Why Top Analysts Say Bitcoin Hyper Is Crushing XRP and Cardano as the Crypto to Buy Now

Forget the old guard—Bitcoin Hyper's tearing up the crypto playbook while XRP and Cardano lag behind.

The New Alpha

Top analysts are dubbing Bitcoin Hyper the standout crypto pick, leaving XRP and Cardano in the dust. It's not just hype; the metrics are speaking louder than a Wall Street bull on espresso.

Performance Over Promises

While XRP battles regulators and Cardano preaches 'potential,' Bitcoin Hyper's already delivering returns that make traditional finance look like it's stuck in dial-up mode. No vague roadmaps—just raw, market-shifting momentum.

Timing the Tidal Wave

Smart money's pivoting fast. Why bet on yesterday’s tokens when Hyper’s pulling ahead with real utility and blistering transaction speeds? Even the most cynical traders are raising eyebrows—and that’s saying something in a space full of 'sure things' that flopped.

Bottom line: In a market crowded with overpromises and underdelivery, Bitcoin Hyper’s not just competing; it’s dominating. And honestly? It’s about time something did.

Bitcoin Hyper turns Bitcoin into programmable money

Bitcoin is known for its security, immutability, and anti-inflation features – but few praise its programmability or speed. That’s because these are Bitcoin’s two main weaknesses, but they’re also what Bitcoin Hyper fixes.

