U.S. GDP Goes On-Chain: Chainlink, Arbitrum, and DeepSnitch AI Emerge as Top Crypto Picks

Blockchain swallows traditional finance whole as U.S. GDP metrics migrate on-chain—crypto's institutional moment has arrived.

Chainlink Leads Oracle Revolution

LINK's data feeds now anchor trillions in real-world asset value. Its oracles verify everything from crop yields to freight logistics—making traditional auditors look like abacus operators.

Arbitrum Scales Ethereum's Economy

Layer-2 activity spikes 400% as institutional traders bypass gas fees. Arbitrum's cheap transactions now process more volume than some national payment networks—take that, Wall Street middlemen.

DeepSnitch AI's Predictive Edge

Machine learning meets DeFi as this algo-trading protocol front-runs market moves. Its neural nets analyze on-chain GDP data faster than any human team—rendering traditional analysts about as useful as a dial-up modem.

While suits debate monetary policy in wood-paneled rooms, code executes economic activity autonomously. The real financial system upgrade isn't coming from the Fed—it's deploying right now on-chain.

DeepSnitch: The AI snitch you actually want watching your wallet

Most traders don’t fail because they can’t click “buy” fast enough, they fail because they don’t see what’s coming. DeepSnitch puts forward five trader-friendly AI agents, each trained to do one job well: sniff out risks, flag the early trends, and strip away the distractions that get your capital rekt.

Built by on-chain analysts who’ve seen every scam playbook in the last cycles, DeepSnitch is less hype, more shield. While governments brag about tamper-proof records and transparent ledgers, the real problem is bad data—and bad actors.

The timing is viciously good. With U.S. GDP feeds hitting the blockchain, whales will MOVE faster than ever on macro news.

Right now, Stage 1 tokens are priced at $0.01602, already climbing from $0.01571. Over $169k has poured in, proving demand is real and rising. Since price tracks demand, early buyers are literally front-running the profit curve. Plus, DeepSnitch AI presale holders get early access to features before anyone else.

If GDP on-chain signals the age of open data, DeepSnitch AI signals the age of open defense. Retail no longer has to play blind while whales run automated tools.

Chainlink price prediction: LINK powers the U.S. data feed

Chainlink locked in its biggest coup yet, securing a contract with the U.S. Department of Commerce to stream Bureau of Economic Analysis data straight to blockchain rails.

LINK popped 3% on the news before pausing around $25 resistance, but technicals suggest the move isn’t finished. A close above $26.50 sets the stage for $28–$30, in line with analyst targets from DigitalCoinPrice and Blockchain.News.

Momentum remains strong, with RSI at 54.04 leaving room for growth before the token risks overheating.

Arbitrum price prediction: ARB to balance inflows and outflows?

The U.S. government moving macro data on-chain boosts demand for scalable L2s like Arbitrum. Every new oracle feed needs throughput, and Arbitrum’s network just hit a record all-time high in stablecoin supply, signaling capital is testing its pipes.

But the charts say patience. ARB keeps banging its head against the $0.60 resistance line, turning it into a magnet zone. Until bulls reclaim it with real volume, downside pressure lingers. Immediate targets sit NEAR $0.47–$0.50, where a strong support cluster could attract bargain hunters.

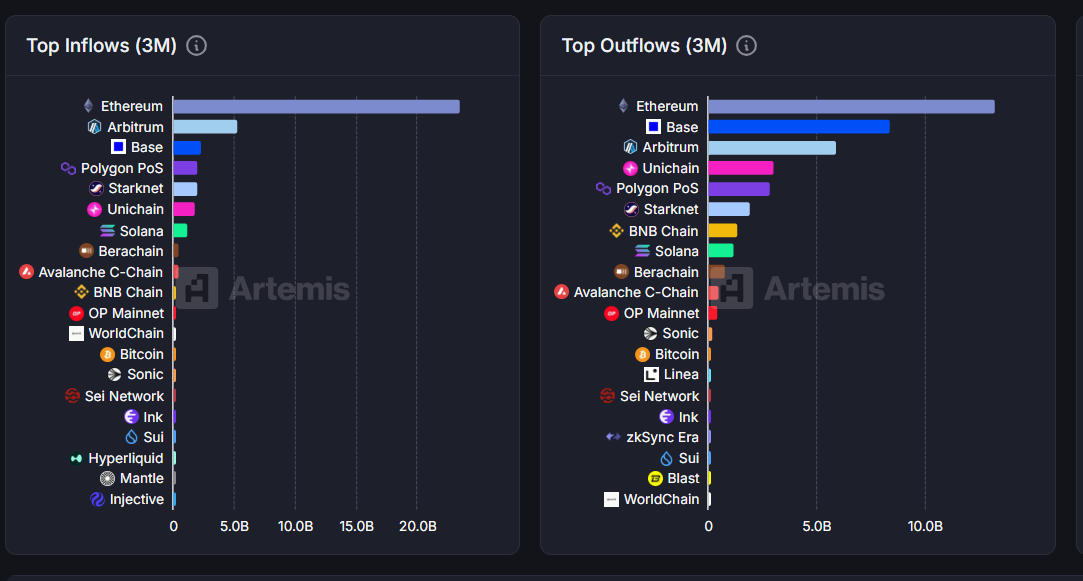

Inflows spiked, but data show capital leaking back out as fast. This tug-of-war means higher volatility in the short term. If inflows stabilize, confidence builds and ARB pushes higher; if not, price action chops sideways or lower.

For now, ARB bulls need to prove they can lock in liquidity before calling for a breakout.

Conclusion

Chainlink brings the data on-chain, Arbitrum provides the scaling rails, but it is DeepSnitch AI that ties it together for traders.

Together, they outline where this market is heading: transparent numbers, scalable rails, and intelligence tools that finally give retail a fighting chance.

The DeepSnitch AI presale has already raised over $169k, with Stage 1 tokens climbing from $0.01571 to $0.01602.

If U.S. GDP going on-chain signals the next chapter for blockchain, DeepSnitch may well be the tool that decides who survives it.

Visit the DeepSnitch AI presale to buy DSNT tokens.

FAQs

- What factors determine the best crypto to buy now?

Adoption, technicals, and catalysts. Right now, LINK benefits from U.S. GDP data, ARB from scaling flows, and DeepSnitch AI from rising presale demand.

- Is it better to buy LINK and ARB or a presale like DeepSnitch AI?

Majors like LINK/ARB are safer with steady upside, while DeepSnitch AI offers early pricing with 10x–100x potential.

- Can AI-driven tokens like DeepSnitch AI rival infrastructure coins?

Not rival, but complement. LINK supplies data, ARB carries it, DeepSnitch AI interprets it for traders. Each adds value at a different layer.