Nvidia (NVDA) Shatters Records as Two Billionaire Titans Triple Down on AI Powerhouse

Nvidia just rewrote the rulebook—again. The chipmaker's stock blasted past previous ceilings, hitting stratospheric new highs that left Wall Street scrambling.

Billionaire Backing Boosts Momentum

Two heavyweight investors didn't just dip toes in—they plunged headfirst, doubling their stakes in the AI juggernaut. Their moves signal unwavering confidence in Nvidia's dominance as the backbone of the machine learning revolution.

While traditional finance scrambles to keep up, Nvidia keeps printing value—proving once more that in the tech arena, silicon speaks louder than spreadsheets.

TLDR

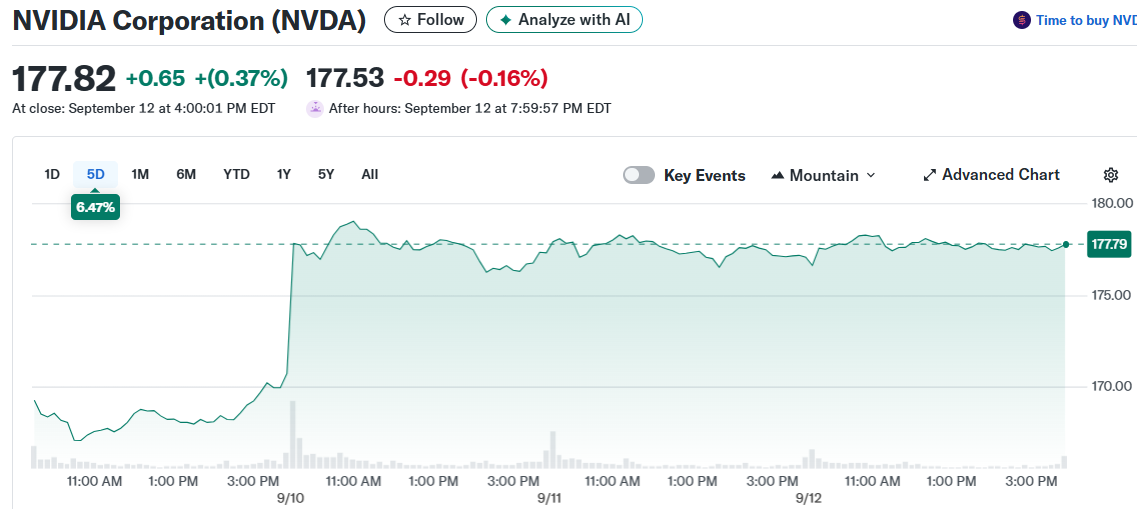

- Nvidia stock hit new all-time highs this week, reaching $177.94 per share

- Oracle’s earnings announcement sparked the rally, with four mega contracts bringing Oracle’s backlog to $450 billion

- Two billionaire hedge fund managers bought Nvidia shares in Q2: Daniel Loeb and David Tepper

- Oracle Cloud Infrastructure expects 77% revenue growth to $18 billion, projected to reach $144 billion by 2030

- Global data center spending projected to grow from $600 billion in 2025 to $3-4 trillion by 2030

Nvidia stock reached new all-time highs this week, closing at $177.94 per share. The chip giant’s latest surge came from an unexpected source.

Oracle’s blockbuster earnings announcement triggered the rally across AI stocks. The database company reported four mega contracts in its first quarter.

Oracle’s contract backlog now stands at more than $450 billion. This represents a four-fold increase from just one year ago.

The news validated the broader AI infrastructure investment thesis. Oracle Cloud Infrastructure division expects 77% revenue growth this year to $18 billion.

Oracle projects this division will reach $144 billion in revenue by 2030. This forecast sparked buying across AI-related stocks including Nvidia.

Billionaire Backing Grows Stronger

Two prominent hedge fund managers added Nvidia positions during Q2. Daniel Loeb of Third Point and David Tepper of Appaloosa Management both purchased shares.

These moves came after Nvidia’s massive run from a $350 billion company to approximately $4.1 trillion in market value. The billionaire backing suggests more upside potential remains.

Wall Street analysts expect Nvidia to generate $206 billion in revenue for fiscal year 2026. The company currently captures about one-third of all data center spending.

Nvidia expects the four largest AI hyperscalers to spend around $600 billion on data centers in 2025. This figure could balloon to $3 trillion to $4 trillion by 2030 when including all global clients.

GPU Demand Continues Outpacing Supply

Nvidia’s graphics processing units remain the Gold standard for AI computing. GPUs process multiple calculations in parallel, making them ideal for AI training and inference.

The chips also power drug discovery, engineering simulations, and cryptocurrency mining applications. Demand currently outstrips available supply across these sectors.

Oracle’s success directly benefits Nvidia since GPUs are critical components in AI infrastructure. Nearly every AI process relies on Nvidia’s top-rated processors.

The connection explains why Oracle’s positive news drove Nvidia shares higher. Oracle’s $450 billion backlog signals sustained demand for AI hardware.

If Nvidia’s market projections prove accurate, the company could generate $1 trillion to $1.3 trillion in revenue by 2030. This WOULD represent a compound annual growth rate of 37% at the low end.

Even if the market reaches half of Nvidia’s projections, the company would still achieve 19% annual growth. This far exceeds the broader market’s typical 10% annual returns.

Oracle’s 77% growth forecast for cloud infrastructure adds credibility to these projections. The database giant’s direct exposure to AI spending provides valuable market validation.

Nvidia’s current market cap sits at approximately $4.3 trillion. The stock has gained 0.43% in recent trading with volume of 5.4 million shares.