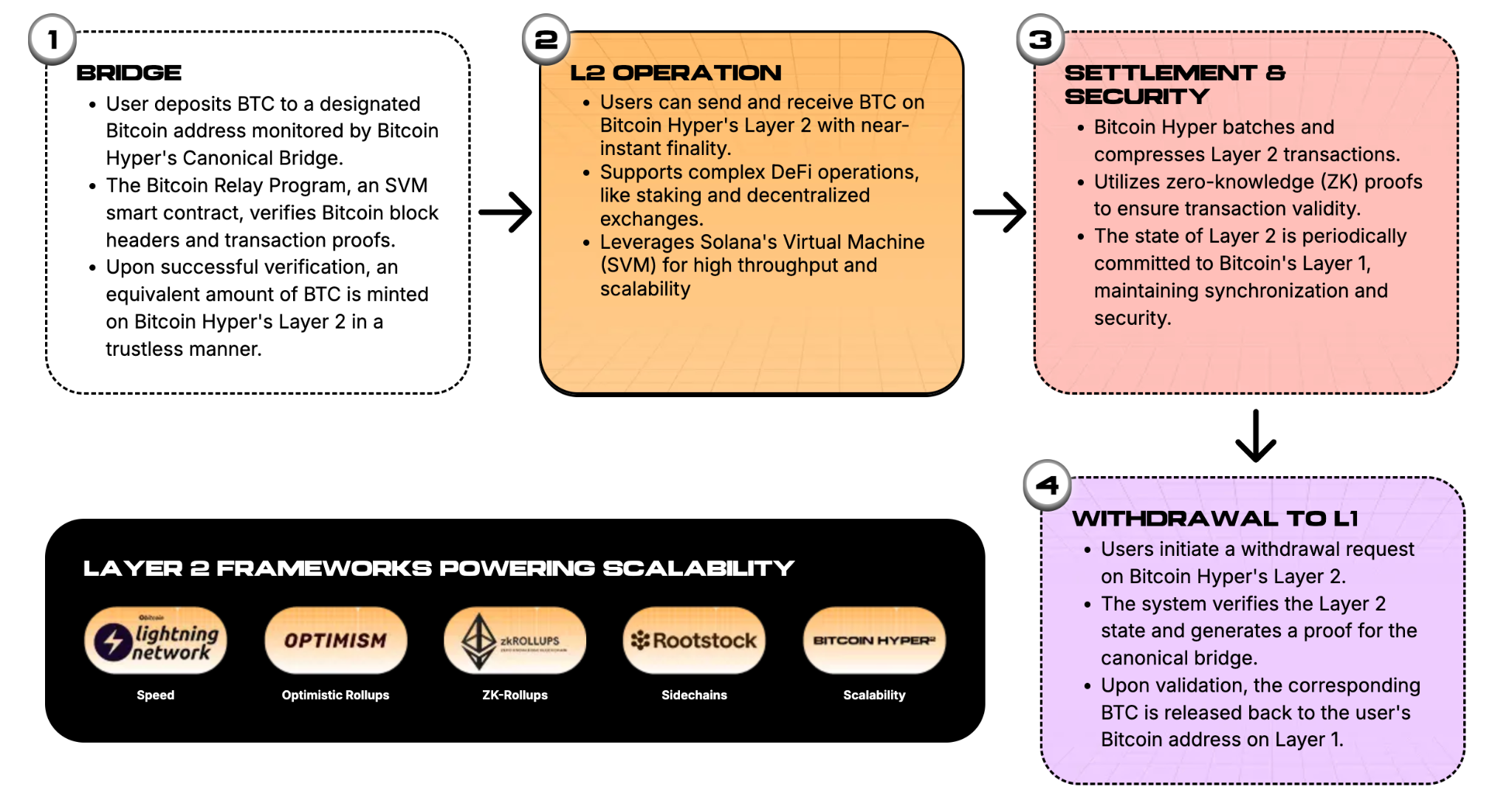

Bitcoin Hyper is a Layer 2 blockchain built using the Solana VIRTUAL Machine, meaning it inherits Solana’s rapid speed and support for smart contracts, while periodically reporting its state back to the Bitcoin L1 for settlement. This setup strikes a perfect balance between security, flexibility, and speed.

As a result, Bitcoin Hyper has the potential to unlock new use cases on Bitcoin like DeFi, meme coins, payments, RWAs, gaming, and much more. It also features a trustless canonical bridge, allowing BTC holders to securely transfer their coins to the L2. That could turn Bitcoin from a store of value into programmable money that powers the world’s digital economy.

Considering Bitcoin has over $2 trillion in mostly dormant liquidity, such use cases could be warmly received by holders, potentially resulting in a sharp influx of users and liquidity onto the Bitcoin Hyper network.

Consequently, experts are backing HYPER for massive gains, with several respected figures, including Umar Khan from 99Bitcoins, suggesting it could yield 100X returns once it lists on the open market.

100x gains don’t happen every day in crypto, but neither do opportunities to invest in projects transforming Bitcoin into a settlement LAYER for on-chain finance. That’s why Bitcoin Hyper could be the exception and give market-leading returns this year.

XRP ETF Delayed: More Bad News

After hitting a record high of $3.65 in July, XRP’s momentum slowed. The Ripple Labs team’s insider selling put an end to what was shaping up to be a historic run for XRP, and now the price is 17.5% lower than its July peak.

Allegations also emerged that the Ripple Labs team had engaged in fraudulent behavior and misled investors, as reported by on-chain sleuth Zack XBT, further weighing on XRP’s outlook.

That was last month, but XRP has been dealt another blow this week after the SEC delayed its decision on Franklin Templeton’s XRP ETF, citing concerns of market manipulation and investor protection. This has added insult to injury at a time when XRP desperately needed a fresh tailwind.

Since July 17, 2025 an address linked to Ripple co-founder Chris Larsen transferred out 50M XRP ($175M) to four addresses.

~$140M ended up at exchanges/services

30M XRP recipient

rPS9kVPbgZF4vXq2hs6s9Xv2754qdRau98

rnQXgGAjqbF4KoBpcBK5YBHyZEL7nGWWoi

10M XRP recipient…

— ZachXBT (@zachxbt) July 24, 2025

Cardano Whales Dump 140M Coins

Cardano also faces its own set of problems, with large holders dumping their tokens at scale. According to data from Ali Martinez, who goes by Ali Charts on X, whales have dumped 140 million ADA in two weeks, meaning they now control less than 15% of the total supply.

This is a bad sign for the asset, indicating weakening confidence among major players and increasing the risk of further downside. However, not only does it damage supply dynamics, but it also acts as a deterrent for new investors, placing ADA in a challenging position right now.

Whales are booking profits, selling over 140 million Cardano $ADA in the last two weeks! pic.twitter.com/tpeGHmWb0O

— Ali (@ali_charts) September 11, 2025

Conclusion: HYPER Beats XRP, ADA

Although the cryptocurrency market is optimistic right now with macroeconomic tailwinds signifying price gains ahead, some of the top coins like XRP and Cardano are struggling. They’ve already seen their market capitalizations increase substantially this cycle, and considering these bearish catalysts, there is a real possibility that the bulk of their gains have already been realised.

And so for investors looking to buy now, there are likely better options on the market. That’s why analysts are backing Bitcoin Hyper – its blend of promising fundamentals and early stage signifies huge untapped potential, meaning it could massively outperform XRP and cardano in the coming months.