Why Is The Crypto Market Surging Today? Unpacking The 2025 Rally

Crypto markets explode upward as institutional money floods in—again. Forget 'slow and steady.' This is digital asset Darwinism at its finest.

Regulatory Green Lights Ignite Fires

Clear frameworks from key jurisdictions finally give TradFi players the confidence to dive in headfirst. No more dipping toes.

The Halving Effect Isn't Just Theory

Supply shocks from recent Bitcoin and Ethereum upgrades are now visibly squeezing markets. Scarcity narratives are playing out in real-time.

DeFi and Real-World Assets Merge

Tokenization of everything from bonds to real estate is pulling traditional capital on-chain. The lines between legacy finance and crypto are blurring—fast.

Of course, Wall Street will take credit for the rally now that their quarterly reports need a boost. Some things never change.

TLDR

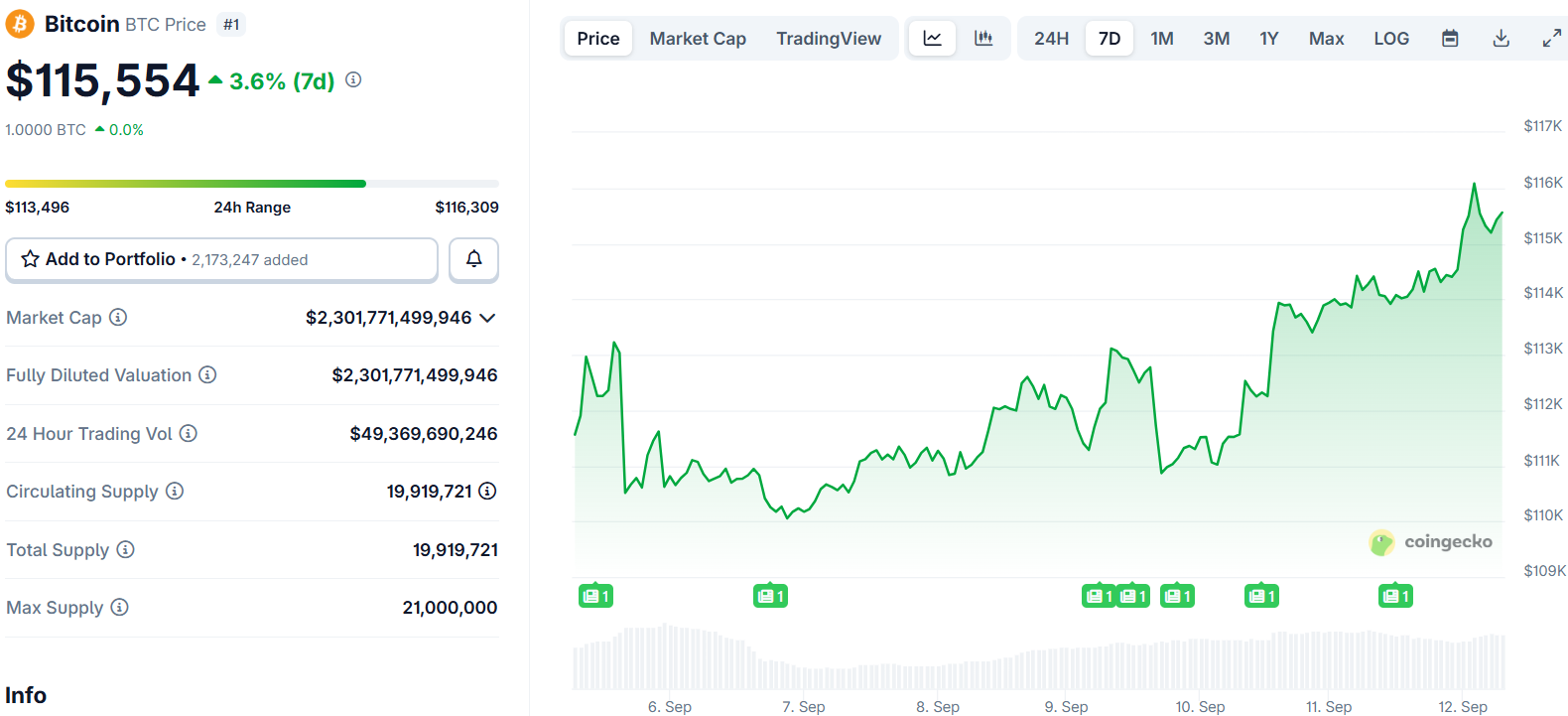

- Crypto market cap hits $3.95 trillion, approaching $4 trillion as Bitcoin holds above $115,000

- U.S. inflation data came in lower than expected at 2.6%, boosting Fed rate cut expectations for next week

- Institutional money pours in with $757 million flowing into crypto ETFs in 24 hours

- SEC launches “Project Crypto” framework for tokenization and stablecoins, improving regulatory outlook

- Technical indicators show bullish signals as altcoins post double-digit gains and “altseason” sentiment returns

The cryptocurrency market posted strong gains today, with total market capitalization reaching $3.95 trillion as Bitcoin climbed above $115,000. The rally comes as multiple factors align to boost investor confidence across digital assets.

Thursday’s U.S. Producer Price Index report showed inflation at 2.6% year-over-year, below market expectations. This data has increased speculation that the Federal Reserve will cut interest rates at next week’s meeting.

Traders now see a near-certain chance of a 25 basis point rate cut. Lower interest rates typically benefit risk assets like cryptocurrencies as investors seek higher returns.

Bitcoin reached $115,256 and is holding key support at the $115,000 level. If momentum continues, analysts see potential for the cryptocurrency to target $117,200 in coming sessions.

The broader crypto market received a boost from institutional participation. Exchange-traded funds focused on digital assets saw $757 million in inflows over the past 24 hours.

BlackRock’s Bitcoin exchange-traded product received regulatory approval in Europe. This development signals growing mainstream financial adoption of cryptocurrency investments.

Regulatory Framework Takes Shape

The Securities and Exchange Commission announced “Project Crypto,” a new framework covering tokenization and stablecoins. This regulatory clarity has improved sentiment around the industry’s long-term prospects.

Global regulators are also showing increased acceptance. Agencies in South Korea and India have signaled support for cryptocurrency firms through new incentives and clearer guidelines.

Technical analysis shows positive momentum building. bitcoin broke through resistance levels while displaying a MACD golden cross pattern, historically viewed as a bullish signal.

Altcoins are participating in the rally with double-digit monthly gains across major tokens. Ethereum, Solana, and XRP have all posted strong performance numbers.

The Altcoin Season Index reached its highest reading in months. This metric tracks when alternative cryptocurrencies outperform Bitcoin, often signaling broader market participation.

Market Structure Remains Strong

Market analysts point to $4.01 trillion as the next key resistance level for total cryptocurrency market cap. Breaking through this threshold could signal continued upward momentum.

The current support level sits at $3.94 trillion. Holding above this level is viewed as critical for maintaining recent gains across the sector.

Gemini’s initial public offering saw demand exceed supply by more than 20 times. The crypto exchange raised its price range to $24-26 per share ahead of Friday’s Nasdaq debut under ticker GEMI.

At the upper end of the range, Gemini could achieve a $3.1 billion valuation. The strong IPO demand reflects growing investor appetite for crypto-related companies.

Market participants are watching for sustained institutional participation and continued regulatory progress. These factors could determine whether current momentum extends through the weekend trading period.