Campbell’s (CPB) Stock Surges 5% as Rao’s Nears $1B Milestone Amid In-Home Cooking Boom

Campbell’s just served Wall Street a hot bowl of momentum—and traders are eating it up.

Rao’s rockets toward $1B

The premium sauce brand isn’t just simmering—it’s boiling over. Almost hitting that ten-figure mark proves consumers still splash cash on quality, even as inflation pinches wallets. Guess some habits are recession-proof—or at least, pasta-proof.

Home cooking fuels the fire

Forget restaurants. Dining in is the new dining out. Campbell’s rides the wave as families stock pantries and prioritize convenience without compromising on taste. Their portfolio’s firing on all burners.

Stock pops 5%—no fluke

That jump isn’t just noise. It’s a signal that old-school brands can still dance when they play their cards right. Even in a market obsessed with AI and crypto, canned soup and premium sauce can still shake the tape. Who needs blockchain when you’ve got tomato basil?

Sure, the rally’s tasty—but let’s see if it lasts beyond the next earnings call. Because on Wall Street, everyone loves a good story until the numbers stop adding up.

TLDR

- Campbell’s surges as Rao’s nears $1B sales and Snacks shows signs of rebound.

- Strong Q4: Campbell’s beats forecasts with Rao’s growth and snack recovery.

- Rao’s fuels Campbell’s premium push as Q4 earnings top expectations.

- Campbell’s climbs 5% on Rao’s momentum and renewed Snacks investments.

- Rao’s drives Campbell’s Q4 gains, setting stage for FY26 premium growth.

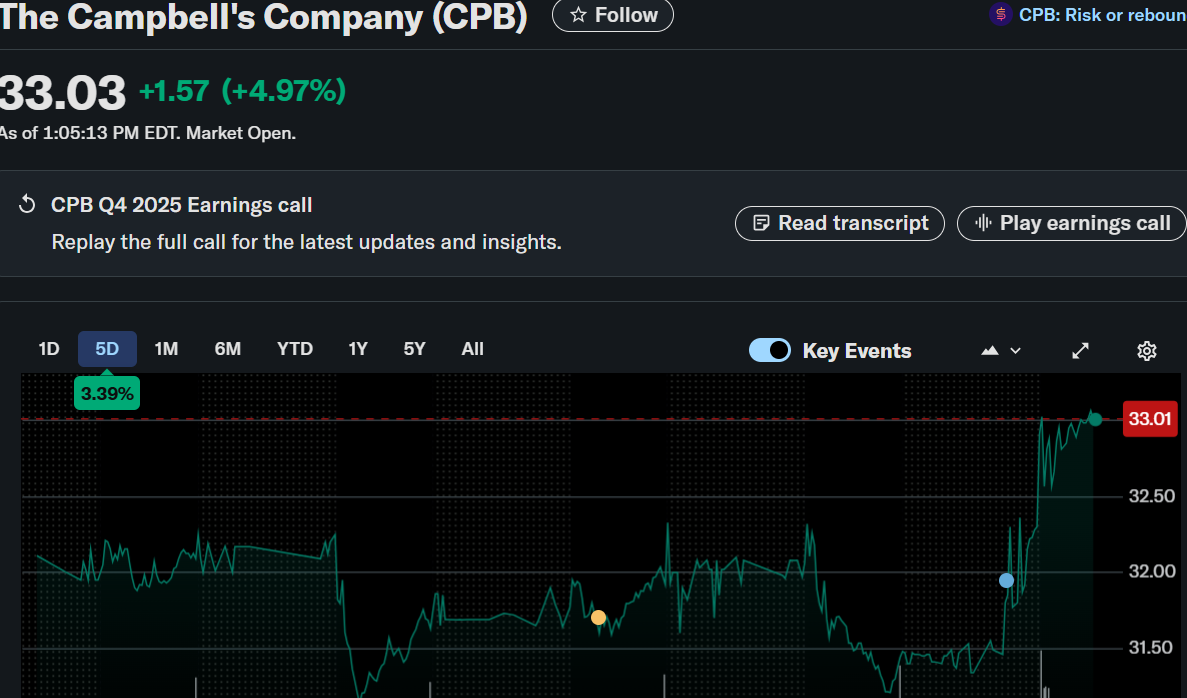

Campbell’s (CPB) shares surged nearly 5% to close at $33.03 after the company reported fiscal Q4 2025 results that exceeded expectations.

Campbell’s(CPB)

The company posted adjusted earnings per share of $0.62 and reported revenue of $2.3 billion for the quarter. Strong performance in Meals & Beverages and early recovery in Snacks contributed to the momentum.

Rao’s Momentum and Core Brand Expansion

Campbell’s highlighted continued momentum for Rao’s, which is now approaching $1 billion in annual sales post-acquisition. This positions Rao’s to become the fourth billion-dollar brand alongside Campbell’s, Goldfish, and Pepperidge Farm. The company emphasized Rao’s growing influence on in-home meal preparation trends.

Rao’s contributed strongly to the Meals & Beverages segment, helping drive category outperformance during the quarter. Campbell’s also noted that in-home cooking remains a key tailwind supporting leadership brands across its portfolio. While Rao’s led growth, Campbell’s continues to invest in brand building and product expansion.

The company plans to further scale Rao’s through marketing and innovation initiatives in fiscal 2026. Campbell’s views the brand as a cornerstone in its premium portfolio strategy. This growth aligns with consumer shifts toward higher-quality, at-home dining options.

Meals & Beverages Fuel Topline Strength

The Meals & Beverages segment drove topline strength, with Campbell’s leadership brands outpacing broader category trends. The division benefitted from sustained consumer interest in cooking at home and continued brand loyalty. Core product lines saw strong demand, especially among value-seeking households.

Net sales increased 1% to $2.3 billion despite a 3% decline in organic sales, reflecting acquisition-driven gains. Earnings Before Interest and Taxes ROSE to $269 million, while adjusted EBIT declined 2% to $321 million. Campbell’s attributed the adjusted decline to inflation and tariff pressures.

Despite these headwinds, Campbell’s delivered better-than-expected results through disciplined cost control and retail execution. The company sees further upside as it increases consumer-focused investments in this segment. Management confirmed a strategy focused on maximizing household penetration and repeat rates.

Snacks Business Shows Early Signs of Turnaround

Campbell’s reported modest sequential improvement in the Snacks division following recent softness in category performance. Net sales and in-market consumption in the fourth quarter saw incremental gains compared to prior periods. The company believes these improvements signal early recovery.

Campbell’s reaffirmed confidence in the long-term potential of its Snacks business, supported by ongoing portfolio actions. Initiatives include renewed marketing support, better in-store execution, and innovation tailored to consumer preferences. These steps are intended to return the division to sustained growth.

In fiscal 2026, Campbell’s expects to accelerate snack-related investments and expand its retail presence. Additionally, cost-saving measures will be intensified to offset inflation and maintain margins. The division remains a strategic pillar in Campbell’s broader growth agenda.