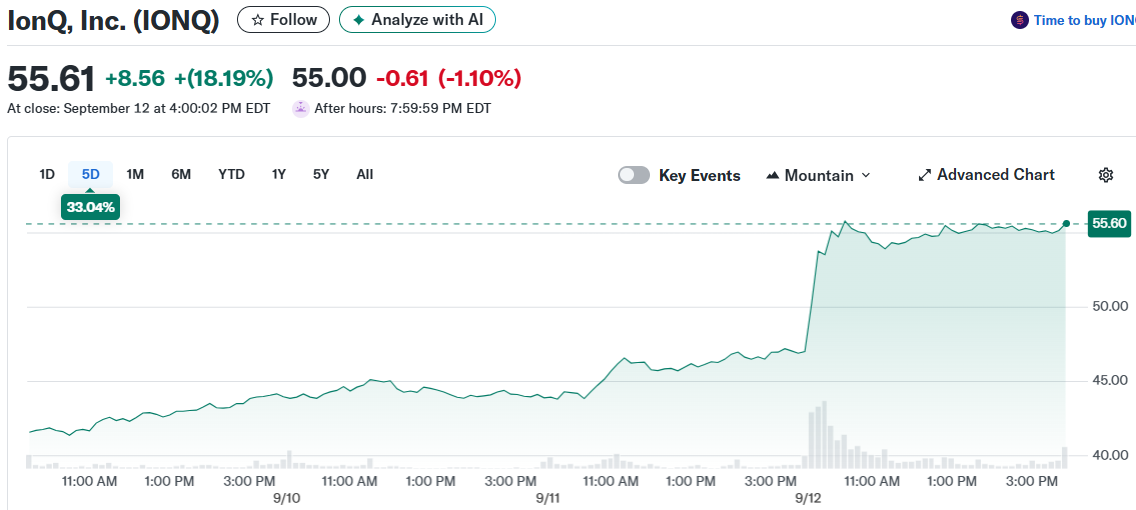

IonQ Stock Soars 16% After UK Greenlights $1 Billion Oxford Ionics Takeover

Quantum computing just got a billion-dollar vote of confidence—and traders are cashing in.

IonQ shares skyrocketed 16% following UK regulatory approval of its massive acquisition of Oxford Ionics. The deal, valued at a cool $1 billion, signals aggressive expansion into European quantum markets.

Strategic Gambit or Hype Cycle?

Quantum remains speculative—hardware’s complex, timelines are fuzzy, and real-world applications are still emerging. But IonQ’s betting big that consolidation will accelerate commercialization. Acquiring Oxford Ionics brings key talent and IP into the fold, positioning IonQ as a consolidator in a fragmented space.

Market Reactions & Realities

Traders piled in on the news, pushing the stock to multi-week highs. Whether the momentum holds depends on execution—mergers often look better on PowerPoint than in practice. Meanwhile, skeptics note that quantum’s ‘five years away’ narrative has been running since… well, always.

One thing’s clear: in tech investing, sometimes a billion-dollar deal is just a fancy way to distract from burning cash and elusive profits. But hey—it worked for a day.

TLDR

- UK Investment Security Unit approved IonQ’s $1.075 billion Oxford Ionics acquisition

- Stock jumped 16% on Friday with all deal conditions now met

- New IonQ Federal division secured over $100 million in government contracts

- Deal includes $1.065 billion in stock plus $10 million cash

- Shares gained 537% over the past year before today’s rally

IonQ stock surged 16% Friday after receiving regulatory clearance from the UK’s Investment Security Unit for its Oxford Ionics acquisition. The quantum computing company now has all approvals needed to complete the $1.075 billion deal.

The acquisition agreement was first announced in June 2024. The deal structure includes approximately $1.065 billion in IonQ stock plus $10 million in cash.

This regulatory approval removes the final hurdle for the transaction. The deal is now expected to close soon according to company statements.

IonQ shares have performed exceptionally well this year. The stock gained over 537% in the past 12 months before Friday’s jump.

Trading sentiment turned bullish on Stocktwits following the news. Retail investor message volume increased to “extremely high” levels from “normal” activity.

Federal Division Drives Government Revenue

IonQ launched its federal division earlier this month. IonQ Federal consolidates the company’s quantum computing and networking services for government clients.

The division targets U.S. government agencies and allied partners. IonQ has already secured more than $100 million in government contracts through this unit.

Key clients include the U.S. Air Force Research Lab and DARPA. Oak Ridge National Laboratory and ARLIS also have active contracts with IonQ.

Robert Cardillo leads IonQ Federal as executive chairman. He previously directed the National Geospatial-Intelligence Agency and advised the U.S. president on intelligence matters.

Oxford Deal Expands Quantum Capabilities

The Oxford Ionics acquisition strengthens IonQ’s quantum computing technology. Oxford Ionics specializes in trapped-ion quantum computing systems.

This technology aligns with IonQ’s existing quantum computing platform. The combination should accelerate development of next-generation quantum computers.

CEO Niccolo de Masi said the company is positioning for quantum advantage at scale. The federal division provides a growth channel for government applications.

IonQ stock closed Friday at $54.32, representing a 15.71% gain for the session. The quantum computing sector has attracted increased investor interest this year.