BREAKING: Trump Media’s $105 Million Cronos (CRO) Token Deal Sends Shockwaves Through Crypto Markets

Trump Media just dropped a crypto bombshell—completing a massive $105 million Cronos token purchase that's rewriting the institutional playbook.

The Strategic Move

This isn't just another corporate treasury allocation. The deal positions CRO at the center of mainstream financial adoption, leveraging Cronos' Ethereum-compatible infrastructure while bypassing traditional banking gatekeepers. Market analysts confirm the transaction executed at current market rates—no sweetheart discounts here.

Market Impact

CRO prices surged on the news as institutional money flooded the ecosystem. The $105 million injection represents one of the largest single corporate crypto purchases this quarter, proving once again that traditional finance's 'wait-and-see' approach just got left behind.

Because nothing says financial innovation like betting $105 million on tokens while traditional banks still can't figure out their KYC forms.

TLDR

- Trump Media acquired 684.4 million CRO tokens worth $105 million in a cash-and-stock deal with Crypto.com

- The purchase represents about 2% of CRO’s total circulating supply

- CRO will be integrated into Truth Social and Truth+ platforms as reward features

- Tokens will be held in Crypto.com custody with staking to generate additional revenue

- CRO price currently trades at $0.2652, down 0.59% in the last 24 hours

Trump Media and Technology Group closed its acquisition of 684.4 million Cronos tokens on September 5. The deal valued the purchase at $105 million.

The transaction was split evenly between cash and TRUMP Media stock. This structure gives Crypto.com an equity position in the Trump Media company.

🚨JUST IN: Trump Media and @cryptocom have closed a strategic agreement: 684.4M $CRO tokens (~2% of circulating supply) will be exchanged as part of a 50/50 cash and stock deal. $CRO will integrate into Truth Social & Truth+ via Crypto. com’s wallet infrastructure.

LOCK IN 🔒 pic.twitter.com/wsGLdXX6Lg

— ⛓️Colin⛓️Ⓥ (@CronosChaz) September 5, 2025

The token purchase represents approximately 2% of CRO’s total circulating supply. Both companies confirmed the deal through a joint press release on Friday.

Trump Media CEO and Chairman Devin Nunes praised the agreement. He called CRO a “versatile utility token” for payments and money transfers.

Crypto.com CEO Kris Marszalek described the deal as the start of wider adoption efforts for CRO. The partnership extends beyond the token purchase.

Integration Plans

CRO tokens will be integrated into Truth Social and Truth+ platforms as reward features. This marks Trump Media’s first major crypto integration effort.

The company plans to store the tokens using Crypto.com’s custody service. The tokens will be staked to generate additional income for Trump Media.

Both CRO tokens and Trump Media shares remain locked up for a set period. The companies did not specify the exact timeframe for this restriction.

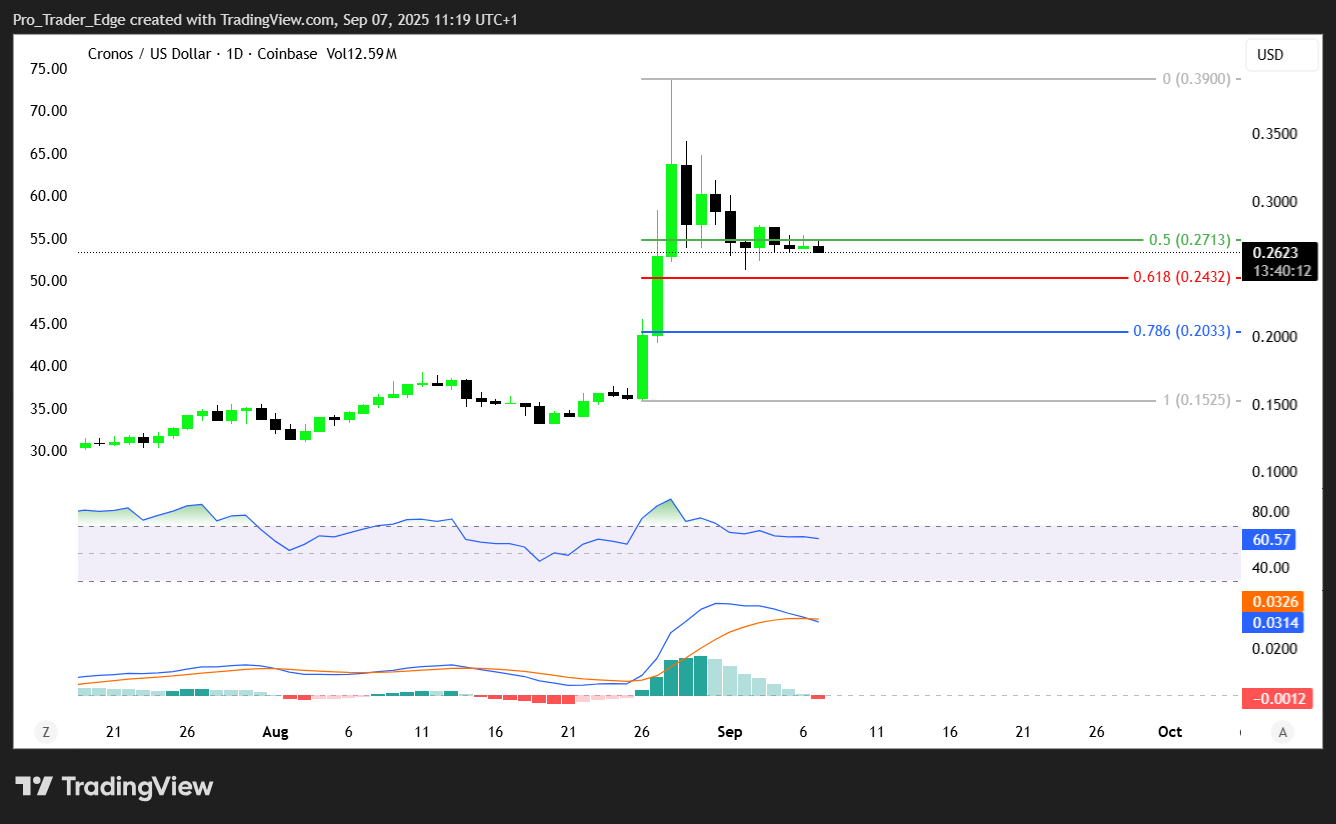

Cronos CRO Price Prediction

CRO price trades at $0.2652 as of September 6. The token declined 0.59% in the past 24 hours following the announcement.

Trump Media stock showed little change in Friday trading. CRO also remained relatively stable despite the large purchase.

Technical analysis shows CRO consolidating after recent upward movement. The token is testing the 23.6% Fibonacci retracement level at $0.266.

This level serves as the first major support zone. If selling pressure continues, analysts watch for support at $0.210 and $0.173.

Broader Strategy

The deal connects to Trump Media’s larger crypto expansion plans. The company launched Trump Media Group CRO Strategy as a separate entity.

This new venture prepares for a planned SPAC merger. The goal involves acquiring up to 19% of CRO’s circulating supply.

Trump Media reported holding $2 billion in Bitcoin in its Q2 financial report. The company also plans to launch multiple crypto-focused ETFs and managed investment products.

The partnership represents one of the largest institutional CRO purchases to date. It follows Trump Media’s push deeper into digital assets and finance.