and strong speculative optimism in the market, Dogecoin’s price could see a significant upward move in the coming months.

With the market structure showing similarities to previous cycles, and institutional interest likely to grow with the ETF filing, the outlook for Dogecoin remains positive. If the current trend continues, a MOVE toward $1 or beyond could be within reach, marking another milestone in the cryptocurrency’s history.