CaliberCos (CWD) Stock Explodes 2,500% Following Chainlink Treasury Strategy Launch

CaliberCos just pulled off the treasury maneuver of the decade—and Wall Street's scrambling to catch up.

Chainlink Integration Ignites Frenzy

The real estate investment firm's pivot to blockchain treasury management sent CWD shares into orbit. That 2,500% surge wasn't just a pump—it was a full-scale market reevaluation of what happens when traditional finance meets DeFi infrastructure.

Treasury Strategy Goes On-Chain

By leveraging Chainlink's proven oracle network, CaliberCos bypasses legacy financial intermediaries entirely. The move positions them at the forefront of corporate treasury innovation—while making traditional wealth management firms look like they're still using fax machines.

Market Responds With Fury

Trading volumes hit unprecedented levels as institutional and retail investors alike piled in. The spike demonstrates how quickly capital moves when real-world assets meet blockchain efficiency—and how painfully slow traditional finance has been to adapt.

Because nothing gets Wall Street's attention quite like watching someone else make 25x returns while they're still waiting for their quarterly reports to clear compliance.

TLDR

- CaliberCos stock jumped 850% to 2,500% intraday after announcing its Digital Asset Treasury strategy focused on Chainlink (LINK) token purchases

- The company becomes the first Nasdaq-listed firm to publicly adopt a Chainlink-focused treasury policy

- Trading volume exploded to 79 million shares compared to the usual 9.6 million daily average

- CaliberCos plans gradual LINK accumulation using equity credit lines, cash reserves, and equity securities

- Despite the massive rally, CWD shares remain down over 80% in the past year due to declining revenues and widening losses

CaliberCos Inc. stock exploded on Tuesday after the Arizona-based company announced its first chainlink token purchase. The move marked the launch of its new Digital Asset Treasury strategy.

$CWD CaliberCos surges over 2,000% after completing its first Chainlink $LINK token purchase under a new digital asset treasury strategy.

The plan will be governed by a crypto Advisory Board, making Caliber one of the first U.S.-listed firms to adopt such a model. pic.twitter.com/EudfZmmfqI

— Ticker Wire (@Tickerwire) September 9, 2025

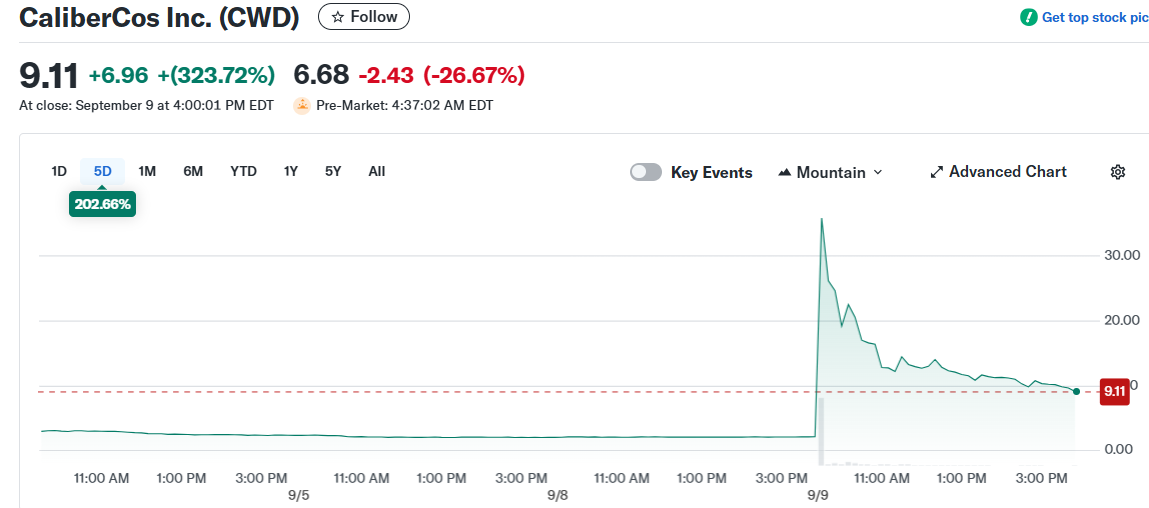

CWD shares surged between 850% and 2,500% intraday depending on the calculation method. The stock peaked at $56 before settling at $7.60 by market close.

Trading volume reached 79.31 million shares on Tuesday. This compared to the company’s typical daily average of 9.69 million shares.

The initial LINK purchase served as a system test for CaliberCos’ broader accumulation plan. The company aims to build its Chainlink position gradually over time.

CEO Chris Loeffler described the strategy as disciplined and institutional. “Each acquisition reinforces our conviction in Chainlink as the infrastructure connecting blockchain with real-world assets,” he said.

The company plans to fund future purchases through multiple channels. These include its equity credit line, available cash reserves, and equity-based securities.

CaliberCos emphasized its measured approach to token accumulation. This allows the company to average into the market while managing volatility.

Historic Nasdaq First

CaliberCos positions itself as the first Nasdaq-listed company with a publicly disclosed Chainlink treasury policy. This gives shareholders direct exposure to LINK token market value.

The company views its role connecting real-world assets with blockchain infrastructure as a key advantage. By adopting LINK into corporate reserves, CaliberCos reinforces this positioning.

The framework includes comprehensive tax, accounting, custody, and governance measures. This institutional approach differentiates the company from more speculative crypto plays.

Loeffler noted that the initial purchase tested internal systems before scaling operations. “Caliber’s Digital Asset Treasury strategy represents a disciplined, institutional approach to building a LINK position,” he explained.

Market Response and Financial Reality

The massive rally comes after a difficult period for CaliberCos stock. Shares have fallen 82.94% over the past 12 months despite being up 30.76% year-to-date before Tuesday’s surge.

Wall Street analysts currently maintain a Hold rating on the stock. The consensus price target sits at $2.50, well below Tuesday’s closing price.

The company’s financial fundamentals present challenges. Revenues declined more than 40% in 2024 while net losses widened by over 50%.

CaliberCos’ announcement followed a similar move by Eightco the previous day. That company announced plans to raise funds for Worldcoin purchases, sending its shares up over 1,400%.

The timing highlights growing retail enthusiasm for companies tying balance sheets to crypto assets. However, analysts warn that valuations remain narrative-driven and exposed to speculative swings.

CaliberCos outlined plans to steadily grow LINK holdings through consistent smaller purchases rather than large one-time transactions. The strategy enhances the company’s long-term staking capabilities as it builds a material position in LINK tokens.