DOGE Price Explosion: Trading Volume Surges as Triangle Breakout Targets $0.38

Dogecoin rockets toward technical breakout as trading activity spikes dramatically

Volume Surge Signals Momentum Shift

DOGE trading volumes just hit unprecedented levels, suggesting institutional money might finally be taking the meme coin seriously—or perhaps just another round of retail FOMO fueling the fire.

Technical Pattern Points to Major Upside

That symmetrical triangle formation everyone's been watching? It's breaking to the upside with conviction. Chart analysts see clear runway toward the $0.38 resistance level if current momentum holds.

Market Psychology Turns Greedy

Remember when DOGE was just a joke? Neither does the market. The same traders who once dismissed it now chase the pattern—proving once again that in crypto, fundamentals take a backseat to pretty lines on charts.

TLDR

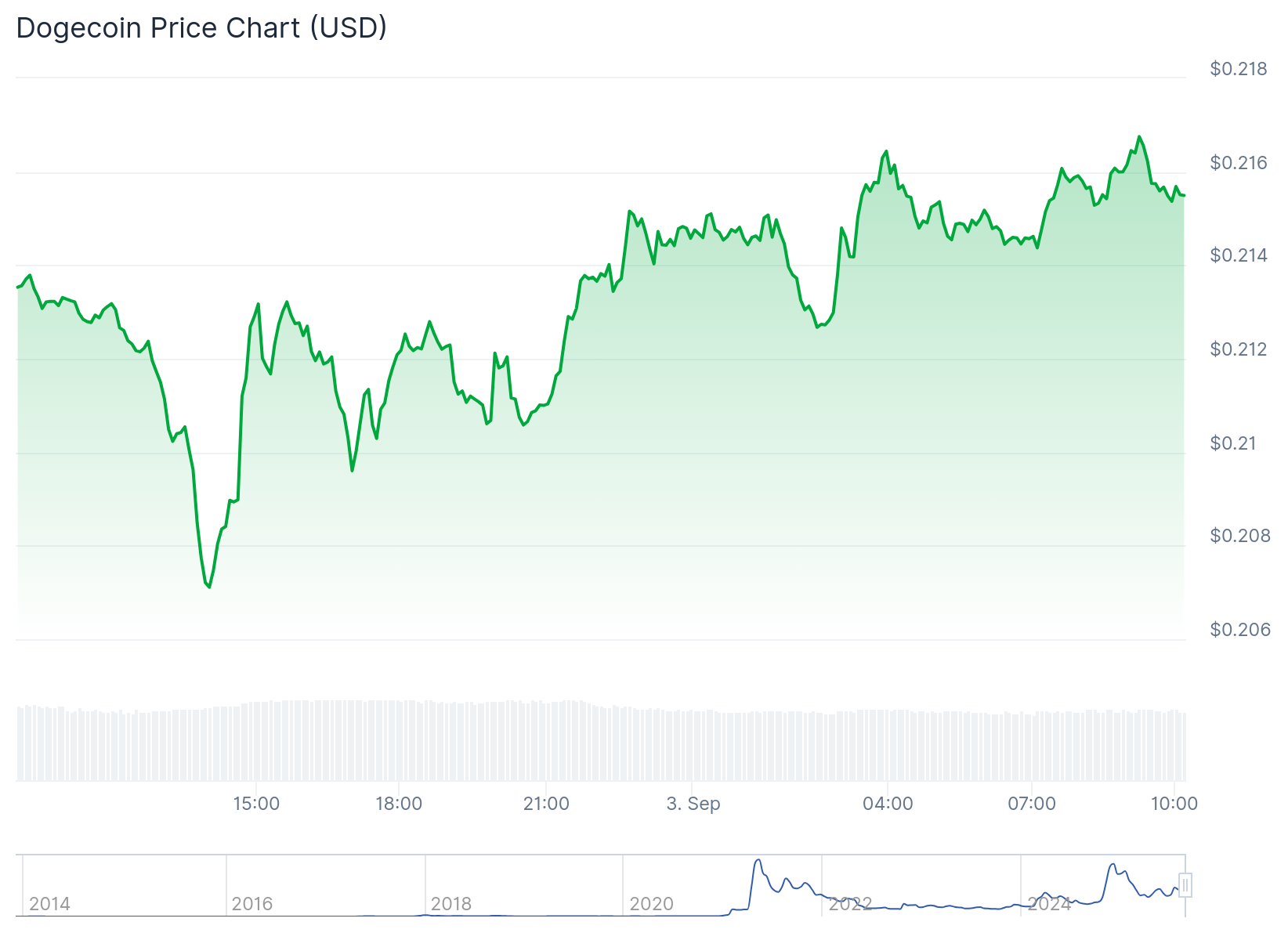

- Dogecoin is consolidating in an ascending triangle pattern near $0.20 support level after two months of sideways movement

- Trading volumes surged to $13.49 billion in late August, suggesting traders are positioning for the next major move

- Market cap reached $31.7 billion on September 1, indicating renewed investor interest in the meme coin

- Technical indicators show momentum building with RSI climbing toward neutral and MACD flattening

- Key resistance sits at $0.245 with potential targets at $0.38 if breakout occurs

Dogecoin has been trading within an ascending triangle pattern for the past two months. The meme coin continues to find support around the $0.20 level.

This consolidation phase appears to be nearing its end. Price momentum is building after another successful test of the key support zone.

Trading activity has picked up recently. Weekly volumes reached $13.49 billion during the week of August 25, according to Token Terminal data.

This volume surge is particularly noteworthy. Rising activity during consolidation often signals that traders are positioning themselves ahead of a breakout.

Similar volume patterns occurred in late 2024. That period preceded an explosive bullish run for Dogecoin.

Market Cap Indicates Growing Interest

Dogecoin’s circulating market cap ROSE to approximately $31.7 billion on September 1. This increase suggests renewed attention from investors.

The rise in market cap reflects broader participation. Greater retail activity typically accompanies such increases.

Token Terminal data confirms this trend. The metrics show sustained interest in the cryptocurrency.

Technical Indicators Show Building Momentum

The Relative Strength Index is climbing from 46 toward the neutral 50 line. This movement indicates building buy pressure.

The MACD line is beginning to flatten. It maintains a narrow lead below the signal line, which often precedes bullish shifts.

These indicators suggest weakening sell pressure. The technical setup appears to favor the bulls.

Dogecoin $DOGE defended $0.208 support five times now. This level is proving crucial for the next move! pic.twitter.com/sorlKm1ZjJ

— Ali (@ali_charts) September 1, 2025

Support at $0.21 has proven reliable. This level has produced sharp rebounds multiple times.

Upside movement has been capped around $0.245. This resistance level represents the first major test for any breakout attempt.

A decisive break above triangle resistance WOULD likely trigger technical buying. However, false breakouts are common in such patterns.

The key question remains whether Dogecoin can sustain current levels. Heavy retail participation means sentiment could change quickly.

If demand holds and volumes provide confirmation, the case for a bullish resolution strengthens. A successful break above $0.245 would confirm the upward move.

Potential targets sit at $0.38 if a full breakout materializes. This represents approximately 75% gains from current price levels.

The pattern suggests Dogecoin’s consolidation phase is ending. The next MOVE will likely determine the direction for the distribution phase ahead.