Bitcoin (BTC) Price Prediction: September Slump Deepens as Traders Brace for Fed Rate Bombshell

Bitcoin's September weakness isn't just continuing—it's accelerating. Traders sit on their hands, eyes glued to the Fed's next move.

The Waiting Game

Market momentum stalls completely as institutional and retail players alike refuse to make big bets ahead of Jerome Powell's announcement. Volatility craters—the calm before the potential storm.

Fed Watch Dominates

Every altcoin move, every leverage position, every OTC desk whisper ties back to one thing: interest rates. Crypto's decoupling myth gets another reality check from traditional finance's 800-pound gorilla.

Technical Breakdown

Support levels look increasingly fragile as volume dries up. The charts scream caution while the fundamentals... well, they're waiting for the Fed too.

September's traditional crypto weakness meets macro uncertainty—because nothing says 'digital gold' like hanging on every word from a central banker. Sometimes the revolution gets put on hold for rate decisions.

TLDR

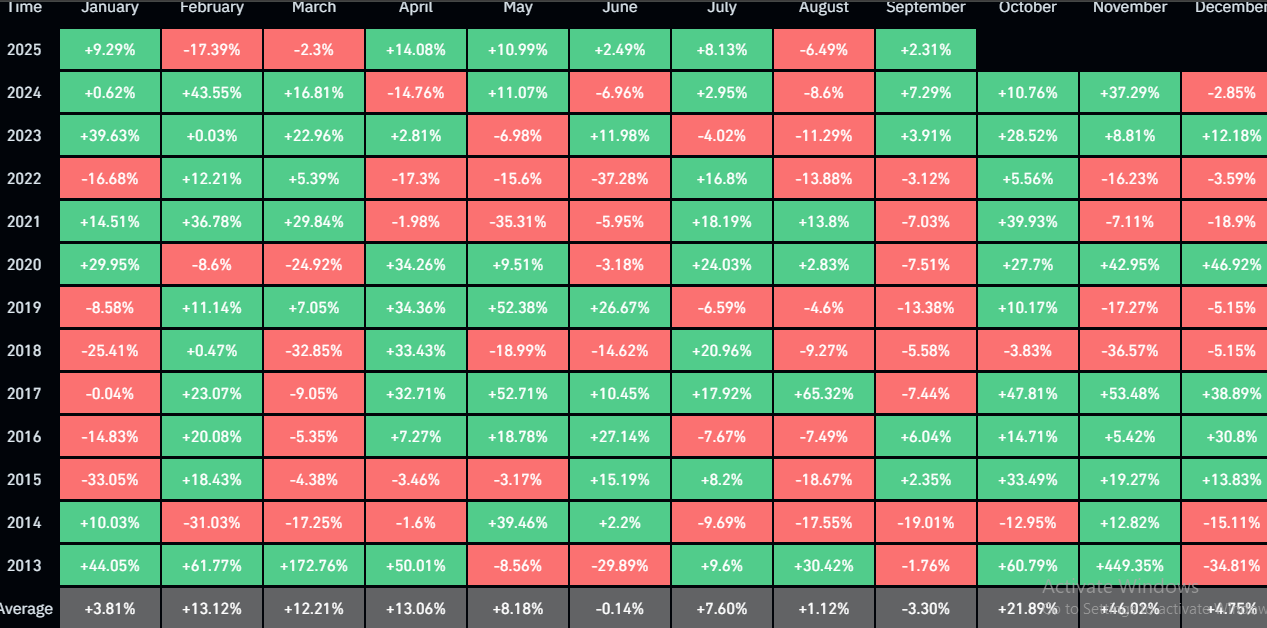

- Bitcoin averages -3.77% returns in September since 2013, making it the weakest month historically

- Six consecutive losing Septembers from 2017-2022 ended with gains in 2023-2024

- Fed meeting on September 16-17 has 97.6% probability of 25 basis point rate cut

- Spot Bitcoin ETFs launched in January 2024 providing new institutional demand channels

- October historically follows with strong rallies, earning the nickname “Uptober”

Bitcoin price continues its historical September struggle as the cryptocurrency dropped from $124,000 in mid-August to around $109,000 by early September. This seasonal weakness has become a familiar pattern for traders.

Data from CoinGlass shows Bitcoin has posted negative returns in eight of the past 12 Septembers since 2013. The average September return stands at -3.77%, making it the worst-performing month of the year.

The current selloff mirrors traditional equity markets, with the S&P 500 also averaging -1.2% in September. Bitcoin’s Wednesday rally to $112,600 quickly faded as sellers emerged during Asian trading hours.

From 2013 to 2016, Bitcoin’s September performance was mixed with equal wins and losses. The trend shifted in 2017 when regulatory crackdowns on initial coin offerings triggered six straight losing Septembers.

China’s central bank banned ICOs on September 4, 2017, followed by South Korea’s similar MOVE on September 29. These regulatory actions created a bearish cycle that lasted until 2022.

The losing streak finally broke in September 2023 when bitcoin gained roughly 4% following a favorable court ruling on Grayscale’s ETF application. September 2024 delivered an even stronger 7.29% gain.

New Institutional Dynamics

Spot Bitcoin ETFs launched in January 2024 have changed the market structure considerably. These funds trade billions of dollars daily and have accumulated large Bitcoin positions throughout 2025.

Public companies have also added Bitcoin to their treasury holdings this year. These institutional flows have provided support during traditionally weak periods.

The Federal Reserve’s September 16-17 meeting has captured trader attention with futures markets pricing in a 97.6% chance of a 25 basis point rate cut. Fed Governor Christopher Waller has publicly supported such a move.

Chair Jerome Powell’s Jackson Hole speech in late August struck a dovish tone, suggesting policy easing may be warranted due to shifting economic risks.

Jobs Data Creates Uncertainty

Wednesday’s ADP private payroll report showed only 54,000 jobs added in August, falling short of the 75,000 estimate. This weak data rattled traditional markets and contributed to Bitcoin’s pullback.

Friday’s official jobs report will provide clearer insights into labor market health. Economists expect 80,000 jobs added, but some fear the number could disappoint.

Labor data revealed the US now has more unemployed people (7.24 million) than job openings (7.18 million). This shift supports the case for Fed rate cuts.

Despite market nervousness, data from Hyblock shows both retail and institutional traders buying Bitcoin during price dips. The liquidation heatmap reveals tight trading between $109,000 and $111,200.

Short-term traders appear to be taking profits NEAR range highs while longer-term investors accumulate on weakness. This pattern suggests underlying demand remains intact despite seasonal headwinds.

October historically provides relief from September’s weakness, with Bitcoin posting gains six years running. The month ranks as Bitcoin’s second-strongest after November, earning the nickname “Uptober.”